With the steep rise in the adoption of contactless payments all around the world, it’s almost imperative for businesses to adapt to the new ways consumers shop in-store and online. As more and more people resort to using digital wallets such as Apple Pay and Google Pay, online business owners can profit heavily from the benefits these mobile payment systems provide.

In this guide, we’ll explain why you should consider adding Apple Pay or Google Pay to the payment options on your website, and we’ll also discuss the main similarities and differences between these two platforms.

Let’s get started!

Why should you consider adding Apple Pay or Google Pay to your online store?

Before jumping right on the Apple Pay vs. Google Pay bandwagon, let’s discuss first the benefits of adding mobile wallets to your payment options.

First of all, it’s worth knowing that mobile wallets are attracting immense popularity across the globe, accounting for 44.28% of e-commerce transactions worldwide! The increase in mobile wallet payments is not likely to slow down soon, as the market is expected to exceed $80 billion by 2026!

But why is this type of payment so successful?

Firstly, mobile payment systems such as Apple Pay and Google Pay are extremely fast and easy to use. Your customers can install them in no time on their phones and instantly use them for purchases. When shopping online, they won’t need to type in their card numbers and waste time filling out lengthy forms.

A further advantage is that mobile wallets provide multiple layers of security that keep your customers’ accounts safe. Your buyers can also trim their wallet contents by storing credit and debit cards as well as loyalty and gift cards in one place.

Last but not least, some mobile wallets offer great reward programs, such as cashback rewards or valuable offers from brands, to keep bargain hunters on their platforms.

Considering the above, it’s clear that by enabling Apple Pay and Google Pay on your site, you can improve your customers’ overall user experience with a popular, safe, quick, and convenient checkout process. The result? Increased e-commerce sales and lower cart abandonment!

