72% of online businesses see EU VAT compliance as a barrier to international growth – and we totally get them! Determining where and when to collect taxes, what rates to charge, or when to file tax returns can be challenging, especially as your business grows. The fact that EU VAT directives change constantly and vary based on what and where you sell, certainly doesn’t grease the wheels, either.

If you don’t have time to sit through EU VAT training programs, this guide will act as one: we’ll walk you through everything you need to know, so you can focus all your energies on successfully growing your business!

What is EU VAT?

As you might already know, EU VAT is the abbreviation of the European Union Value Added Tax. It’s a consumption tax that applies more or less to all physical and digital products or services bought and sold in the EU.

EU VAT is charged whenever value is added to goods throughout the supply chain, from production to the point of sale. Imports are also taxed so that EU producers can compete on equal terms on the European market with suppliers situated outside the Union. What about goods sold for export?

Products or services which are sold to customers abroad are usually not subject to VAT.

How is EU VAT charged?

The VAT due on any sale is a percentage of the sale price. However, from this, the taxable person is entitled to deduct all the tax already paid at the preceding stage. This way, double taxation is avoided.

To get a clear picture of how EU VAT is charged, let’s see an example:

A laptop manufacturer sells a laptop to an e-commerce retailer for €1,200 at a VAT rate of 23%. In addition to the cost of the laptop itself, the retailer pays €276 in VAT to the laptop manufacturer. The retailer then adds a markup of €600 to the laptop and posts it in its webshop for €1,800. At the online checkout, the customer pays an additional 23% in VAT, which equals €414. This way, the retailer ends up making back the VAT he previously paid to the laptop manufacturer. When filing taxes to the government, the retailer only pays €138. This sum equals €414 minus the laptop manufacturer’s VAT of €276.

What are the EU VAT rates by country?

Each EU country is responsible for setting its own rates. Therefore, EU VAT rates vary from country to country and depend on the product or service involved in the transaction.

These rates can be categorized as follows:

- Standard rate: it applies to the supply of most goods and services. This rate cannot be less than 15%.

- Reduced rate: one or two reduced rates may be applied to the supply of specific goods and services (based on the list in Annex III of the EU VAT Directive). However, these rates cannot be less than 5%.

- Special rates: some EU countries are allowed to apply special VAT rates on certain supplies (such as intra-community and international transport, for instance).

The most reliable source of information on current EU VAT rates for a specified product in a particular EU country is the given country’s VAT authority.

How to comply with EU VAT rules?

In a nutshell, EU VAT rules depend on:

- where you are;

- what you sell;

- where your customer is based;

- whether your customer is a business or an individual.

At first blink, this may sound confusing. Don’t worry! We’ll explain how to stay compliant in 4 steps.

1. Register for VAT

Before selling anything in the EU, you have to register your business in the VAT system.

Are you a business based outside of the EU selling digital products to private individuals in the EU? In this case, you’ll have to register for the VAT One Stop Shop Non-Union scheme. You can choose any EU country to host your tax registration. After registering, you’ll receive a unique EU VAT number in the format starting with “EU”.

Are you a European business selling to private individuals in multiple EU countries? Well, in this case, you can either register and file in up to 27 countries, or – and here comes the much better option – you can register for the VAT OSS Union scheme. This program was created to simplify the process of collecting and paying VAT across EU countries. How does it work?

If you sign up for OSS, you don’t have to register with each EU country where you sell products or services remotely. As an EU business, you can register with your home country’s OSS portal. You will transfer all the VAT that you collected to your local tax authority, who will then distribute this VAT revenue to other EU countries on your behalf. Simple, right?

Finally, if you’re an EU-based business selling locally, the threshold to register and collect VAT depends on the country in which your business is based. For instance, businesses in Austria need to register for and collect VAT once they’ve made €35,000 in annual revenue.

When you register for VAT, you’ll receive an EU VAT number. This starts with the two-digit country code (e.g., DE for Germany) and is followed by 2-13 other characters.

