Cash App is a peer-to-peer (P2P) mobile payment service available in the United States and the United Kingdom with over 50 million active users.

The Cash App method is popular for making it so easy to send and receive money instantly using the app. This is often done by linking a bank account or debit card to the Cash App account.

Users can send payments to another user by entering the recipient’s username, phone number, or email address.

Easy right?

Though the most common use case of the CashApp method is sending/receiving money quickly via the mobile app, businesses can offer this payment method on their websites too.

Cash App Pay overview

Cash App Pay is the digital payment feature of mobile payment service Cash App. Customers make payments from their Cash App balance, linked bank account, or linked credit or debit card. This service is widely used for various financial activities, including paying bills, online shopping, and in-store purchases.

Cash App Pay has wide use cases and user profiles for personal and business transactions.

This payment method is especially popular among:

- Generation Z and millennials who prefer digital transactions.

- Independent contractors needing flexible payment solutions.

- Social media users making quick, small purchases.

- Early adopters and tech enthusiasts.

- Cost-conscious individuals looking for economical financial tools.

- Small businesses that need simple, cost-effective payment solutions.

- Online retailers seeking smooth integration with ecommerce platforms.

- Service providers looking for easy invoicing software and payment methods.

- Businesses operating primarily through mobile platforms.

Cash App Card

The Cash App Card is a Visa debit card that lets you spend your Cash App balance easily. You can use it to pay for purchases both online and in stores, just like any other debit card.

Supported Cards with Cash App

Cash App works with most major debit and credit cards, including Visa, MasterCard, American Express, and Discover. Many prepaid cards are also accepted. However, ATM cards, PayPal, and business debit cards are not supported at the moment.

Cash App vs Zelle

Zelle is a digital payment network that allows users to send and receive money quickly through their bank’s mobile app or website. It connects directly to your bank account, enabling instant transfers between participating banks in the U.S.

Unlike services like Venmo or PayPal, Zelle doesn’t hold your money in a separate app balance; instead, the funds move directly between bank accounts, usually within minutes. It’s commonly used for personal payments, such as splitting bills, paying rent, or reimbursing friends. Many major U.S. banks offer Zelle as part of their online banking services.

Both Zelle and Cash App allow users to send and receive money quickly between friends, family, or others using just their phone number or email. The main difference lies in how they hold and manage funds, with Zelle moving money directly between bank accounts, while Cash App allows funds to be held within the app or sent to a linked bank account.

How does the Cash App Pay work?

Business account setup

You can either create a new Cash for Business account or convert your existing Cash App account to a business account through the app settings.

Receiving payments

You choose a unique username, called a $Cashtag, to receive payments, which can be displayed on business cards or marketing materials.

As a business, you also get a custom payment page URL. Customers can make payments by clicking a link on your website or by visiting the unique cash.me URL.

Payments can be sent to Cash for Business accounts via Cash App, even if the customers don’t have a personal Cash App account. Customers using the cash.me link can also pay with credit or debit cards.

How can customers pay using the Cash App method on a site?

Here is how Cash App method works for customers:

- Customers browse your site, add products to their cart, and proceed to checkout.

- At the checkout page, customers select Cash App as the payment method.

- Customers are provided with a QR code or payment link to complete the payment using the Cash App on their mobile device.

- QR code: Customers open their Cash App, scan the QR code, and confirm the payment.

- Payment link: Customers click on the payment link, which redirects them to Cash App, where they can confirm the payment.

- Once the payment is successful, customers receive an order confirmation on your site, and you receive the payment in your Cash App account.

Source: Stripe

How to accept money on Cash App?

To accept payments on Cash App, follow these steps:

1. Download and install Cash App

You can download the Cash App from the App Store (iOS) or Google Play Store (Android) and install it on your smartphone.

2. Sign up or log In

Open the app and either sign up for a new account or log in to your existing account.

3. Link your bank account

To accept Cash App payment, you should link your bank account or debit card. You can do this by going to the Banking tab (represented by a bank icon or a dollar sign) and following the prompts.

4. Receive payments on Cash App

There are 2 ways to receive money on Cash App: with the Cash App tag or payment request feature.

