Are you struggling to find specific Stripe reports or trying to make sense of your earnings and fees along the way? You’re in the right place! This comprehensive guide will walk you through precisely how to find and utilize Stripe’s reporting functionality, from basic transaction data to advanced analytics and custom metric insights.

Ready?

What are Stripe reports?

Stripe reports are detailed financial statements that provide valuable insights into your business’s payment activity. These reports help with accounting tasks like reconciliation, aiding tax accuracy, and strategic business analysis decisions. Stripe financial reports help verify transactions, identify trends, and maintain accurate financial records.

With Stripe reporting, you can also track and analyze key data points, such as sales, customer behavior, and payment trends.

For instance, you can identify top-performing products, determine the success of your marketing activities, pinpoint areas for improvement, and understand your customers. Moreover, Stripe reports can even help you fight fraudulent activities, such as card testing attempts.

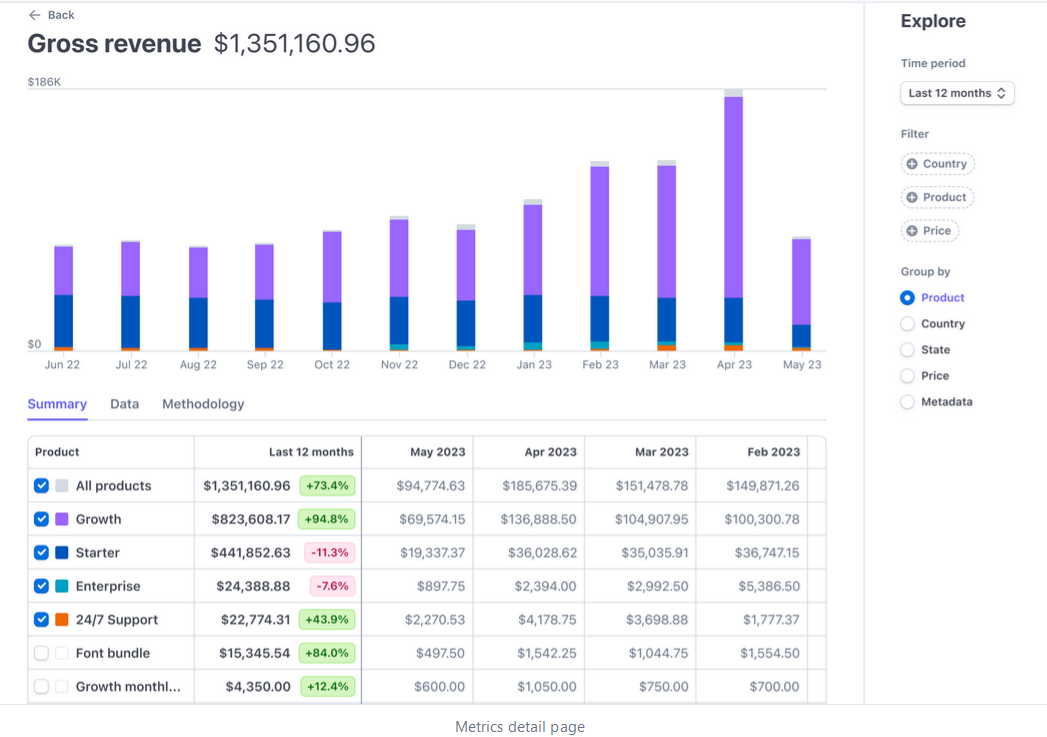

What are Stripe Metrics?

Stripe metrics are the data points and numbers that Stripe tracks to give you insights into your business’s financial performance. These metrics can include total sales, average payment size, number of refunds, chargeback rates, and more.

By analyzing Stripe metrics, you can understand how your business is doing in terms of sales, customer behavior, and overall financial health.

| Metric | Definition |

|---|

| Number of payments | Counts successful payment transactions |

| Payment average | The average amount per payment transaction |

| Discount amount | Total savings provided through discounts |

| Discount average | Average discount value applied per transaction |

| New customers | Number of first-time customers acquired |

| Existing customers | Count of returning or ongoing customers |

| Number of disputes | Total contested or chargeback transactions |

| Refund amount | Cumulative value of refunded transactions |

| Refund average | Average amount refunded per transaction |

| Monthly recurring revenue (MRR) | Regular income from subscriptions |

| New subscribers | Count of new subscription sign-ups |

| Trial conversion rate | Percentage of trials converting to paid subscriptions |

| Average revenue per subscriber (ARPS) | Average earnings from each subscriber |

| Churned subscriptions | Subscriptions ended per period |

| Retention rate | Proportion of customers continuing subscriptions |

| Subscriber lifetime value | Predicted total revenue from a subscriber over time |

Which Stripe metrics should you track?

