No matter how focused your marketing efforts are, without providing a secure form on your website, there’s no chance that conversion rates will increase.

The reason: people these days are paying huge attention to protecting their personal data while surfing the web. If they feel you don’t provide them with a secure form, they’ll leave.

In this guide, we’ll show you some of the best strategies for how to create hack-proof forms so that you can ensure your customers: their trust and security is your number one concern!

You might also like to read: 8 cart abandonment reasons and how to solve them.

When filling out web forms, people today are extremely conscious about protecting their personal information. No wonder – according to reports from the University of Maryland, a hacker attack occurs every 39 seconds!

And if this number isn’t convincing enough, we’ve brought you a few other data security statistics that highlight the importance of a secure form on your website:

The above numbers make it clear that even a single data breach can irreparably ruin a company’s reputation. Since hackers get more and more proficient in their malicious actions, a secure form is therefore pivotal to any online information exchange in which sensitive data is being sent.

Let’s dive right into those 11 strategies that will help you build a secure form on your website!

By entering random data into your form fields, hackers can expose vulnerabilities your site might have and gain access to it.

Consequently, whenever you create a secure form, using field validation rules is a must! This way, you can define what the input data should look like.

For instance, if you ask users to provide their phone numbers, you need to make sure that the form field can accept nothing else but numbers!

2. Display generic error messages

Exposing that certain data does or doesn’t exist is really helpful to hackers. And we don’t want to ease their life, right?

So, here’s the rule: forget detailed error messages! Never return something like:

“Your password for this account is incorrect.”

Instead, make the guesswork harder, and display something like this in your secure form:

“Incorrect login information” or “Incorrect username or password”.

This way, hackers won’t know if they used a valid username or email address. But hey, nice try!

3. Secure file uploads

Are you using a file upload form such as a job application form or a request a quote form on your website?

In this case, we’ve some bad news for you: hackers might seize this opportunity to inject something malicious into your site through the file upload form.

The good news is that you can take extra precautions to create a secure form:

- Restrict the type of file extensions you’ll allow.

- Limit the size of the files users can upload.

- Analyze uploaded files before using them.

- Isolate uploaded files as much as possible.

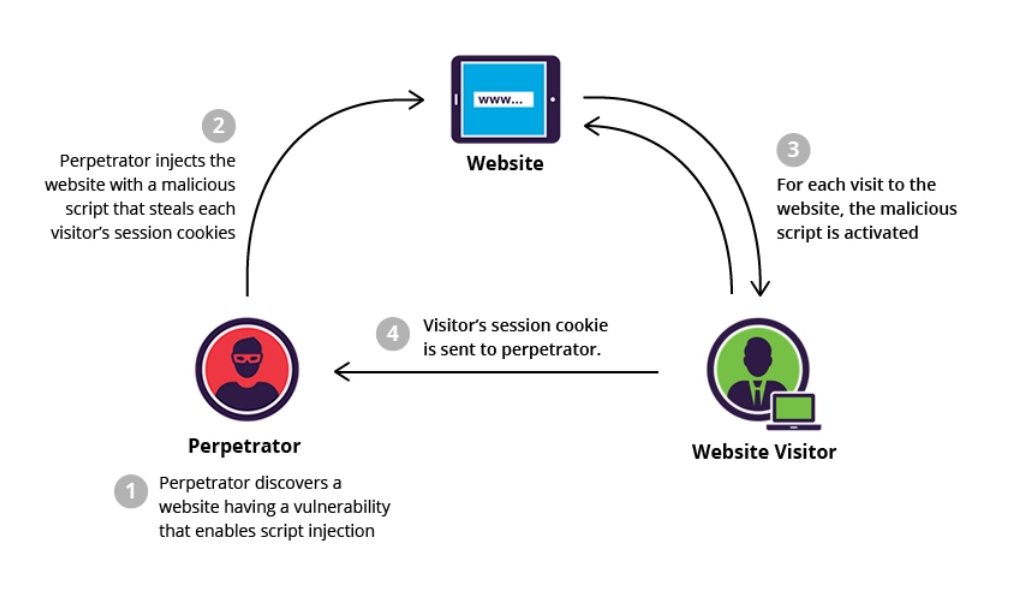

4. Prevent cross-site scripting attacks

Did you know that cross-site scripting (XSS) is one of the most common cyber attack types?

