The recurring payments model is becoming increasingly popular across various industries.

This payment method isn’t just about making billing automatic. It’s also about building strong, ongoing relationships with customers and having a more predictable income.

The automated recurring billing model align with various business models, this is especially considerable for businesses like SaaS startups or services.

In this article, we’ll:

- Cover how does recurring payment processing work?

- Explore the benefits recurring payment model offer

- Understand the use cases of subscription-based payment model

- Learn how to collect recurring payments using Stripe in WordPress

Understanding recurring payments

Automated recurring payments are automatic payments where a customer authorizes a business to charge money for services or subscriptions at regular intervals.

It’s a common model for SaaS platforms, membership sites, and various service-based businesses.

What are examples of recurring payments?

A classic example of a recurring payment model is Netflix. When you join Netflix, you give them your credit card info and agree to pay a certain amount every month. Then, Netflix automatically charges your card each month, so you can access the content – keep watching shows without any break.

Another example is Shopify, a cloud-based ecommerce platform which offers subscription-based plans. Businesses using Shopify pay a recurring fee to access the platform’s features and services, essential for operating their online stores.

This setup offers customers the convenience of uninterrupted service without the need to manually make a payment each month. From Netflix and Shopify’s side, the company enjoys a steady, predictable revenue stream.

Other than that, you can also accept donations as recurring payments. This is commonly done by setting up a subscription model where donors can choose to give a fixed amount at regular intervals, like monthly or annually.

Additionally, you can sell physical products on a WordPress site without WooCommerce on a subscription basis. For example, if you sell cat food, you can offer a recurring delivery service where customers receive a set amount of cat food each month.

Selling subscriptions vs accepting recurring payments

Selling a subscription is one specific form of accepting recurring payments which involves offering a product or service on a subscription basis.

By implementing this model, customers pay regularly to receive ongoing access to that product or service. The focus with selling subscriptions is on what is being sold – a continuous, usually time-based, access to something.

On the other hand, accepting recurring payments is a broader concept. Collecting recurring payments refers to the ability to process payments that you charge your customers at a set time interval. Time intervals for recurring payments can be such as weekly, monthly, quarterly, yearly, or even at custom intervals.

Recurring payments could be for subscriptions but also for other things like memberships, utility bills, or any regular service.

How recurring payment processing functions in a digital setup?

In a digital setup, recurring payment processing work through a payment gateway like Stripe.

Once a customer enters their payment details and authorizes the transaction with Stripe API Keys, the system automatically charges them at the specified intervals (like monthly or annually).

This automated billing is managed electronically, and it ensures a seamless and consistent revenue stream for the business while providing uninterrupted services or access to the customers.

Recurring payments is a convenient and efficient way to handle transactions, reducing manual efforts in billing and collections.

Subscription-based models use cases

Creating a subscription-based payment model is ideal in scenarios where you offer products or services on a regular, ongoing basis.

Subscription-based models offer a sustainable, customer-centric approach to business across a wide range of industries.

Here are common use cases for accepting recurring payments:

- SaaS (Software as a Service): For software platforms that require regular access, such as cloud-based applications or online tools like Trello and Zoom.

- Content platforms: For sites offering regular content updates, like news websites, online magazines, or educational platforms like The New Yorker or Medium.

- Membership clubs: For exclusive access to a club or group offering regular benefits, events, or services.

- Regular deliveries: For businesses providing regular deliveries, such as meal kits, subscription boxes, or recurring product shipments.

- Online courses and training: For educational content that is updated regularly or offers ongoing access to learning materials like Coursera and Udemy.

- Maintenance and service plans: For ongoing services like software maintenance, gardening, cleaning, or technical support.

What are the benefits of enabling recurring subscription payments?

Selling recurring payments can transform how businesses handle transactions and maintain customer relationships.

Here are some of the benefits of recurring payments.

Stable revenue stream.

When you enable recurring subscription payments, you get a steady flow of income, making it easier to predict earnings and manage your finances.

Customer retention.

Automated recurring billing can help you to keep churn rate low. By simplifying the payment process, customers are more likely to continue using a service, increasing loyalty and reducing churn.

Operational efficiency.

Automatic recurring payments can significantly reduce the administrative burden by saving time and resources.

Enhanced customer insight.

When you accept recurring payments using Stripe, you can check saas-based reports and get valuable data on your customer preferences and behavior.

Here, you can learn more about Stripe reports and which metrics you should track when you run a subscription based mode.

How to set up recurring payments for customers and take recurring payments?

Here is a step by step guide on how to set up recurring payments on your website.

Step 1. Choose a payment processor

Select a payment service that supports recurring payments like Stripe or PayPal.

Step 2. Integrate with your website

Use a plugin or API to integrate the payment processor with your website.

Step 3. Create subscription plans

Set up various subscription plans with different pricing and billing intervals (e.g., pricing tiers with monthly or yearly).

Step 4. Implement a payment form

Add a recurring payment form on your site where customers can sign up for the subscription and enter their payment details.

Step 5. Automate billing

Configure the system to automatically bill customers at the specified intervals.

Step 6. Monitor and manage subscriptions

Keep track of active subscriptions and manage them through your payment processor’s dashboard.

How to collect recurring payments using Stripe in WordPress?

To accept Stripe payments in your WordPress site, you need to create a payment subscription form in WordPress by using plugins like WP Full Pay.

Creating payment subscription forms in WordPress using WP Full Pay is an easy and straightforward process.

Here’s a step-by-step guide on how to collect recurring payments in WordPress with WP Full Pay:

- Create a Stripe account.

