It serves 80 million merchants, covers over 100 million transactions a day, and has more than a billion active users worldwide. Yes, we’re talking about Alipay payments, China’s popular payment app that managed to overtake PayPal as the largest mobile payment platform in the world! It’s not hard to guess: if you’re looking to reach a critical mass of Chinese shoppers, accepting Alipay payments will be a life-saver to succeed in this huge and diverse market!

In this article, we’ll explore:

- what Alipay is;

- how it works;

- what kind of benefits it provides;

- what you should keep in mind before enabling it; and

- how you can start accepting it with Stripe!

Let’s get started!

What are Alipay payments?

Alipay is a popular payment app and digital wallet used in China. In fact, it’s the most widely used third-party online/mobile payment service provider in the country, allowing users to send and receive money without using cash.

Launched in 2004 by Alibaba Group, the Alipay payments app lets users store debit or credit card details to shop online and in-store using their smartphones.

Additionally, users with an Alipay account can enjoy countless other features. For instance, people can use it to buy a train ticket, hail a taxi, order food, buy insurance, or get a credit card.

Dominating the Chinese market and gaining popularity across the world, the Alipay payment method currently supports transactions in 18 major foreign currencies. To appeal to tourists traveling through China, the app has recently added English in addition to Chinese.

What’s the difference between Alipay payments and other e-wallets?

Now that you’re getting a bit more familiar with the Alipay app, you might be wondering: are Alipay payments similar to other digital wallets like Apple Pay, Google Pay, or PayPal? Or are there any differences?

Alipay wallet payments revolutionize traditional card payment methods, just like the above-mentioned apps. Generally, they also work in a similar way.

However, the main difference between Alipay payments and other popular digital wallets is that Alipay online payments are not immediate. Although Alipay users receive instant notification of the transaction, the funds transfer between the parties involved won’t happen immediately.

When users hit send, Alipay will hold funds until both sides of the transaction are confirmed. Therefore, it can take between an hour and four business days for the recipient to receive the payment.

Furthermore, Alipay payments are available to Chinese nationals exclusively. Although, there’s an option for tourists to use the Alipay Tour Pass. This allows visitors to pay online without a Chinese bank account during short-term trips. In terms of fees, Alipay only has a transaction fee, whereas e-wallets like PayPal can also charge sellers additional fees (such as a foreign exchange fee, for instance).

Why should you add Alipay payments to your checkout?

At this point, you might be already getting the hang of why Alipay is a must-have payment method for any business looking to conquer the Chinese market.

With over 1 billion monthly active users and a 54% market share, Alipay payments have already been adopted by over 3 million merchants worldwide!

Given that Chinese shoppers have been some of the fastest adopters of digital payments, those who forget to accept the most popular payment method in the country will miss out on a huge opportunity!

Alipay’s strong brand awareness allows merchants to earn the trust of customers and enjoy high conversion rates when entering the market. Furthermore, accepting Alipay payments also means avoiding the risk of chargebacks. The reason is that buyers need to authenticate each payment so that online merchants don’t have to deal with disputes.

Additionally, real-time payment confirmation enables e-commerce sellers to speed up their delivery processes, leading to higher customer satisfaction.

The key takeaway: to increase your customer base in China, you’ll need to make people feel comfortable purchasing from you by adding Alipay payments to your checkout.

Pro tip

Talking about conquering the Chinese market, the question may arise: are there similar rules to keep in mind if your company wants to succeed in other parts of the world? Absolutely! In most countries, people prefer to use local payment methods. iDEAL payments secure high conversions in the Netherlands, and BECS is a must-have payment method to succeed in Australia, for instance. Similarly, Giropay and Sofort are among the most commonly used payment methods in German-speaking markets. Before entering new markets, make sure to do your research and add the right payment options to your checkout!

How do Alipay payments work?

The popularity of Alipay can be traced back to the fact that it’s extremely simple to use. The app is free, people just have to download it and add their card details.

An Alipay payment can be initiated online or in-store.

Let’s see how these work:

Online payments

When shopping online, buyers just need to select Alipay as their preferred payment method at the checkout. Obviously, this only works in online stores that accept Alipay payments.

Next, the user will be redirected from your website to Alipay’s secure checkout page. Here, they can authorize and confirm the payment.