Cross-site scripting allows an attacker to compromise the interactions that users have with a vulnerable application. The attacker inserts data, such as a malicious script, into content from trusted websites. The malicious code is then delivered to the user’s browser. This way, the hacker is able to masquerade as a victim user and might carry out any actions that the user can perform and access any of the user’s data.

How can you prevent this?

One of the surest ways is to escape user input in your secure form. Escaping means taking the data the application has received and ensuring it contains no executable script before rendering it for the user.

5. Use encrypting practices

The process of encryption means securing data and making it unreadable to people who don’t have the key. By using HTTPS via Transport Layer Security protocol (TLS), you can create a secure form on your website and help customers feel more comfortable when submitting sensitive information.

Data sent using HTTPS provides three key layers of protection:

- Encryption ensures that while users are browsing a website, nobody can “listen” to their conversations, track their activities, or steal their information.

- Data integrity means that data cannot be modified or corrupted during transfer without being detected.

- Authentication ensures that the parties exchanging information are who they claim to be.

To build even more trust with your customers, don’t forget to showcase these security practices in the form of trust seals on your webpage, especially near your secure form!

6. Enable reCAPTCHA

One of the quickest and easiest ways to create a secure form is to enable reCATPCHA on it. This way, you can eliminate spam submissions and increase the quality of your email marketing efforts.

Google reCAPTCHA allows legitimate users to log in, make purchases, view pages, or create accounts. Fake users, however, will be blocked.

Google reCAPTCHA v2 is the “classic” version where users will have to click the “I’m not a robot” checkbox or solve a puzzle before a secure form submission:

Learn how to enable Google reCAPTCHA in payment forms.

Google reCAPTCHA v3 sits silently near your secure form (only a reCAPTCHA icon is visible in the lower right corner of the site), and triggers a CAPTCHA challenge when suspicious activity is detected:

7. Use 3DS

3D Secure (3DS) is a technical standard that adds an additional security layer for online payments. What does that mean?

To complete an online purchase, the secure form requires the customer to complete an additional verification step with the card issuer. You redirect buyers to an authentication page on their bank’s website, where they’re asked to provide proof of identity by entering a unique password, an SMS code, or a temporary PIN.

The following card networks have already developed their own 3D Secure transaction services:

It’s important to know that enforcement for 3DS or Strong Customer Authentication (SCA) will vary by country. For instance, the SCA regulation in Europe requires using 3DS for card payments. Although 3DS may be optional in other regions, you should still use it as a tool to reduce fraud when building your secure form.