2. Calculate VAT

As the next step, you’ll have to calculate VAT on the given transaction. To do so, you need to determine:

- whether your customer is a business or an individual;

- which country’s VAT to collect;

- the correct VAT rate.

Sounds complicated at first glance? Let us explain in more detail.

Is your customer a business (B2B) or a private individual (B2C)?

To answer this question, just ask yourself: does my customer have a valid EU VAT ID number? If yes, you can consider it a business. You are required to verify the validity of the number with the VAT Information Exchange System (VIES) portal to help prevent tax fraud.

As a European business conducting a B2B transaction in a different EU country, you often don’t have to charge EU VAT. In this case, either the reverse charge method applies (your customer pays the VAT directly to his government rather than through you), or you may apply the zero VAT rate (which is a special rate meaning you don’t have to pay any VAT).

Which country collects VAT?

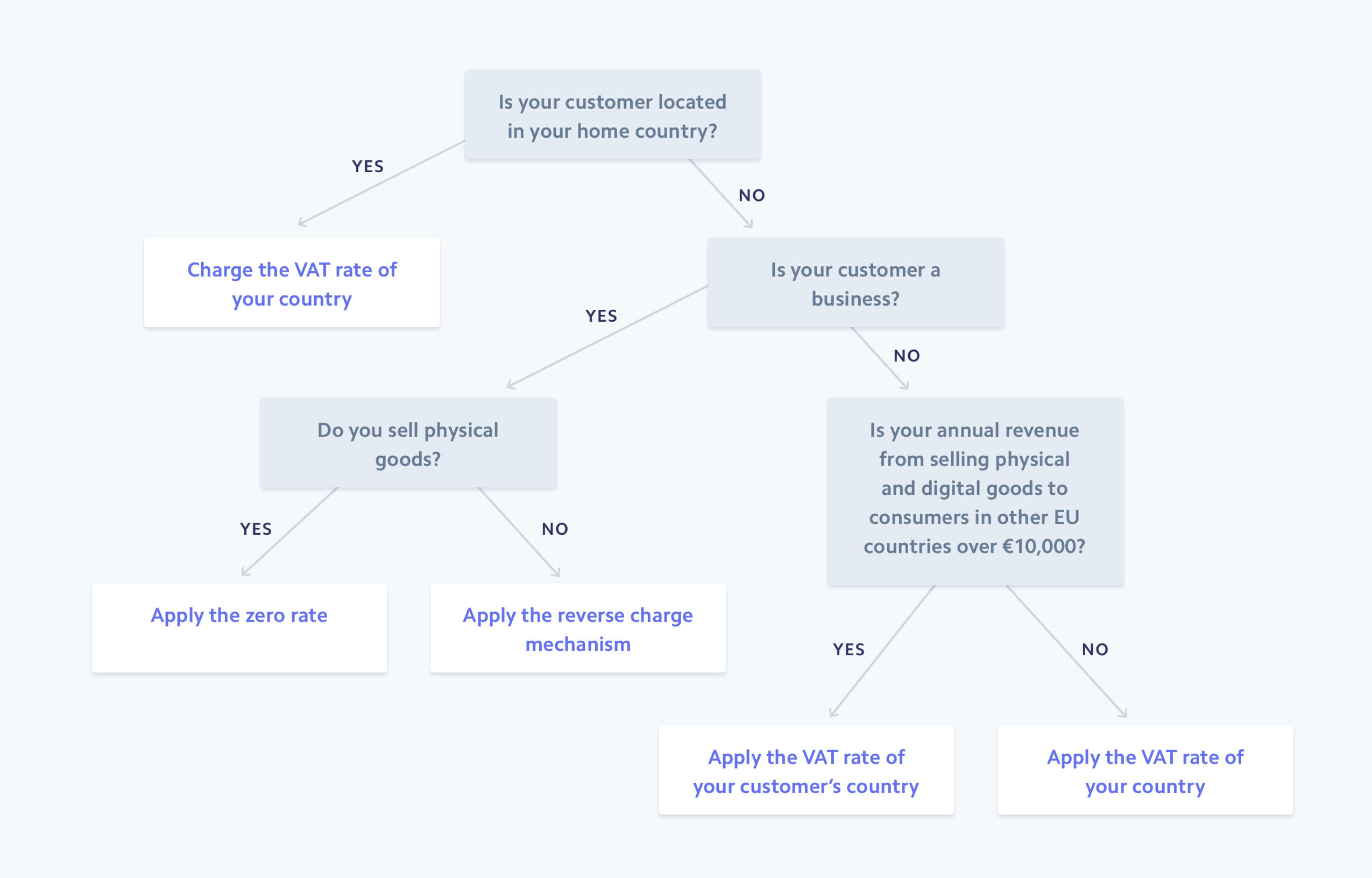

If you’re an EU-based business and your customer is located in your home country, you have to charge the VAT rate of your country. What about cross-border transactions?

As already mentioned, as an EU-based business, you don’t have to charge EU VAT when selling to other EU businesses. However, regarding B2C transactions, you have to charge VAT to all customers. The VAT rate depends on how much you’re selling within the EU. If your business stays below €10,000 per year regarding cross-border sales throughout the EU, you have to apply the VAT rate of your home country. Once you pass this threshold, you have to charge the VAT rate of your customer’s country.

If you’re a non-EU-based business, simple rules apply. Regarding B2B transactions, you should use the reverse-charge method. Regarding B2C transactions, you have to charge the VAT of your customer’s country.

3. Gather evidence of the transaction

Since tax rates vary significantly based on the buyer’s location, the government demands a record that confirms the customer’s residence and that the correct tax rate was charged and paid.