The metrics you track will depend on your business model. Here are actionable suggestions for common payment types:

| Payment model | Metrics to track |

|---|

| One-time payments | Total sales revenue, average order value, number of transactions |

| Recurring payments | Monthly Recurring Revenue (MRR), churn rate, retention rate |

| Save card | Number of cards saved, usage rate of saved cards for repeat transactions, failed transactions |

| Donations | Total donation volume, average donation size, frequency of donations |

Stripe metrics for one-time payments

When tracking metrics for one-time payments through WP Full Pay, you’ll want to focus on the following key performance indicators that Stripe offers:

- Payments: This metric counts all successful one-time payment transactions, giving you a clear picture of sales volume.

- Average Revenue per User (ARPU): While typically used to evaluate revenue from subscribers, for one-time payments, you can use this to assess the average transaction value.

- Net Revenue: It reflects the total revenue after accounting for refunds, disputes, and any other deductions.

- Refunds: Track the total amount and number of refunds to understand the post-purchase satisfaction and any potential issues with products or services.

These metrics provide insights into the health of your one-time sales, customer spending habits, and overall financial performance.

Stripe metrics for recurring payments

For “Recurring Payments” processed through WP Full Pay, focus on these Stripe metrics:

- Monthly Recurring Revenue (MRR): Tracks the total predictable revenue generated from subscriptions each month.

- Churn Rate: Measures the percentage of subscribers who cancel their subscriptions within a given period.

- Lifetime Value (LTV): Estimates the total revenue expected from a subscriber over the duration of their subscription.

- Active Subscribers: Counts the number of active subscription customers.

These metrics help in understanding the stability and growth of your recurring revenue streams, subscriber retention, and overall subscription business health.

Stripe metrics for “save card” transactions

For “Save Card” transactions processed through WP Full Pay and Stripe, you would generally focus on the following metrics:

- Card Save Rate: Indicates the percentage of customers who choose to save their card information for future transactions.

- Repeat Purchase Rate: Measures the frequency at which customers using saved cards return for additional purchases.

- Failed Payments: Tracks the number of transactions that fail due to issues with saved card details.

These metrics help evaluate customer trust and convenience in your system, the effectiveness of the saved card feature, and the reliability of transaction processing.

Stripe metrics for “Donation” transactions

If you’re accepting “Donations” managed through WP Full Pay and Stripe, consider tracking these key metrics:

- Total Donation Amount: The sum of all donations received over a certain period.

- Average Donation Size: The average amount donated per transaction.

- Donation Count: The total number of individual donations received.

These metrics help you gauge the overall success of your fundraising efforts, understand donor generosity, and assess the frequency of donations. They are crucial for non-profits and organizations relying on charitable contributions.

| Stripe metrics | Payment models |

|---|

| Total Revenue | Across all payment types, track the cumulative revenue, including one-time purchases, recurring payments, and donations. |

| Total Revenue | The total number of transactions, irrespective of type, giving a broad view of overall business activity. |

| Average Transaction Value | Averages across all payment types to understand typical revenue per transaction |

| Refund and Dispute Rate | Common to all types, showing customer satisfaction and potential issues. If you see an unusually high number of disputes, this may indicate fraudulent activities which need further investigation! |

| Customer Acquisition and Retention Metrics | Encompassing new and returning customers for one-time, recurring, and donation models. This percentage metric will reveal the number of customers retained over a period of time. |

You might also like to read how to create form and accept donation on WordPress with WP Full Pay.

How to Download & Use Stripe Reports

There are 3 types of Stripe reports:

- Balance Reports: Reflect payments and balances similarly to bank statements.

- Payout (Reconciliation) Reports: Match Stripe payouts directly with your bank account statements, critical for transaction reconciliation.

- Stripe Custom Reports (Sigma): Tailored reports you can design to fit specific needs like subscription churn rates or revenue per customer.

You can access Stripe reports by navigating the “Reports” section of your Dashboard.

Stripe Balance Reports and how to download them

Balance report resembles a bank statement. It’s optimized for users who treat their Stripe account similarly to a bank account in their accounting system.