In-store payments

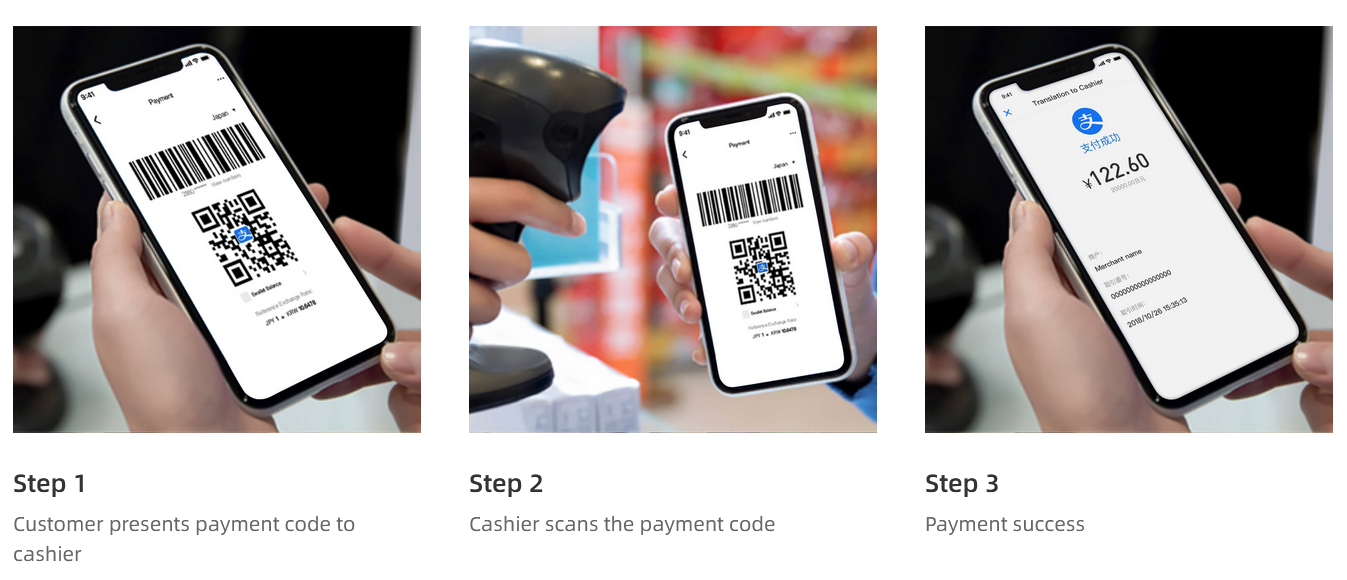

Alipay also allows customers to pay in-store using their smartphones.

There are two types of in-store payments:

- The merchant-presented method – For this type of payment, sellers need to present an Alipay payment QR code for their customers to scan. Merchants can place the barcode next to the tills, for instance. Shoppers need to scan this code on their phones. Next, they have to enter the payment amount to complete the transaction. The huge benefit of this method is that sellers don’t have to buy any equipment to receive the payment.

- The customer-presented method – If the merchant has a point-of-sale system, they can scan the payment code presented by the shopper to collect Alipay payments. The advantage of this method is that it works well even in places where there’s a weak connection. Therefore, it’s pretty quick.

It’s important to know that Alipay payments are basically escrow payments. This means that nobody gets paid unless all parties are happy with the transaction.

Once both parties have confirmed the payment, funds are deposited into the receiver’s account.

This reduces transaction risk for online shoppers and increases long-term customer satisfaction.

Is Alipay safe?

Generally, Alipay payments are secure, as they provide specific features to ensure customer data and transactions are safe.

These include advanced encryption, real-time risk monitoring, and an efficient risk management framework to protect sensitive data and reduce the number of fraud attempts.

However, you should keep in mind that Alipay is not FDIC-insured. This means that shoppers can lose any funds they have in their account in case the company goes out of business.

Start accepting Alipay payments with Stripe!

Stripe offers the most popular e-wallet payment methods including Alipay to help you successfully expand your business into the Asian market and beyond.

If you’re new to Stripe, you should know that it provides way more than merely functioning as a payment gateway. Basically, it brings together everything that’s required to build websites and apps that accept payments and send payouts around the globe. It supports payments for online and in-person retailers, subscription-based businesses as well as software platforms and marketplaces.

Additionally, Stripe helps businesses beat fraud through its Stripe Radar tool, send invoices through its Stripe Invoicing platform, handle online marketplace payments through Stripe Connect, comply with EU VAT rules, and much more.

But let’s head back to how easily and quickly you can add Alipay payments to your checkout using Stripe.

First of all, make sure that prices for all line items have the same currency. If you have line items in different currencies, you can create separate checkout sessions for each currency.

To add Alipay payments to your checkout, all you have to do is head to the Stripe Dashboard, and select Alipay as an additional payment option. Stripe will automatically present payment options to your customers by evaluating their currency, payment method restrictions, and other parameters.

Summary

Given its tempting market dynamics, China holds a distinct position among the global economies. Nevertheless, expanding into the world’s most populous country isn’t an easy affair.

A successful strategy starts with being aware of the needs and wants of Chinese shoppers. This involves adding Alipay payments – China’s most popular digital payment option – to your online store to earn the trust of your target audience, improve your overall customer experience, and increase your shopping cart conversion rates.

Read more about 8 cart abandonment rates and how to solve them.