Are you a small business owner without a webstore looking for ways to accept online payments? Or are you an established online seller looking to increase your customer base and reach a wider audience? Accepting MOTO transactions might be an excellent idea in either case!

MOTO transactions – Definition

They’re fast, simple, and convenient – but what exactly are MOTO transactions?

MOTO stands for Mail Order and Telephone Orders.

This term refers to payments accepted by phone, email, or even fax. It’s handy when your business is remote and doesn’t meet customers in person. Commonly used in call centers, travel agencies, and offices, MOTO is popular for service-based businesses that take online bookings via phone

With MOTO payments method, customer provides their payment details by mail or over the phone rather than in person or online.

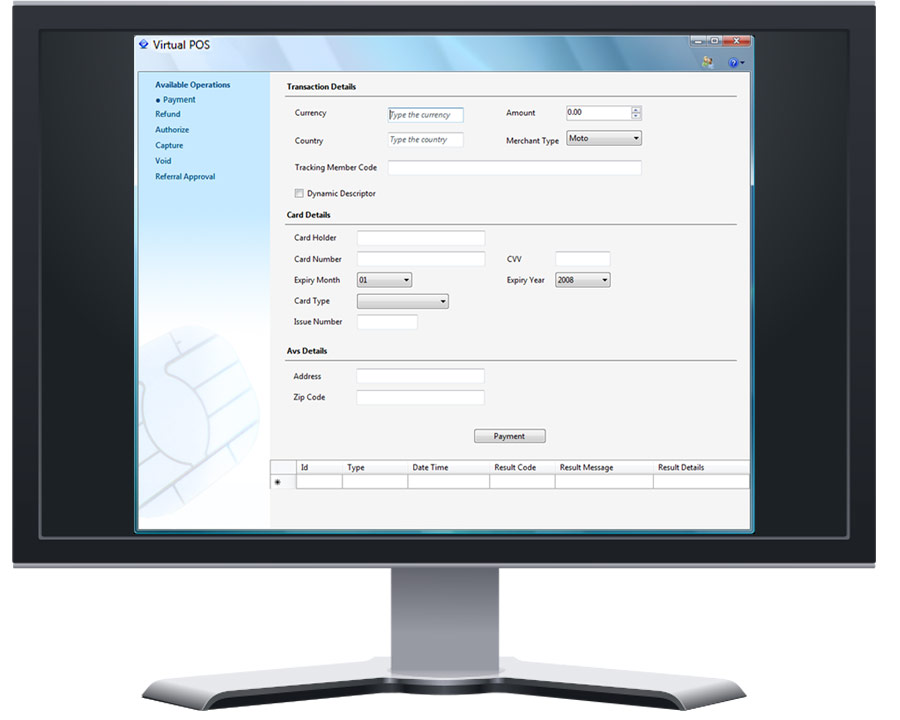

The process is simple: shoppers provide you with their order and payment details, giving you permission to process the transaction. Accordingly, the seller, aka you, takes the responsibility to enter these details into a virtual terminal to finalize the payment.

Sounds great! But how do MOTO transactions exactly work?

Well, it’s simple.

For MOTO payments, the business collects payment info over the phone or by email.

- A staff member enters these details into a virtual terminal to process the payment.

- The payment processor checks the transaction and tells the salesperson if it’s approved or declined.

- This is a type of card-not-present transaction, so customers don’t have to be there in person.

Virtual terminals can be accessed on any internet-enabled device:

Pro tip

If you want to make MOTO transactions available for your buyers, we recommend partnering with an experienced and trustworthy payment service provider such as Stripe to facilitate the payment!

Are MOTO payments legal?

Yes, MOTO payments are legal. However, if you’ve ever tried to set up MOTO payments with Stripe or another processor, you’ll notice they need extra approval.

Why the extra step? Because with MOTO payments, there’s a higher risk of accepting stolen cards. Make sure to carefully verify payments you take over the phone.

Fraudulent transactions, like friendly fraud, can also happen more easily with MOTO payments. Ensure you keep good records of each sale to use as proof if needed.

What is an example of a MOTO transaction?

An example of a MOTO payments would be a customer calling a travel agency to book a flight over the phone. The customer provides their credit card information, including the card number, expiration date, and CVV code, verbally to the agent. The agent then enters the details into their payment processing system to complete the transaction without the physical card being present.

This is a typical MOTO transaction because it is conducted over the phone (telephone order), and the credit card details are manually entered into the system by the merchant. Similarly, if the customer mailed their payment details to a business and the business manually processed the payment, it would be considered a MOTO transaction as well.

What are the advantages and disadvantages of MOTO?

Advantages of MOTO

- Flexibility for customers: Accepting payments by phone or email means customers can pay without being there in person. This can speed up the booking process and help you close sales quicker.

- Remote transactions: Useful for businesses that don’t meet customers face-to-face.

- Easy integrations: Works well with Click & Collect and other online sales options.

- Higher limits: MOTO payments often allow larger transaction amounts.

Disadvantages of MOTO

- Security risks: Since you manually enter card details, there’s a higher chance of error or fraud.

- Less customer verification: As a type of ‘card not present’ payment, it’s harder to confirm the customer’s identity.

- Extra approval needed: Payment processors often require additional steps to approve this type of transaction.

- Fraud and chargebacks: More prone to both types of fraud, which can be costly to resolve.

Are MOTO transactions a right fit for your business?