Sharing your Cash App tag. To receive payments with the Cash App tag you should first claim $cashtag. To claim a $cashtag, you must have an active debit card linked to your Cash App.

Next, you can share your unique $Cashtag, email address, or phone number associated with your Cash App account with the person who will be sending you money.

Requesting payments. You can also request a payment by entering the amount and selecting “Request” in the app, then entering the sender’s $Cashtag, email, or phone number.

- When someone sends you money, you’ll receive a notification. Open Cash App and check your balance or the Activity tab (represented by a clock icon) to see the transaction.

- If prompted, tap “Accept” to confirm and receive the money into your Cash App balance.

To transfer money from your Cash App balance to your linked bank account, go to the Banking tab, tap “Cash Out,” and follow the prompts to transfer the funds.

How to create a Cash App tag?

Creating a Cash App tag, also known as a $Cashtag, is an easy process that requires the following steps:

- If you don’t already have Cash App, download Cash App from the App Store (iOS) or Google Play Store (Android) and open the app.

- Sign up for a new account or log in to your existing account.

- Follow the on-screen prompts to link your bank account or debit card to complete the setup.

- Create a $Cashtag:

- Tap the profile icon on your Cash App home screen.

- Select “Personal” or “Edit Profile.”

- Look for the $Cashtag field and enter your desired $Cashtag. Your $Cashtag must be unique and can be up to 20 characters, including letters and numbers.

- Once you’ve chosen an available $Cashtag, tap “Set” to confirm it.

Your $Cashtag is now created, and you can share it with others to receive payments easily on Cash App.

Enable Cash App Pay method for your site

Offering Cash App Pay as a payment option on your site can significantly increase sales due to its popularity and ease of use. Many customers in the US prefer Cash App for its seamless and quick payment process, making it an attractive option for online transactions.

If you’re using WordPress, you can integrate Stripe to your WordPress site with WP Full Pay to accept payments on your site. Next, you can enable the Cash App from the Stripe dashboard in a few clicks.

Learn more about payment methods supported by Stripe.

To offer Cash App on your site checkout:

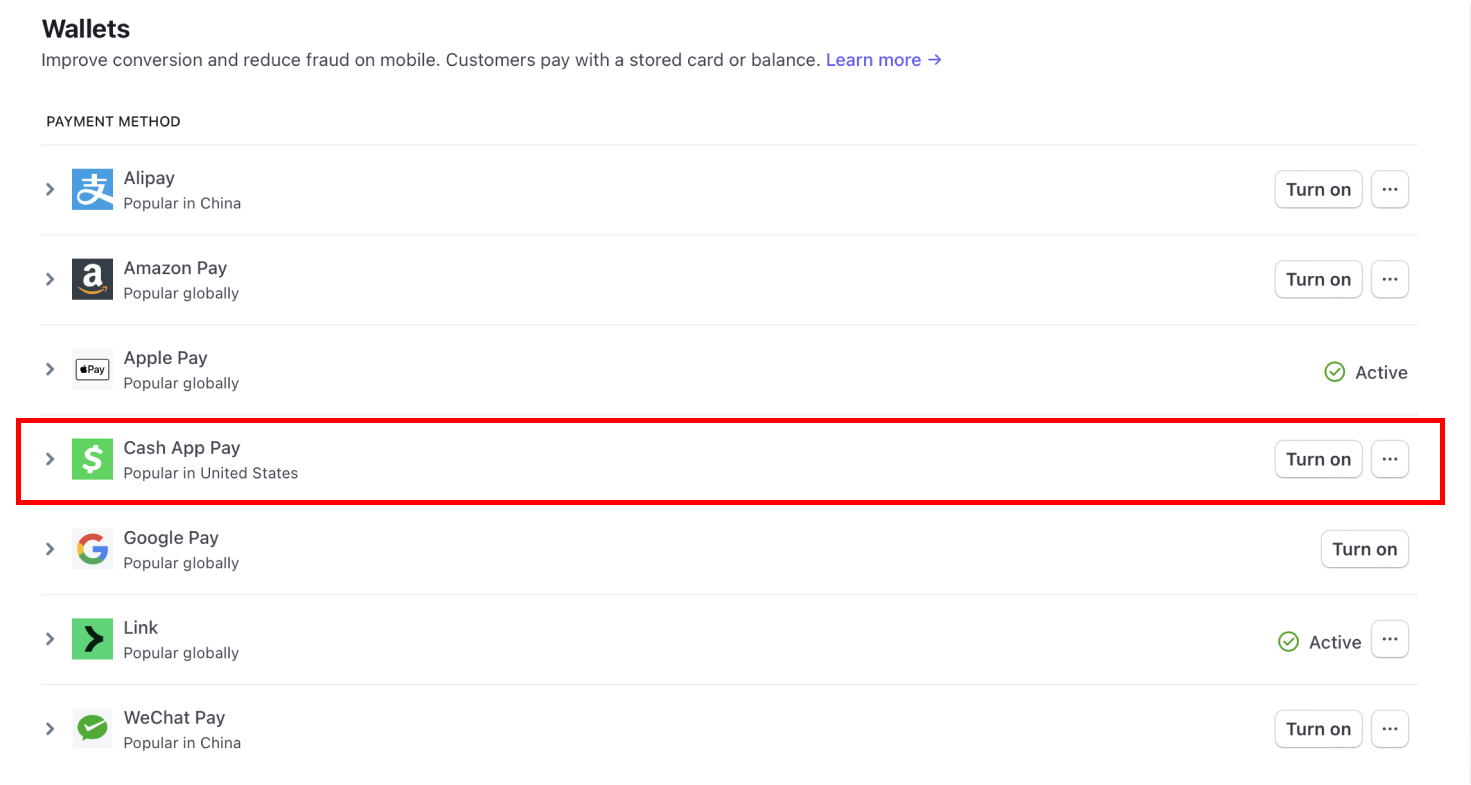

On your Stripe dashboard, navigate to Settings -> Payments -> Payment methods

Scroll down to the Wallets section and find the Cash App Pay.

Click on the Turn on button to activate the Cash App Pay.

After enabling the Cash App Pay, you should see the Active status.

You can download WP Full Pay plugin for free, create the forms with Cash App Pay enabled, and test Stripe transactions on your WordPress site.

How to set up recurring payments on Cash App?

Cash App itself does not support recurring payments directly. However, you can set up recurring payments through third-party services or by using Cash App’s integration with platforms like Stripe. You can use WP Full Pay to integrate Stripe to your WordPress site, enable CashApp method from your Stripe dashboard, and accept recurring payments.

Here are the steps to set up recurring payments using Cash App through Stripe:

- Create a Stripe account: Sign up for a Stripe account if you don’t already have one.

- Set up a recurring payment plan: In your Stripe dashboard, create a Stripe product with recurring payment plan.

- Enable Cash App: Enable Cash App method in your Stripe account settings under payment methods.

- Embed the payment form: Create a subscription form with WP Full Pay. Next, embed the payment form on your website where your customers can enter their payment details and choose the recurring payment option.

Frequently Asked Questions about Cash App

What is a Cash App tag?

A Cash App $Cashtag is a unique identifier used to send and receive money through Cash App. It’s like a username, allowing others to find and transact with you on the platform.

How to use Cash App?

To use Cash App, download the app, create an account, link your bank account or card, and start sending or receiving money. You can also request payments using your $Cashtag.

What is a cash code on Cash App?

A “cash code” on Cash App typically refers to a unique code used for promotional purposes, like discounts or referral bonuses. It’s not a standard feature for regular transactions.

What bank does Cash App use?

Cash App uses Lincoln Savings Bank to provide its banking services, including the ability to have a Cash Card and set up direct deposits.

How to accept payment on Cash App?

To accept a payment on Cash App, simply provide your $Cashtag or linked email/phone number to the sender. Once they send the money, you’ll receive a notification, and the funds will appear in your Cash App balance.

Wow to top up – add money to Cash App?

To add money to your Cash App:

- Open Cash App.

- Tap the “Banking” tab (looks like a bank or house icon).

- Tap “Add Cash.”

- Enter the amount you wish to add.

- Confirm the transaction.