Affordable, convenient, secure, and simple – ACH payments offer an increasingly attractive option for businesses to collect payments. In fact, ACH has grown to become one of the largest and most efficient systems in the world of banking over the past decades: the network now handles more than $72 trillion worth of transactions every year.

This is why we’re sure you’ve already heard of this payment method. However, as a business owner, you might still have some questions: how do ACH payments work? What are their benefits and drawbacks? How do they compare to other payment methods? And most importantly: are they right for your business? This article will guide you through the answers.

What’s the meaning of ACH payments?

ACH stands for Automated Clearing House, a US financial network used for electronic payments and money transfers. ACH payments are a method of transferring money from one bank account to another directly, using the ACH network. This means that the transaction is being done without the use of credit cards, cash, checks, or wire transfers.

ACH payments can be used for one-time payments; however, they’re more commonly used for recurring transactions. For instance, if you have recurring payments for your mortgage or gym membership deducted from your bank account periodically, you’re using ACH bank transfers as a consumer. On the other hand, if you have automated payment set up for your employees weekly or monthly, you’re using ACH payments as a business owner.

The network continues to grow

As a business owner, it’s worth knowing that ACH payments are continuously increasing in popularity. Nacha reported that more than 2 billion online transfers were initiated in 2020. That’s an increase of 15.2% from 2019. The leap to 2021 was even more remarkable: last year, ACH moved financial transactions worth more than $72.6 trillion!

No wonder the ACH payment volume is steadily growing: ACH payments offer an affordable, convenient, and simple solution for companies and organizations to accept recurring payments. We’ll talk later about these benefits – let’s discuss the different types of ACH payments first!

What are the different types of ACH payments?

There’re two ACH payments types:

ACH debit

ACH debit, also known as direct payment, is a transfer type where funds are pulled from a bank account. In practice, this happens when a customer (payer) gives permission to a merchant (payee) to take payment from their account to meet a recurring payment agreement, such as paying for monthly utility bills.

ACH credit

ACH credit payments, also known as direct deposits, mean that funds are pushed into a bank account. This occurs when a customer (payer) sends a given amount of money to a merchant (payee) to purchase some goods. Another example would be paying monthly bills manually.

How do ACH payments work?

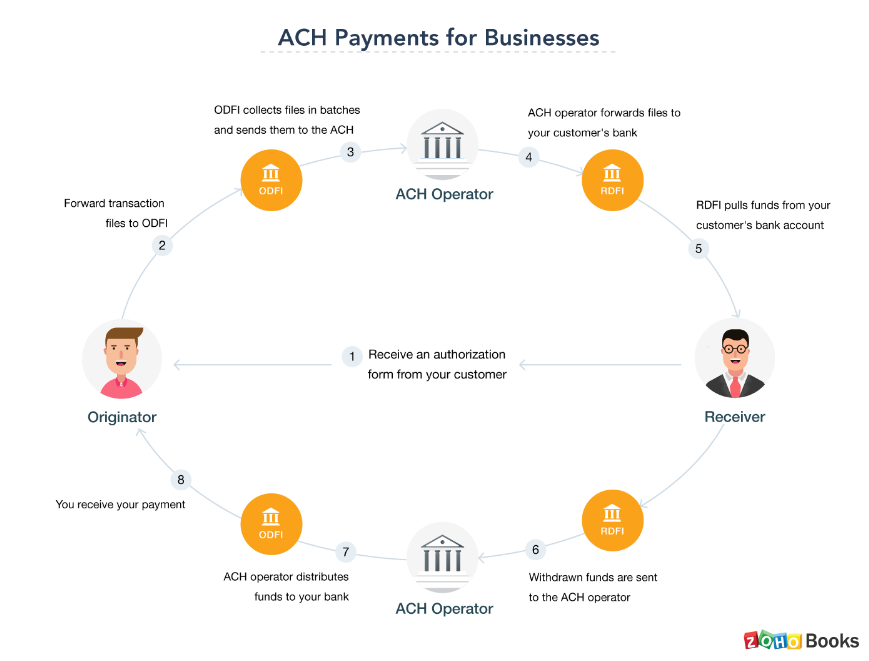

In simple terms, an ACH transaction consists of a data file containing information about the desired payment. In order to process a transaction, that file needs to be sent to the originator’s bank, then to the clearing house, and finally to the recipient’s bank, where the funds are transferred to the receiving account.

Let’s look at how you can initiate an ACH direct debit payment if you need to bill a customer:

1. Customer authorization

Before starting the transaction, you need to make sure you’re allowed to pull money from your customer’s bank account. Your customer can authorize recurring payments by filling out an authorization form with their bank.