- Add the WP Full Pay plugin to your WordPress site.

- Configure Stripe API Keys in the WP Full Pay plugin to connect your WordPress site with Stripe. Learn how to integrate Stripe with WordPress.

- Create a recurring payment form in WP Full Pay.

- Switch to test mode to conduct Stripe test transactions.

- Switch to live mode to start collecting recurring payments using Stripe on your WordPress site.

By following these steps, you’ll be able to accept recurring Stripe payments on your WordPress site.

You might like to read how to configure Stripe API Keys for WordPress.

NOTE: You no longer need to manually add Stripe API keys with WP Full Pay version 7.0 and later. Stripe Connect makes the integration process easy and allows you to connect your Stripe account directly through the WP Full Pay.

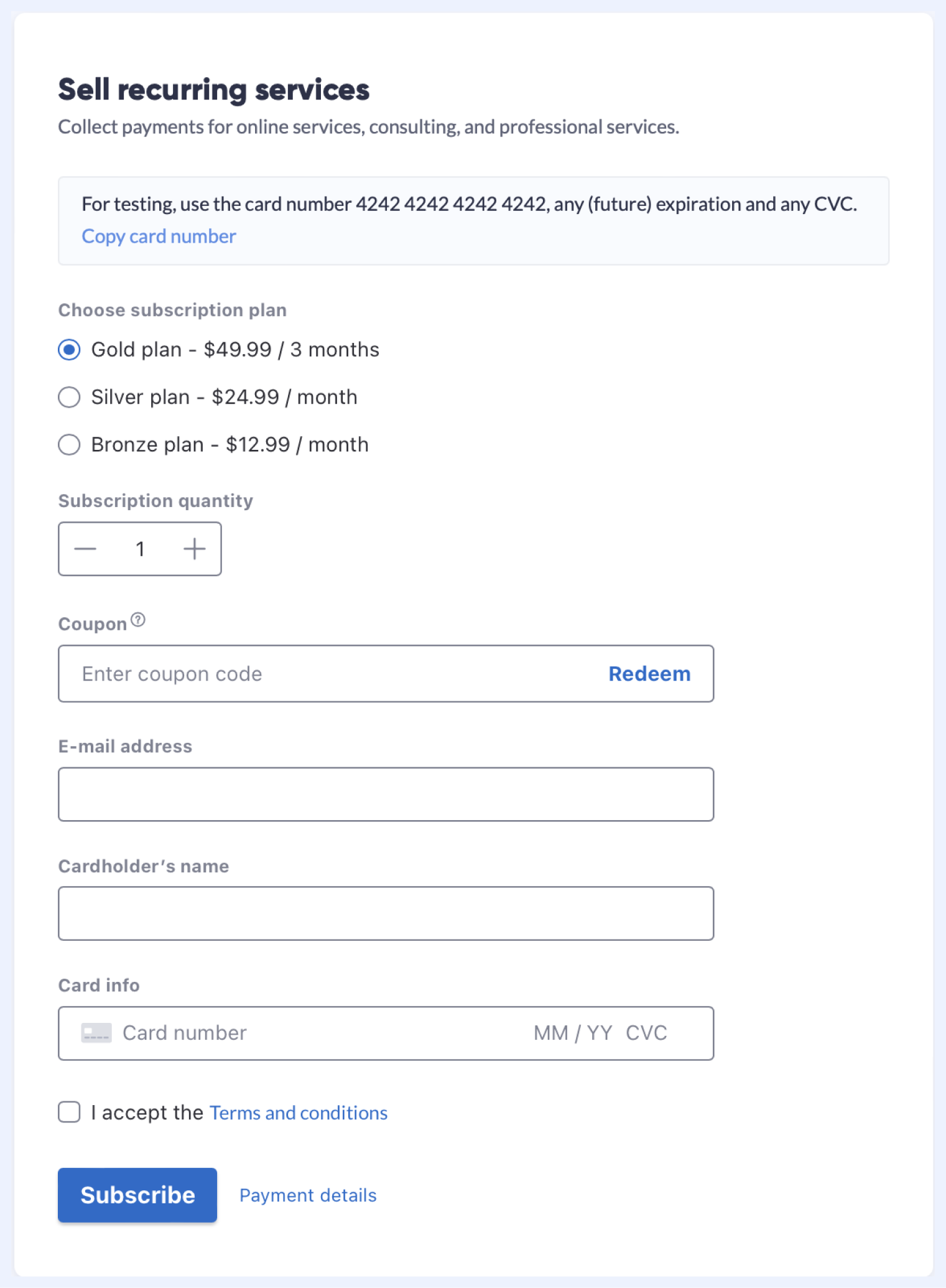

Here’s an example of Stripe subscription form by WordPress plugin – WP Full Pay.

Here’s an example of Stripe subscription form by WordPress plugin – WP Full Pay.

Takeaway

- If your business model aligns with a SaaS payment approach, you can automate billing and collect recurring payments effectively.

- This model is particularly suitable for SaaS platforms, members only sites, and various service-based businesses.

- To implement recurring payments in WordPress, choose a payment processor like Stripe and integrate it using a WordPress plugin designed for subscription management and payment handling.

- Accept recurring payments easily by using plugins like WP Full Pay, which are available for creating subscription forms and managing payments in WordPress, some even at no cost.

- Stripe recurring payments and automated recurring billing make it simple to manage subscriptions and ensure consistent cash flow.

- Set up recurring payments with Stripe to benefit from streamlined recurring payment processing and efficient Stripe recurring billing.