With the Balance report, you can track data on a daily, weekly, or monthly basis to see how the balance of your Stripe account varies over a time period. This will allow you to get a good understanding of cash inflows and outflows that can be used to formulate business strategies.

This Balance report can also help you calculate Stripe fees, allowing you to pass the appropriate fee on to your customers. Furthermore, you may also want to use Balance Stripe reports when seeking external funding.

How to download the Stripe Balance Report?

Navigate to Stripe Dashboard → Reports → Balance. Choose the desired time range and click ‘Download’ to get a comprehensive financial summary.

Next, click show, then choose which columns to display in your report:

Stripe Payout Reconciliation Reports and how to download them

The Reconciliation report helps you match the payments received in your bank account with the activity in your Stripe account. This data is real-time so you can check the status of lined payments whenever you want.

Accordingly, Stripe payout reports can be handy if you use Stripe to make payments via a business bank account. Keep in mind: these documents are only available if you have automatic payouts enabled!

How to download Stripe Payout Reconciliation Reports?

Navigate to Stripe Dashboard → Reports → Payment Reconciliation. Choose the period, select ‘Summary’ or ‘Itemized,’ then click ‘Download.’

Using Stripe Custom Reports (Sigma)

Stripe Sigma allows advanced users to run custom SQL queries for tailored analytics, such as measuring churn rates or monthly sales.

Stripe reporting for different payment models

If you’re accepting Stripe payments on your WordPress site using WP Full Pay, the Stripe report you choose depends on the type of payment you’re handling.

| Payment type | Ideal Stripe report |

|---|

| One-Time Payments | Balance Report |

| Recurring Payments | Payout Reconciliation Report |

| Save Card | Custom Reports (Sigma) |

| Donations | Custom Reports (Sigma) |

How to get the most out of Stripe Reports?

Let’s see how you can maximize the benefits of your Stripe reports when it comes to building killer business strategies:

1. Check reports frequently

First of all, it’s wise to check your Stripe reports frequently. This enables you to identify any suspicious activity before it causes irreparable harm to your business.

For instance, it’s worth paying attention to activities happening frequently in a short period of time, such as purchases from a specific area, at a specific time, or with a specific payment method. Analyze your daily, weekly, and monthly reports to see if anything sticks out.

2. Customize your reports

There are many different custom column options in your Balance and Payment reports that you can add to help you better understand specific characteristics and trends.

For instance, if you wanted to know how much of your business is coming from a certain part of the country, you might add the “shipping_address_state” column to your Balance report. This will show you each transaction by the state to which the order was sent.

Adding the “available_on” column to your Payment report might be also useful to see when funds will be available in your Stripe account. Furthermore, the “source_id” column allows you to connect a transaction to a particular Stripe object. Another useful customization is using the “subscription_id” column that lets you understand how much of your sales are derived from billing subscriptions connected to your Stripe account.

3. Share your findings with your team

Since your Stripe reports contain such a vast amount of information, it’s critical to share your findings with other departments.

Make sure to share the raw data, as team members may have a unique interpretation of the results.

4. Modify your strategies if needed

Did your Stripe reports reveal that you’re attracting high traffic from a particular region? You might want to specifically target this demographic with an email campaign!

Are a lot of purchases coming during the weekend? You might want to run a Sunday flash sale!

Did you notice an increasing number of refunds? It might be worth investigating why your customers are unsatisfied with your product! It might also be a wise decision to inspect if your marketing materials promise more than what’s being delivered to your customers.

Don’t forget to follow up on results after devising your marketing strategies!

You might also like to read: Top 10 Finance AI Tools

Frequently Asked Questions (FAQs)

Can You Give Read-Only Access to Stripe Reports?

Yes. Stripe allows setting custom permissions, including read-only access to reporting dashboards. You can manage these settings from your Stripe team’s access controls.

How to See Stripe Fees Paid?

To view Stripe fees quickly: Go to Reports > Balance in your dashboard. Your fees appear under the transactions listed there.

Does Stripe Provide Monthly Statements?

Yes. Stripe provides downloadable monthly statements from the Reports > Monthly Summary area. These summaries simplify monthly financial reconciliation.

What is Stripe Sigma?

Stripe Sigma is an advanced reporting product by Stripe that allows custom, SQL-based querying of your Stripe data, offering instant and highly customized financial analytics.

How to Download Stripe Statements?

You can download reports and financial statements from your Stripe dashboard in the Reports section by clicking the download icons next to your preferred report.