Now that you’re familiar with the meaning of MOTO transactions, let’s see if they’re a good fit for your business.

Generally, MOTO transactions are common in businesses that take orders via mail or phone, such as catalog sales, phone-based customer service centers, or some service-based businesses. Because the card is not physically present, these transactions are typically seen as higher risk and may incur higher processing fees compared to standard card-present transactions.

However, integrating MOTO transactions might be a smart choice for any type of business that wants to have access to a wider customer base by removing barriers for buyers who can’t shop in person.

Furthermore, it’s a brilliant solution for small businesses or startups without a webshop that engage in selling products or services remotely and wish to accept online payments.

Moreover, MOTO transactions are an excellent solution for merchants who want to keep their overhead low, as these types of transactions can be completed by only using a desktop, tablet, or smartphone with internet access.

Are MOTO transactions secure?

MOTO transactions are undoubtedly one of the simplest, fastest, and cheapest solutions for businesses to remotely accept payments.

But let’s not sugarcoat it: they do have some potential drawbacks you should be aware of!

First of all, you should know that these kinds of payments carry extra risks because there’s no way to prove that the buyer is actually the rightful cardholder.

If a dispute is raised for a MOTO transaction, it will be your liability to prove that the rightful cardholder authorized the payment.

What if the evidence provided is insufficient?

Well, in this case, you’ll be liable for the chargeback and may have to refund payment received for the items that may have already been delivered.

Tip for secure payments

For more tips and tricks on how to prevent fraud and hackproof your website, make sure to read our blog posts on how to fight credit card testing attacks and how to create secure forms!

Setting up MOTO Payments

With many customers preferring to pay online, it’s smart to offer multiple payment options. The more ways you can take payment, the fewer barriers between you and making a sale.

Step-by-Step to Accept MOTO Payments:

- Choose the Right Terminal: Use a virtual terminal for quick card processing and payment links for email payments.

- Ensure Affordability: Pick a provider that doesn’t charge extra fees for MOTO payments.

- Pick a Merchant Host: Consider systems like Stripe. They offer free virtual terminals for phone payments.

- Bundle with In-Person Payments: Some systems let you accept both MOTO and in-person payments without extra gateway fees.

- Connect to Your Website: Use Plugins or APIs to integrate with your online booking system, reducing manual work.

- Work with Payment Gateways: If you’re using an eCommerce system, make sure your MOTO payments work smoothly with it.

To accept MOTO payments, all you have to do is follow the below steps:

- Log in to your virtual terminal.

- Input your buyer’s details, such as name, address, and card details.

- Submit the transaction.

- Once it’s approved by the customer’s bank, you’ll get a confirmation message, and the buyer will receive a digital receipt.

And that’s it, the payment is complete! The funds will be typically settled to your bank account within a working day.

How to start accepting MOTO payments with the help of WP Full Pay?

If you’re using Stripe as your payment service provider, the first step to getting started will be to contact Stripe support to enable MOTO transactions for your Stripe account.

If you’re using the Stripe payments plugin WP Full Pay for your WordPress website to accept payments, you’ll simply need to implement a WordPress filter depending on what type of payment form you’re using.

For inline forms, use the following WordPress filter implementation:

| <?php |

| function paymentIntentParameters( $params ) { |

| $result = $params; |

| |

| $result[‘payment_method_options’] = [ |

| ‘card’ => [ |

| ‘moto’ => true |

| ] |

| ]; |

| |

| return $result; |

| } |

| add_filter(‘fullstripe_payment_intent_parameters’, ‘paymentIntentParameters’, 10, 1 ); |

view rawmoto-payment-inline-forms-v6.2.php hosted with ❤ by GitHub

In the case of checkout forms, use the following:

| <?php |

| function checkoutSessionParameters( $params ) { |

| $result = $params; |

| |

| $result[‘payment_method_options’] = [ |

| ‘card’ => [ |

| ‘moto’ => true |

| ] |

| ]; |

| |

| return $result; |

| } |

| add_filter(‘fullstripe_checkout_session_parameters’, ‘checkoutSessionParameters’, 10, 1 ); |

view rawmoto-payment-checkout-forms-v6.2.php hosted with ❤ by GitHub

Generally, you can put the above code snippets into the functions.php of your active WordPress theme. However, unless you’re a developer, we don’t advise it, since adding these code snippets incorrectly can break your website.

Instead, we recommend using the Code Snippets plugin that provides a fail-safe solution.

Make sure to ask your developer’s help if you’re unsure about the process.

What are the costs of MOTO transactions?

MOTO transaction fees are somewhat higher compared to standard card payments.

Transaction fees for card payments entered manually in the Stripe Dashboard cost 3.4% + 30¢ per transaction for businesses on standard pricing based in the US. Fortunately, the gap isn’t huge, as currently, Stripe asks 2.9% + 30¢ for standard card payments.

The somewhat higher fees for MOTO transactions reflect the cost of higher fraud rates associated with collecting sensitive information over the phone or other unencrypted sources. Directly typing in customer data bypasses much of the security features (such as the smart fraud prevention tool Stripe Radar, for instance) built into Stripe’s online payments.

MOTO transactions – Final thoughts

MOTO transactions are one of the fastest, cheapest, and most convenient solutions to remotely accept payments – for small business owners and established companies alike! Now that you got familiar with the topic, it’s time to sit down and consider the benefits of incorporating MOTO payments into your business. Remember to keep an eye out for any potential red flags as well!