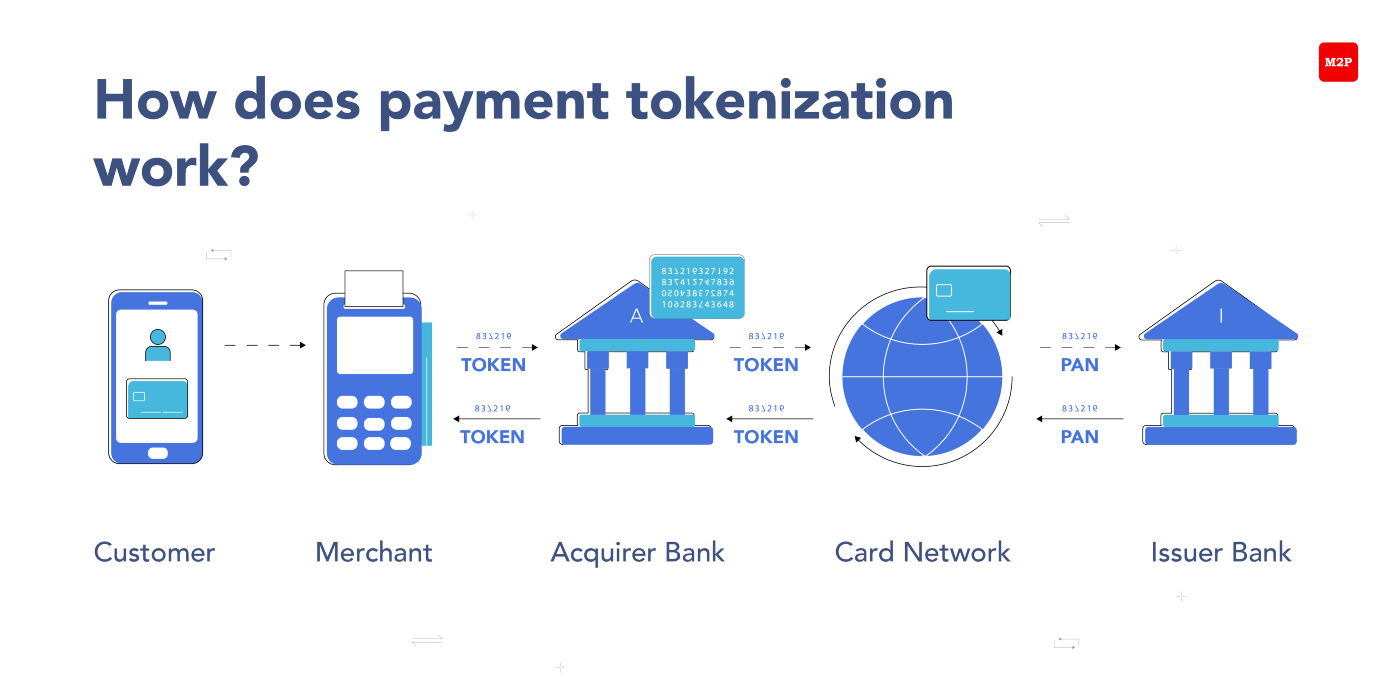

8. Use payment tokenization

Payment tokenization is another brilliant method to provide your customers with a secure payment form. How does it work?

The method replaces sensitive debit or credit card data with a unique identification code called a “token”. This numeric code is used during the digital transaction. Since there’s no need to provide the customer’s actual card data anymore in your secure form, payment tokenization makes online transactions extremely secure.

9. Set a minimum payment amount

Scammers get really creative when it comes to stealing customers’ personal information and money. While the above examples require some serious technical skills, one of their simplest tricks is to make small payments ($0.5 and the like) to see if they’re accepted.

So, what can you do to make attackers’ life harder in this case?

Providing your customers with a secure form should involve setting a minimum payment amount on your payment page! This is a simple yet effective way to prevent scammers from testing stolen credit cards.

10. Use nonce to avoid replay attacks

OK, so this may sound very professional, but: what is a nonce, and what are replay attacks?

First things first, a replay attack is a technique where a cybercriminal eavesdrops on a secure transaction, intercepts it, copies it, and then fraudulently resends it to gain financial benefits or cause financial damage.

Let’s see an example.

An attacker could take an encrypted order from your customer and repeat the transaction over and over again without your customer having a clue. This way, the scammer won’t gain any benefits in financial terms but can cause financial loss to your buyers meaning severe damage to your brand’s reputation.

This is where nonce comes into the picture.

A nonce is an arbitrary number that can be used just once in a cryptographic communication. Authentication protocols may use nonces to give originality to a given message. Concerning a secure form, this means that a unique number is generated for an instance of a form that is served to a visitor. This way, if the company receives further orders from the same person with the same nonce, it will discard those as invalid orders.

11. Use a secure payment gateway

Last but not least, choosing a secure payment gateway is crucial to (if not the foundation of) providing your customers with a secure form.

When talking about secure payment gateways, you cannot avoid getting involved in the Stripe vs PayPal debate since these are two of the most popular options. So which one is better?

While both have you covered when it comes to security and PCI compliance, Stripe is fully compliant with no effort necessary on your end.

Stripe is certified to PCI Service Provider Level 1, which is the most stringent level of certification available in the payments industry. The company uses best-in-class security tools and practices. Additionally, with its built-in Radar feature, Stripe helps you detect and block fraud for any type of business. To do so, Stripe uses machine learning that trains on data across millions of global companies. It helps you distinguish fraudsters from customers and apply Dynamic 3D Secure to high-risk payments. Radar’s algorithms adapt quickly to shifting fraud patterns and to your unique business.

Additionally, if you’ve got a WordPress site, WP Full Pay is the perfect Stripe payments plugin to accept recurring and one-time payments with a peace of mind. The secure form builder plugin doesn’t store any credit card data in WordPress. Furthermore, both Stripe and WP Full Pay Customer Portals are available only to authenticated users. If you’re using WP Full Pay to build a secure form, you can be sure that your website will be fully PCI DSS compliant!

When creating a secure form for your customers, it’s helpful to ask yourself: how would a scammer be able to utilize the displayed information? The above best practices serve as a guidance to how to maintain a high level of security and thus gain the trust of your customers!