Did you know that over 50% of sellers will leave a marketplace for another one that offers a better payment system? As an aspiring online marketplace or software platform owner, weighing up the needs of your users is critical for success. So, if you’ve already decided to use Stripe Connect as your payout engine but still don’t know which Stripe Connect account type is right for your business, this guide will lead you to the right answer!

What is Stripe Connect?

If you’re quite new to Stripe Connect, you may have some questions regarding how the solution can help you build and scale your business.

Therefore, before discussing which Stripe Connect account is right for your business, let’s sum up quickly the most important facts you need to know about the integration.

As you might already know, until recently, one of the most challenging parts of launching an online marketplace was handling payments. The upfront costs and development required for payment facilitation represented a major hurdle for many businesses. Onboarding users, controlling the flow of funds, and scaling globally were some further stumbling blocks many business owners could simply not overcome.

That’s where Stripe Connect comes into the picture.

How does Stripe Connect help?

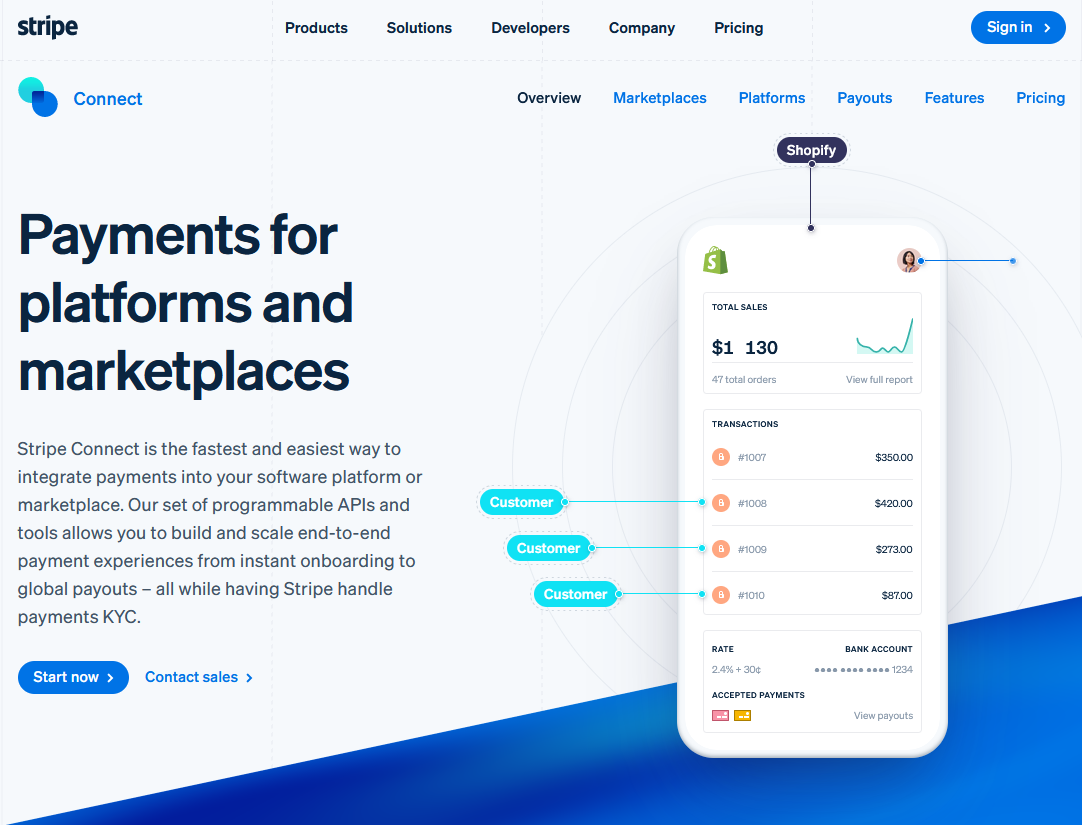

Stripe Connect is a global routing and payout engine for online marketplaces and software platforms offered by the payment service provider Stripe.

The integration is basically a set of programmable APIs and tools that allow you to control payment interactions between businesses and their customers on a global basis. It allows you to split funds between multiple users, instantly route payments across borders, and specify your earnings on each transaction.

Using Stripe Connect means that you can pay out around the world in local currencies without additional engineering effort or local banking relationships. You can use the Stripe Dashboard to send funds, issue refunds, and handle chargebacks with one click.

Stripe Connect also helps you onboard users with ease, simplify compliance, and reduce manual processes to build and scale with less overhead and more opportunities for revenue growth. The integration allows you to keep full records of all transactions so that you can easily track and reconcile payments.

Which Stripe Connect account is right for your business?

Now that you know what Stripe Connect is all about, let’s take a look at its account types.

As you might already know, all users (anyone who receives money on your platform) need to have a Stripe account in order to use Stripe Connect.

Therefore, you’ll need to create a Stripe Connect account for each user when they sign up for your platform.

Choosing the right Stripe Connect account type is critical for success, since it’ll determine the Stripe integration you need to build, the operational responsibilities, and most importantly, the user experience. These factors can affect the amount of engineering resources spent as well as your conversion rates.

So, what are the account types you can choose from?

There are three Stripe Connect account types, each designed for different use cases: Standard, Custom, and Express.

