Low-cost, secure, and virtually risk-free – iDEAL is a payment method you can’t afford to ignore if you’re planning to expand your online business to the Netherlands. In fact, iDEAL payments are the most popular online banking method among Dutch consumers, holding a 70% market share in the country!

But what exactly are iDEAL payments? How do they work? How can you benefit from adding this payment option to your checkout?

Keep reading to find out more!

What’s an iDEAL payment?

iDEAL is the leading online payment brand in the Netherlands. Supported by all the major banks in the country, it provides a guaranteed payment to merchants and lets consumers pay online through their mobile banking app or online bank account.

iDEAL payments were introduced by the Dutch bank association Currence in 2005. Originally, they were mostly used for webshop payments. However, today, they’re the go-to payment method to settle all kinds of transactions, from making donations to paying local taxes or settling traffic fines.

Why should you enable iDEAL payments in your online store?

Cultural norms and technology impact consumers all over the world when it comes to where to purchase and how to pay.

In most countries, people prefer to use local payment methods. In several European countries, customers may not even have a credit card, for instance. This means you’re losing out on opportunities to sell!

Accordingly, if you see Dutch customers visiting your online store and abandoning their cart in the latter stages of a purchase, the offered payment options could very much be the reason.

Read more about 8 cart abandonment reasons and how to solve them.

To increase your customer base and outpace competition, you’ll need to make people feel comfortable purchasing from you. If you want to successfully tap into the Dutch market, it’s worth knowing that the popularity and trustworthiness of iDEAL payments have grown tremendously over the past decade.

While the number of processed payments was around 4,5 million in 2006, this number skyrocketed to more than 640 million in 2019:

In fact, 60% of e-commerce transactions in the Netherlands were paid with iDEAL in 2019:

What’s more, 96% of all Dutch online shoppers used iDEAL in the first half of 2021, translating into a whopping 50 million purchases per month!

Now that you know why it’s worth adding iDEAL payments to your online store, let’s see what additional advantages it has to offer!

What are the advantages of iDEAL payments?

Adding iDEAL payments to your online store allows you to:

- Increase conversions – iDEAL payments provide a secure, convenient, and fast payment option for customers. The immediate payment guarantee enables e-commerce merchants to speed up their delivery processes, leading to higher customer satisfaction.

- Gain consumer trust – iDEAL is consistently in the top 10 strongest brands in the Netherlands. Payments are also extremely secure due to the two-factor authentication.

- Avoid disputed payments – Chargebacks or consumer-initiated automatic refunds are not possible within the iDEAL scheme. The risk of fraud or unrecognized payments is extremely low, as buyers need to authenticate the payment with their bank.

- Keep your costs low – Transaction fees for iDEAL payments differ per iDEAL contracting partner, but generally, you can expect low costs. In most cases, a fixed fee per transaction is applicable. Some parties might also ask for a monthly subscription fee.

How do iDEAL payments work?

Now that you’re familiar with all the advantages of offering iDEAL payments in your online store, let’s see what the transaction flow looks like.

As we’ve already discussed, customers can use their bank’s online environment when using iDEAL payments. Therefore, the exact customer experience depends on the given bank.

The main steps are as follows:

- Your customer selects a product in your online store and clicks “Pay” to see the list of payment options.

- The buyer chooses iDEAL payments and selects their bank.

- Next, the customer is redirected to the bank environment and enters bank details.

- The shopper completes the authorization process.

- The bank authorizes the transaction in real time, deducting the amount directly from the buyer’s account.

- You receive a real-time confirmation of the payment from the bank. Your customer obtains a notification on the success of the payment as well.

- Finally, the shopper is redirected back to your website or thank you page.

Other ways to pay with iDEAL

As mentioned above, your customers can use iDEAL payments to pay in your online shop. However, this is not the only way to provide this fast and safe payment method.

You can send your customers an iDEAL payment link via email, WhatsApp, text message, or any other channel. This allows them to pay later for a subscription fee or electronic invoices.

The payment link takes the buyer directly to your landing page where the iDEAL payment request is ready for approval. The validity of the landing page will expire once the customer pays or after the expiration date of the offer.

It’s worth providing this option, as electronic invoices with an iDEAL payment link are paid three times faster!

Pro tip for using iDEAL payments link

Don’t forget to secure your landing page with SSL! You can use the Really Simple WordPress SSL plugin to automatically install a free SSL certificate on your WordPress site and migrate your entire page from HTTP to HTTPS. Additionally, the plugin’s built-in features help you fix SSL-related issues on your site – all this without any coding experience on your part! For further useful tips on how to hack-proof your website, make sure to read our article on secure forms!

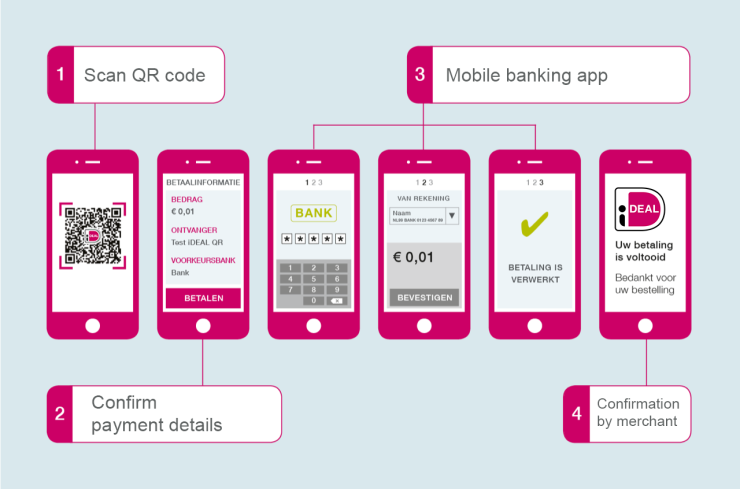

You can also offer iDEAL payments via the iDEAL QR code. You can display these codes on invoices, bills, screens, billboards, and posters. The QR code features the iDEAL logo in the middle. Your customers can scan it quickly and securely with the QR scanner of their bank’s app. They can simply approve the payment by using their mobile access code, fingerprint, or facial recognition.

Accept iDEAL payments with Stripe

If you’re using Stripe as your payment service provider, integrating iDEAL payments will be as easy as accepting them!

You can add iDEAL payments from the Stripe Dashboard without changing your code. To enable this option, your prices need to be expressed in EUR!

Stripe will display the list of supported payment methods to your customers by evaluating the currency, payment method restrictions, and other parameters.

As your buyers need to authenticate the payment with their bank, the risk of fraud or unrecognized payments is low. Consequently, you won’t have to deal with disputes that turn into chargebacks, and funds won’t be withdrawn from your Stripe account.

Pro tip – Think about adding other payment methods to your checkout!

Depending on your target markets, this might include cards, bank debits (such as ACH Direct Debit payments or BECS), bank redirects (such as Giropay or Sofort), bank transfers (such as SEPA payments), or virtual wallets (such as Apple Pay or Google Pay), for instance.

Summary

If you want to successfully tap into the Dutch market, adding iDEAL payments to your webshop is a must! As the leading online payment method in the Netherlands, iDEAL provides a guaranteed payment to e-commerce merchants and allows buyers to pay online through their own bank. Thanks to its secure, user-intuitive system, immediate payment confirmation, and undeniable popularity, iDEAL payments help merchants boost their customer base in no time!