Giropay and Sofort are among the most commonly used payment methods in German-speaking markets. Adding these online bank-to-bank transfers to your checkout page allows you to expand your market share, leading to increased sales volume and revenue!

Sounds good?

Let’s discuss everything you need to know about these popular payment options!

Giropay and Sofort – Important facts and statistics

Both Giropay and Sofort are widely used by customers in German-speaking countries and beyond for online purchases.

First, let’s see what Giropay has to offer!

Giropay: brief history, scope, and benefits

Giropay is a local bank transfer payment method in Germany founded in 2005. It’s a real-time online payment service which means that all the transactions are concluded in a matter of seconds!

It has over 85% bank coverage in the country and accounts for 10% of online checkouts. These numbers imply that e-commerce merchants can reach over 45 million potential users in Germany by integrating this type of bank transfer payment method into their webstores!

Impressive, right?

But why do people love to hit the “Pay with Giropay” button when shopping online?

Well, the answer is simple: Giropay provides a safe, fast, and convenient payment method. It adheres to the highest security and data protection standards, and the payment procedure takes just a few taps.

Furthermore, it doesn’t require any additional registration: users only need an online bank account to use the service. No wonder this payment method is popular in a wide range of industries, such as technology, lifestyle, home and garden, or forex industries. Needless to say, the system is optimized for PCs, tablets, and smartphones.

What about Sofort?

Just like Giropay, Sofort is also a real-time online banking payment service. Founded in 2005 in Germany, it’s offered by more than 25,000 online shops worldwide and accounts for over 4 million transactions per month!

Trusted by more than 85 million users, Sofort is available in the following countries:

- Germany;

- Austria;

- Switzerland;

- Belgium;

- Italy;

- the Netherlands;

- Poland;

- Spain;

- Slovakia;

- France;

- the United Kingdom;

- Hungary; and

- the Czech Republic.

This payment method is popular in a broad range of industries such as retail, travel, and forex, and it’s also widely used among customers of online casinos, for instance.

Compared to Giropay, Sofort is also one of the safest payment methods on the Internet. Since its launch, it has securely processed many millions of transactions, with not one online banking information fraud case arising!

Just like Giropay, Sofort allows customers to use its services without registration if they have an account in one of its partner banks. Funds are transferred directly from the buyer’s online bank account to the merchant’s account who’ll receive a transaction confirmation in real time.

What are the benefits of adding Giropay and Sofort to your checkout page?

A key advantage for merchants offering Giropay and Sofort on their checkout pages is the ability to attract customers with limited credit card usage across a number of European countries.

This means you’ll be able to expand your market share and attract new clients, leading to increased sales volume and revenue.

The low risk of fraudulent payments is another good reason for adding these trusted payment solutions to your checkout page. Since the payment is authenticated by the customer’s bank in real time, you’ll have to deal with fewer disputes and a lower chargeback risk.

Furthermore, as registration is not required to proceed, Giropay and Sofort will allow you to provide your customers with a simple and frictionless payment option. This will enable you to minimize cart abandonment rates and increase conversions!

Last but not least, real-time payment implies that both Giropay and Sofort allow your buyers to expect faster delivery, increasing customer satisfaction and loyalty in the long term.

How do Giropay and Sofort work?

The payment flow of Giropay and Sofort is very similar:

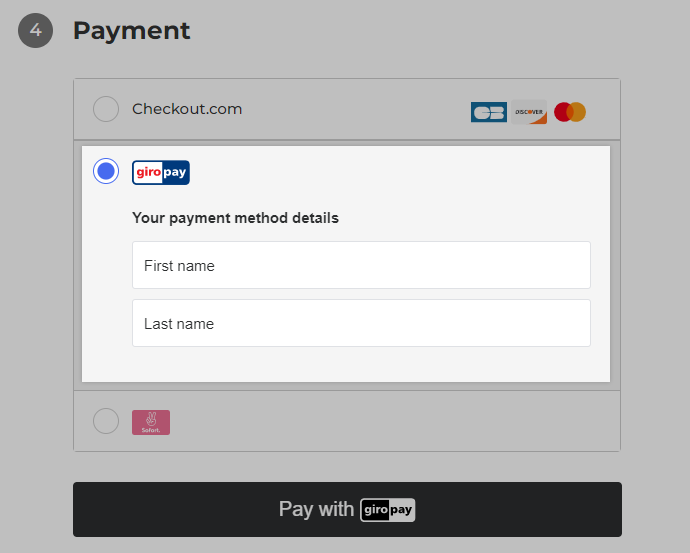

- Your customer selects Giropay or Sofort as their preferred payment option on your website.

- The shopper is redirected to the online banking environment where they select their country and their bank.

- The consumer enters the transaction authentication number or the code generated with a secure device (this depends on the bank) and enters it for final approval of the transaction.

- The bank authorizes the transaction in real time, deducting the amount directly from the buyer’s account.

- The merchant receives a real-time confirmation of the payment.

- The customer is redirected to the seller’s website or thank you page.

Start accepting Giropay and Sofort payments with Stripe

The payment gateway Stripe offers a wide variety of payment methods from around the globe to add to your website.

You can accept cards (such as Visa, MasterCard, or American Express), bank debits (such as ACH payment or SEPA payment, Buy Now, Pay Later options (such as Affirm or Klarna), or digital wallets (such as Apple Pay or Google Pay) to expand your global reach and improve your conversions!

Here’s how you can expand your list of accepted payment methods by adding Giropay and Sofort to your checkout:

- Navigate to the Stripe Dashboard.

- Go to Payments » Settings.

- Click Activate next to Giropay:

- Make sure to read the Terms of Service and the Giropay Addendum, and click Activate to continue.

- Next, enter your personal ID number, and click Update.

- Repeat the same steps for Sofort.

And that’s it! Your payment pages should now include Giropay and Sofort as additional payment methods.

Stripe will evaluate the currency, payment method restrictions, and other parameters to determine the list of supported payment methods to be offered to each of your customers.

The bottom line

Giropay and Sofort are among the most popular and trusted payment methods for customers in German-speaking countries and beyond.

Adding these real-time online bank-to-bank transfers as payment options to your checkout pages will help you:

- attract customers with limited credit card usage across a number of European countries;

- expand your market share, leading to increased sales volume and revenue;

- provide your buyers with a simple and frictionless payment option;

- minimize cart abandonment rates and increase conversions;

- prevent disputes and chargeback fraud;

- speed up your delivery processes; and

- increase customer satisfaction and loyalty in the long term.

So, if you’re looking for ways to quickly grow your market share in Europe, make sure to integrate Giropay and Sofort into your checkout pages today!