Therefore, you need to collect and store two of the following:

- location of the customer’s bank;

- IP address location of the buyer’s device;

- billing address;

- country that issued the credit card.

Make sure to keep these records on file for ten years!

4. Report taxes

The rule is simple: even if you have no VAT to pay or reclaim, you need to file your returns on time to avoid penalties.

You’ll need to report two types of EU VAT: the amount you charged to your customers and the amount of VAT you paid to your suppliers. When filing your return, you need to deduct the VAT you paid from the VAT you charged.

But when are returns due?

The filing frequency varies per country. It may also depend on your annual sales revenue. For instance, in Germany, the standard filing period is quarterly, but sellers who make more than €7500 in annual sales revenue have to file monthly. Businesses that make under €1000 need to file yearly.

If you opted for OSS registration, you need to submit a quarterly OSS return in your country of registration.

Ensure compliance & simplify your life with Stripe Tax

We hope that with the help of the above EU VAT guide, there’s nothing anymore that could stop you from scaling your business.

However, if you feel like you still need some assistance, we have some good news for you: staying compliant with EU rules will be a walk in the park with the help of Stripe Tax!

Using Stripe as your payment gateway, you can get started in minutes by adding a single line of code to your existing integration or clicking a button in the Dashboard.

How does Stripe Tax help?

It monitors your transactions, so you know when and where you need to register to collect taxes. Furthermore, Stripe Tax also acts as an EU VAT rate calculator: it constantly monitors and updates tax rules and rates. Consequently, it always calculates and collects the correct amount of taxes, no matter what or where you sell. It also validates the EU VAT ID when needed. Additionally, it helps you speed up filing and remittance with comprehensive reports for each market in which you’re registered.