2. Transaction initiated

As the originator, you forward the payment details to your bank or ACH provider, known as the Originating Depository Financial Institution (ODFI).

3. Transaction forwarded

Your ODFI forwards the payment details to an ACH operator. This can be the FedACH (Federal Reserve Banks’ Automated Clearing House) or the Electronic Payments Network (EPN). The ACH operator then sends the transaction details to your customer’s bank, known as the RDFI (Receiving Depository Financial Institution).

4. Payment processed

Before the RDFI processes the payment, it checks if the given account has sufficient funds. If so, the RDFI pulls the funds from your customer’s bank account, and you receive the payment.

ACH payments vs wire transfers

Now that you’re familiar with the definition of ACH payments and the process itself, the question may arise: what’s the difference between ACH transactions and wire transfers?

The most important difference is that wire transfers are processed in real time. ACH payments, on the other hand, are processed in batches a few times a day. Consequently, wire transfer funds are guaranteed to arrive on the same day, while ACH takes an average of one to three business days to complete.

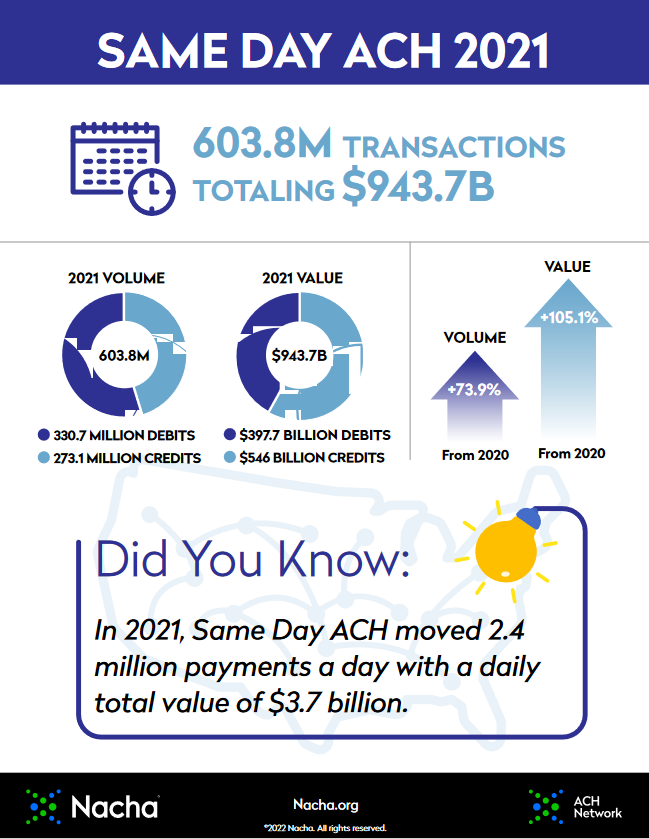

However, to solve this issue, same-day ACH processing is growing. Between 2020 and 2021, same-day ACH volume rose by 73.9%, with a total of 603.8 million payments made in 2021:

In terms of expenses, ACH payments are much cheaper than wire transfers. Sending wire transfers involves typical outgoing fees of $25 per transfer within the US. However, in some cases, they can cost customers up to $50! ACH payments, on the other hand, usually cost under $1.

What are the benefits of ACH payments?

There are a number of reasons why ACH payments are becoming an increasingly attractive option for businesses accepting recurring payments. Notably:

Extremely low processing costs

The greatest advantage of ACH payments is that they typically have the lowest processing fees of any type of payment, including credit cards!

Credit card transactions usually cost around 2% of the payment amount, and wire transactions cost $10-35 each. By contrast, ACH payments cost under $1, regardless of the amount paid. Flat rates usually range from $0.25 to $0.75 per transaction. Some ACH processors might charge a flat percentage fee, ranging from 0.5% to 1% per transaction. Therefore, it’s safe to say that savings can be significant if you’re a business that accepts recurring payments.

Convenient usage

Paper checks? Paper invoices? Time-consuming trips to the bank? Forget the hustle!

ACH payments are easy to set up on your website, and the payment flow is smooth. Furthermore, you don’t need to chase late payments or remind customers to pay.

Similarly, opting for the ACH payment allows your customers to spend less time on each transaction since payments will be taken care of automatically. This means they’ll never need to worry about missing a payment!

Expanded reach

Did you know that about 1 in 6 US adults doesn’t have a credit card, but only 1 in 20 doesn’t have a bank account?