Google Wallet VS Apple Wallet

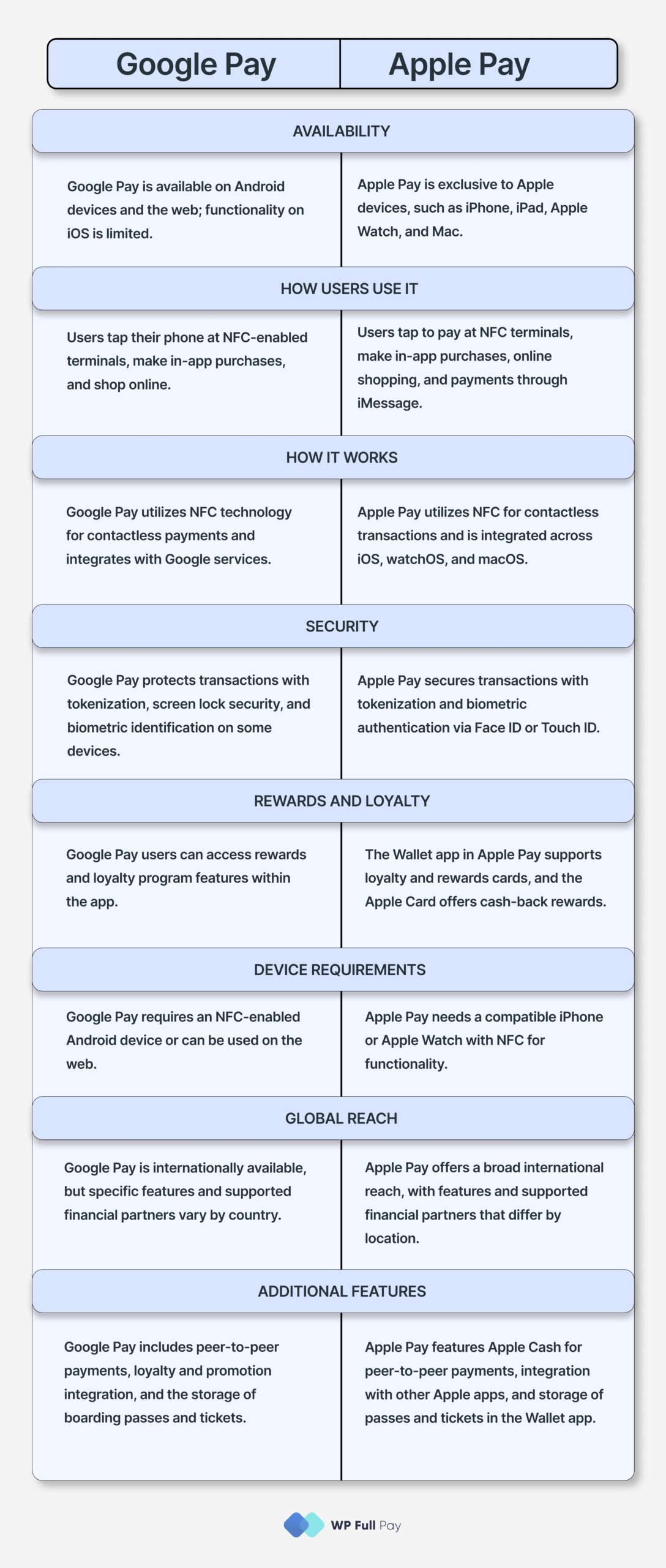

When you choose between Apple Wallet and Google Wallet, your decision largely depends on the devices you use and your personal preferences. If you’re deeply invested in the Apple ecosystem, Apple Wallet will provide you with a seamless and integrated experience. Conversely, if you’re an Android user, you’ll discover that Google Wallet offers a versatile and functional option for your device.

Apple Wallet and Google Wallet (previously Google Pay, and Android Pay before that) stand as two leading digital wallet services for Apple and Android devices. Users of both services can store payment information, including credit and debit cards, along with other types of passes like boarding passes, tickets, and loyalty cards.

Both services are actively evolving, constantly adding new features and expanding their capabilities to enhance user convenience and security.

Apple Wallet and Google Wallet are both available worldwide. However, the features they offer, along with the banks and financial institutions they support, can differ a lot from one country to another.

For example, Apple Wallet might support a certain credit card or bank in the United States, but that same bank or card might not be compatible with Apple Wallet in another country, like India or Brazil. Similarly, Google Wallet could allow users to add a specific loyalty card or transport pass in the UK, but this option might not be available to users in Japan or Australia.

These differences arise because each service makes different agreements with local banks, financial institutions, and service providers across various countries.

Apple Pay vs. Google Pay in 2024 – What are the differences?

Apple Pay and Google Pay are both widely accepted mobile payment systems all around the world.

If you’re asking “does Google Wallet work like Apple Pay?” the answer is yes.

Both offer digital wallet services that let you make contactless payments, store loyalty cards, boarding passes, and more.

If you have the feeling that they’re largely identical offerings, you’re pretty near the mark. However, as an online business owner, there are some nuanced differences you should be aware of!

Brief history

Apple Pay was introduced in late 2014, and Google Pay launched in 2018, replacing Google Wallet, which made its debut in 2011.

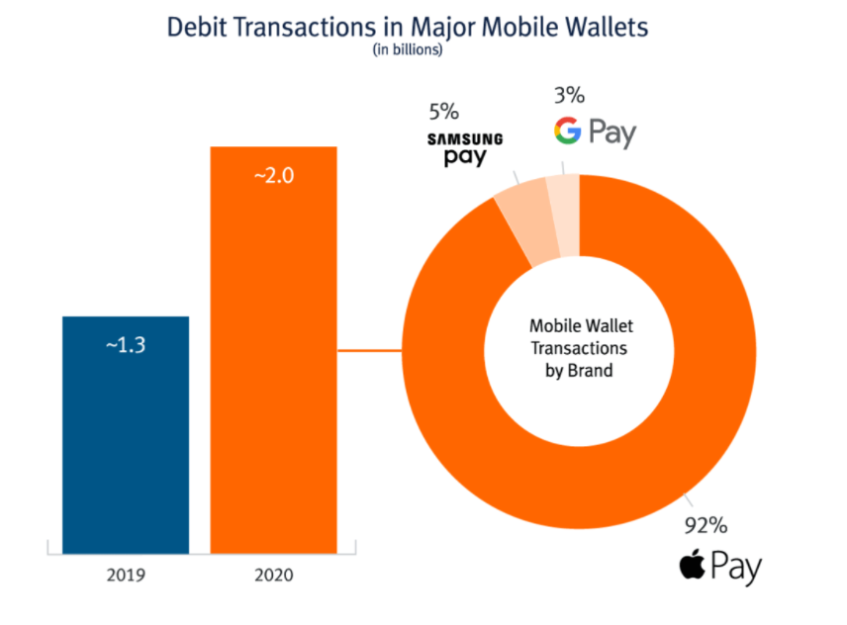

Apple Pay vs. Google Pay market share statistics clearly reflect the fact that Apple Pay was the first to successfully break into the market. In 2020, Apple Pay made up a staggering 92% of mobile wallet transactions in the U.S., while Google Pay accounted for only 3% of the market.