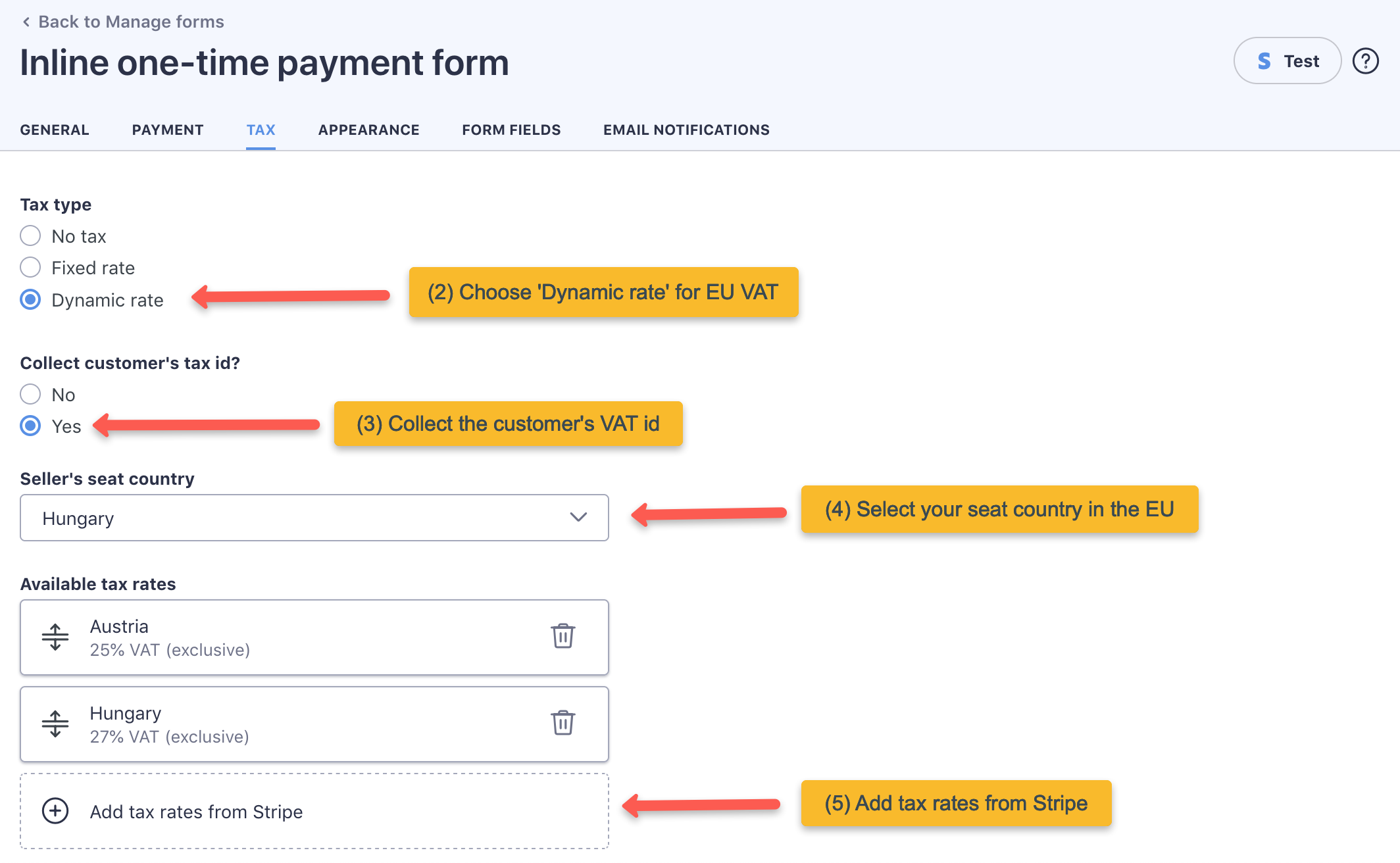

Furthermore, WP Full Pay is the perfect payments plugin for your WordPress site if you need to comply with complex tax rules. The plugin supports charging tax on top of one-time as well as subscription payments. You can use the following tax calculation strategies:

- No tax

- Fixed rate

- Dynamic rate

The plugin has a WordPress filter hook for overriding the tax rates picked by the dynamic tax rates selector. In case of a B2B transaction, it helps you check for instance if the buyer is an EU-based business. If the EU VAT ID is specified, it removes all tax rates so that no VAT is added on top of the purchase price.