This is where ACH payments come into the picture: since your customers only need a bank account to use this payment method, it allows you to reach customers without credit cards, and therefore improve checkout conversion.

Secure payment

Credit card fraud, bounced checks, wire transfers sent by mistake – payment errors can cause a headache for your customers and can seriously damage your business’ reputation as well.

Using ACH payments, you and your customers won’t need to worry about the above! ACH provides secure payments due to the direct transaction between the two parties involved. Unlike other electronic payment methods, ACH allows you to set up a recurring payment without asking your customer to provide their bank account information every time. This reduces the chances of fraud.

Additionally, ACH payments are reversible and users are authenticated. Wire transfers, on the other hand, are irreversible, and there’s no way of verifying the sender’s or recipient’s identity. Therefore, it’s easy to pull off a wire transfer scam using fake identities.

Improved customer retention

Credit and debit cards expire which often leads to involuntary churn. This is not an issue with ACH payments. Furthermore, ACH payments are made directly from bank account to bank account, which significantly reduces the chances of payment failure and therefore customer churn.

So far, so good, but are there any drawbacks?

It’s obvious: ACH payments bring significant benefits for businesses.

But are there any downsides?

Just like any other payment method, ACH payments do have some potential drawbacks to keep in mind.

Slow process

As mentioned earlier, ACH payments can take several business days to process. The good news is that ACH debit transactions must be processed either on the same day or the next business day. ACH credits can be processed on the same day or up to two business days later.

Since many banks now allow same-day or next-day ACH transfers, it’s more common for ACH transactions to take only one to two business days. Therefore, as long as the request is submitted before the cut-off for the day, it’s possible to receive the money within 24 hours.

Transaction limits

Many banks impose limits on how much money your customers can send via an ACH transfer. These can be daily, weekly, monthly, or per-transaction limits.

Limited availability

Finally, a disadvantage of ACH payments is that usually, banks don’t allow ACH transfers to and from international bank accounts. Generally, only businesses in the United States can accept ACH direct debit payments from customers with a US bank account.

Penalty fees

Although rejections rarely occur, they could land your business a penalty fee. So, what can you do to avoid these fees?

If you get a return code, the first thing you should do is to quickly correct the issue. For instance, in case of insufficient funds, you should try to rerun the transaction after the customer transfers more money into their account or provides a different payment method. This way, you can avoid incurring additional fees on each recurring billing cycle.

Are ACH payments right for your business?

Weighing the benefits and downsides of ACH payments is a complex task when it comes to making the right decision. Try to think about the following questions:

- Does your business accept recurring payments?

- Do many of your customers pay by paper checks or credit card?

- Would they be happy to use a more comfortable option?

- Do your customers have a US bank account?

- Receiving payments instantly is not a priority for your business?

- Would you pay lower fees for ACH processing compared to what you pay for credit card transactions?

- Would your customers be willing to pay by ACH?

A “yes” to any of the above questions means that your business would benefit from accepting ACH payments.

Accepting ACH payments with Stripe

It’s clear to every business owner: accepting more payment methods helps your business expand its reach and improve checkout conversion. The good news: if you’re a US-based business and are using Stripe as your online payment processor, you can expand your accepted payment methods by ACH payments.

In Stripe, accepting ACH payments works almost the same way as accepting credit card payments, by providing a verified bank account as the source for a charge request.

However, accepting ACH payments requires a slightly different workflow than accepting credit cards:

- You have to collect a mandate from your customer to take payments before you can debit their bank account.

- Bank accounts must be verified to comply with ACH Direct Debit rules.

If both steps are completed, your customer can choose ACH from the list of payment methods on your website and can use it for recurring charges:

Using Stripe.js, Stripe’s foundational JavaScript library for building payment flows, Stripe provides a fully-hosted collection of bank account details, instant bank verification, and delayed verification using micro-deposits. This ensures to reduce payment failures and fraudulent activities.

What do ACH payments cost?

For ACH direct debit payment, Stripe charges 0.8% capped at $5. There are no monthly fees or verification fees. This means that a $100 payment would incur a $0.80 fee; any payments above $625 cost $5. This can be especially useful if you charge customers large amounts on a recurring basis.

Wrap-up

ACH payments are continuously increasing in popularity since they’re a secure, affordable, and convenient way for businesses to receive funds, especially if they handle recurring payments. Its simplicity and ability to increase customer retention make it an attractive alternative to conventional payment methods like check, card, or wire transfer.

If you’re a US-based business that currently takes recurring payments, your customers have a US bank account, and you’re happy to trade real-time payments for significant savings, switching to ACH payments is definitely a good move!