Besides Apple Pay and Google Pay, Samsung Pay is also a big player in the segment with a stable 5% market share. (As Samsung Pay is only natively supported on Samsung devices, leaving it with a considerably smaller user base, this article will only focus on the two other big players.)

Which one has more users?

Apple Pay has more than 227 million users and Google Pay has around 100 million.

No wonder Apple Pay accounts for nearly half of all in-store digital wallet purchases, while Google accounts for only 10.3%. Apple Pay also seems to do better in targeting affluent customers: their users tend to live in urban centers, are younger and earn more than users of other digital wallets.

Given the fact that over 85% of U.S. merchants accept Apple Pay, and 44% of U.S. consumers have an Apple Pay-enabled device, it’s not hard to understand why this payment method is a popular option.

Despite the above, one of Google Pay’s greatest advantages is that it’s available on all Android phones besides providing mobile apps for iOS as well. Additionally, its compelling reward program makes it an attractive choice for shoppers. As the standard Android mobile payment option, it has a fast projected growth of 40% until 2025!

How do Apple Pay and Google Pay work?

Regarding in-store payments, Google Pay works on most NFC-enabled Android smartphones or watches. Additionally, Google offers an app for iPhone users as well. Usually, users have to download the Google Pay app to their respective devices and add their credit, debit or prepaid cards to begin using it.

In the case of in-store purchases, users simply need to unlock their phones and hold them near the contactless payment reader. As a security measure, every transaction requires a Google PIN, pattern, password, or screen lock. Furthermore, transactions can be verified via a security code sent by Google. When the transaction is complete, a blue checkmark will be displayed on the screen.