Let’s see the differences!

Stripe Connect Standard account

This type of Stripe Connect account requires the lowest integration effort. Therefore, you can launch faster, without the upfront costs or development usually required for payment facilitation.

Here, sellers are prompted to create their own accounts and connect them to your marketplace.

This means that they have full control over their accounts: they’re interacting directly with Stripe and are able to log in to the Dashboard. They can also process charges on their own and can disconnect their account from your platform. Since in this case, buyers transact directly with the seller’s account, sellers are responsible for Stripe fees, refunds, and chargebacks.

Prominent users of this type of Stripe Connect account include e-commerce SaaS platforms such as Shopify or Invoice2go.

Taking the above into consideration, you should use Standard accounts when:

- you don’t want to waste time when starting your business;

- your users are experienced online sellers and might already have a Stripe account;

- you’re fine with having only limited control over your user experience;

- you don’t want to manage liability or seller Stripe accounts;

- you want to use direct charges (i.e., buyers will transact with sellers, often unaware of your platform’s existence);

- you’d like Stripe to handle direct communication with your users for account issues (such as Stripe Connect account verification).

Stripe Connect Custom account

This type of Stripe Connect account can be considered as a white-label solution: it enables you to fully customize the payment process and thus, the user experience.

You’ll have full control over the Stripe Connect account onboarding process, the dashboard, and reporting interfaces. Consequently, the Stripe Connect Custom account will almost be completely invisible to the account holder: they won’t have access to the dashboard, and Stripe won’t contact them directly.

This also means that your platform will be responsible for all interactions with your users. This includes collecting any information Stripe needs for handling any account issues. Furthermore, your platform will be responsible for Stripe fees, refunds, and chargebacks on behalf of the seller accounts.

What does all this mean in terms of costs?

Yep, you might have already guessed it right: this Stripe Connect account type requires the most development resources and a considerable integration effort with Stripe’s API. (If you’d like to know more about how Stripe API can be integrated into your website or application, reading our Stripe API keys blog post is a good start.)

You should use the Stripe Connect Custom account when:

- you wish to have full control over your user experience;

- you want to use destination charges (i.e., buyers transact with your platform; however, goods are delivered by the seller account);

- you have the resources to build the significant infrastructure needed to collect user information, create a user dashboard, and handle support;

- you prefer to communicate with your users instead of having them contact Stripe directly.

What’s a real-world example of this type of Stripe Connect account?

Lyft became a Custom account user when its drivers wanted to get paid on demand instead of weekly. Customizing the payment process enabled Lyft to increase user satisfaction and attract even more drivers.

Stripe Connect Express account

The Stripe Connect Express account is basically a hybrid option that allows sellers to sign up to your marketplace within two minutes!

With this type of Stripe Connect account, Stripe handles the onboarding and identity verification processes. The payment service provider also takes care of reporting and account management. However, your platform will have control over some elements of the user experience such as specifying charge types or managing the payout schedule. Furthermore, just like with Custom accounts, your platform will be responsible for handling disputes and refunds.

As you can see, sellers will have some interactions with Stripe; however, they’ll primarily interact with your platform. Stripe provides a pre-built Express Dashboard for your users in this case, which is a lighter version of the Dashboard. This reduces development time significantly. Therefore, you’ll be able to get started with payment in weeks instead of months!

Some examples of this type of Stripe Connect account include Airbnb, Spotify, and GitHub.

Use Express accounts when:

- speed is an important factor when getting started;

- you want to use destination charges or separate charges and transfers;

- you don’t want to deal with account onboarding, management, and identity verification yourself;

- you’d like to customize the payment process to some extent.

Additional Stripe Connect account differences

Besides the above, there are some further differences between the Stripe Connect accounts you should be aware of.

First, you should know that Stripe Connect prices vary for the different account types. The good news is that Standard accounts allow you to get started for free! Express and Custom accounts cost $2 per active account per month plus 0.25% + $0.25 per payout sent.

Regarding refunds, you should be aware of the fact that they’re handled differently depending on the account and charge type. If you’d like to use destination charges, there’s no difference between the three Stripe Connect account types: Stripe will automatically process the refund once sufficient funds are available in your platform’s account.

The story is a bit different for direct and separate charges. In the case of Standard accounts, Stripe will automatically process refunds once sufficient funds are available in the seller’s account. The same applies to Custom and Express accounts; however, funds can be deducted from either the seller’s or the platform’s account.

Choosing the right Stripe Connect account type – Key takeaways

If you’d like to start your own online marketplace or software platform, getting your payment system right is a critical part of building a successful global venture.

Stripe Connect offers three types of accounts that provide different levels of integration, features, and costs:

- You should use the Standard account if you want to get started quickly, you don’t want to manage liability, your users are experienced online sellers, and your platform is similar to Shopify where buyers transact with sellers directly.

- Custom accounts work best with platforms like Amazon where buyers transact with the platform, but goods are delivered by the seller account. This Stripe Connect account type is a great choice if you wish to have full control over the user experience and have the resources to build the required infrastructure.

- Finally, the Express account is the go-to solution if you want to get started as quickly as possible, would like to customize the payment process to some extent, and want to use destination charges.

Now that you already know which Stripe Connect account to choose, we wish you good luck in successfully building and scaling your business!