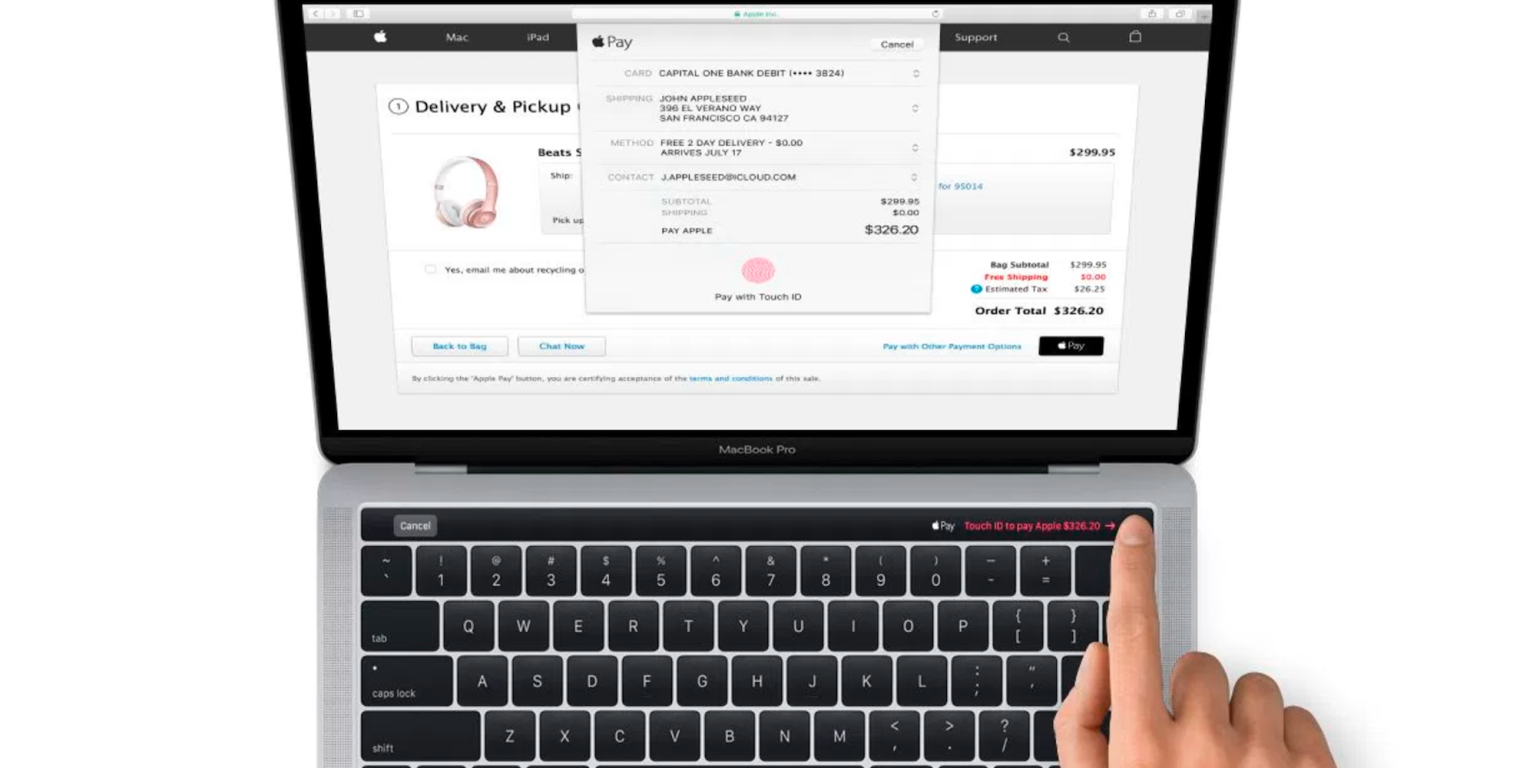

Apple Pay offers a similarly easy, secure, and private electronic payment service and is also based on NFC technology. Shoppers can use Apple Pay on iPhone, Apple Watch, iPad, or Mac devices. Every transaction requires authentication with Face ID, Touch ID, or passcode. Just like Google Pay, Apple Pay also ensures that loyalty points, rewards, and benefits from users’ cards will continue to accrue.

Regarding in-app or online purchases, users can shop wherever they see the Apple Pay or Google Pay logo, skipping the lengthy checkout forms and paying with just a touch or a glance.

Do Apple Pay and Google Pay charge fees?

Apple Pay is free to use for your consumers, and you don’t have to pay a penny either. The way the company makes money is by charging the bank directly that issued the card linked to the given Apple Pay account.

Google doesn’t charge transaction fees for your consumers, either. However, it charges vendors a percentage of each transaction, and it also makes money through targeted ads.

How secure are Apple Pay and Google Pay?

Security is always a concern for your consumers when it comes to sharing their financial information.

The good news is that Apple Pay and Google Pay both incorporate some fairly serious security measures and tricks to protect sensitive data.

With both systems, users have to provide their card details only once, during the initial setup. Google Pay saves these details on its servers and issues a virtual card to the user’s device. When your customer makes a purchase, the device only transmits the virtual card’s information. As a vendor, you’ll never see your buyer’s real card, which is protected by Google’s secure servers. When you charge the virtual card, Google charges your customer’s stored debit or credit card. This way, Google is the only entity that ever sees your shopper’s real card.

Apple takes a different approach known as tokenization. In this case, your customer’s device contacts the issuing bank directly and upon confirmation receives a device- and card-specific token. This is called the Device Account Number (DAN), which resembles a credit card number and is stored on a secure chip on the device. This number is passed on to the vendor when any payment is made before getting authorized by the bank.

Further considerations to maximize your success

Apart from providing your customers with simple and secure payment options such as Apple Pay or Google Pay, it’s vital to have a solid payment gateway in place to maximize conversions.

The payment service provider Stripe allows you to go the extra mile when protecting your customers from credit card fraud, identity theft, and scams. As Apple Pay and Google Pay are supported by Stripe’s secure servers, your customers’ sensitive financial information is even better protected.

Stripe is a certified PCI Service Provider Level 1 which is the most stringent level of certification in the payments industry. As all transactions through Stripe are SSL/TLS protected, every exchange of information between your customer’s device and Stripe’s servers is fully encrypted. To top it all, Stripe also provides multiple payment products (such as the fraud prevention tool Stripe Radar, the global routing and payout engine Stripe Connect, or the global invoicing software platform Stripe Invoicing), to collect payments safely, securely, and easily.

Additionally, if you’ve got a WordPress site, WP Full Pay is the perfect Stripe payments plugin to accept payments with a peace of mind. The plugin doesn’t store any credit card data in WordPress and ensures that your website is fully PCI DSS compliant!

Apple Pay vs. Google Pay – The bottom line

Due to the rapid increase of mobile payments all around the world, adding digital wallets such as Apple Pay or Google Pay to your website is a critical factor for success. Both payment systems allow you to improve your customers’ overall user experience, resulting in higher e-commerce sales and lower cart abandonment.