Let’s face it—recurring payments are the heartbeat of your subscription business. But when that heart skips a beat? Your revenue flatlines and customer relationships suffer. If you’re running a WordPress site with Stripe handling your subscription payments, knowing how to prevent and recover from failed transactions isn’t just nice-to-have knowledge—it’s essential.

With the right approach, you can reduce involuntary churn and keep the lifeblood of your business flowing. Let’s dive in.

Understanding failed recurring payments in Stripe

Before we start fixing problems, let’s get clear on what we’re dealing with.

Voluntary vs. involuntary subscription churn

When it comes to subscription churn, there are two very different beasts:

Voluntary churn: When customers actively decide “thanks, but no thanks” and cancel their subscription;

Involuntary churn: When subscriptions vanish due to payment failures without customers even wanting to leave.

Here’s the kicker: Stripe’s research shows involuntary churn makes up a staggering 25% of all subscription cancellations, reported Stripe as “Nearly a quarter of churn is involuntary”. That’s a massive chunk of revenue silently slipping through your fingers—revenue you could reclaim with the right systems in place.

Common types of payment failures: soft vs. hard declines

Soft declines are like temporary roadblocks that often clear up with a bit of patience:

- Temporarily empty bank accounts (insufficient funds)

- Network hiccups or processing glitches

- Overzealous bank security flags

Hard declines are more like brick walls that need customer action to break through:

- Expired cards (that forgotten expiration date sneaking up)

- Permanently closed accounts

- Cards reported lost or stolen

The true cost of failed payments for your business

Failed recurring payments hurt more than just this month’s balance sheet:

- You’re burning staff hours on customer service issues

- Your customer experience takes a hit

- Cash flow becomes as predictable as the weather

- Worst of all? You might lose customers permanently.

Let’s put this in perspective: If your average transaction is $50-100, improving payment recovery by just 1% could put thousands back in your pocket annually. Not too shabby for fixing an often-overlooked problem.

Top reasons why Stripe recurring payments fail

Customer-related payment failures

Insufficient funds

The empty wallet scenario accounts for roughly 30% of all payment failures. The frustrating part? Your customer might have plenty of money—just not on the exact day you tried to charge them. Talk about timing being everything.

Expired or cancelled cards

Every 3-5 years, cards expire like clockwork. Without good notification systems, these expirations translate directly to failed payments. And that’s not counting the approximately 15% of cards replaced yearly due to life’s mishaps—loss, theft, or damage.

Incorrect payment information

A single typo in a billing address can trigger security alarms that block transactions faster than you can say “declined.” Even minor mismatches between stored information and bank records can cause payments to fail.

Bank fraud protection triggers

Banks have become incredibly sophisticated at spotting potential fraud. Unfortunately, legitimate transactions sometimes get caught in these safety nets. An unusual purchase amount or unexpected activity pattern? That might be all it takes for your transaction to get flagged.

Technical payment failures

Payment gateway configuration issues

Your Stripe account or WordPress plugin settings might be silently sabotaging your payments. Incorrect API connections, broken webhooks, or—the classic rookie mistake—test mode accidentally left on can all lead to transaction failures.

Misconfigured Stripe account settings

Payment behavior settings in Stripe control everything from retry logic to billing cycles. When these aren’t optimized for your specific business model, they can cause unnecessary payment issues.

WordPress plugin compatibility problems

WordPress is a magnificent ecosystem of plugins working together—until they don’t. Conflicts between different WordPress plugins can disrupt your payment process, especially after updates when previously harmonious tools suddenly start fighting each other.

API connection errors

The digital handshake between your WordPress site and the Stripe API occasionally gets interrupted. When this happens, transactions might not process correctly or could fail to record altogether.

How Stripe handles failed payments

Understanding Stripe’s payment behavior settings

Stripe gives you powerful controls for handling failed payments:

- Collection method: Do you want things on autopilot or manual control?

- Cancellation thresholds: How many strikes before they’re out?

- Proration behavior: How to handle mid-cycle billing adjustments

You’ll find these settings tucked away in the Stripe Dashboard under the Billing section—worth a visit if you’ve never explored them before.

Stripe’s Smart Retry logic for failed payments

Stripe’s Smart Retries aren’t just about persistence—they’re about intelligence.

Their system uses machine learning to determine when to try again based on:

- Your customer’s unique payment history

- Their specific card type and issuing bank

- Patterns from previous successful payments

- Even the day of week and time of day

This approach is light-years beyond rigid retry schedules, increasing recovery rates by attempting charges when they’re most likely to succeed.

Payment status lifecycle in Stripe

Subscription payments in Stripe follow a specific journey:

- Upcoming – queued up and waiting for their moment

- Incomplete – first attempt stumbled

- Incomplete_expired – we tried, we failed, we’re done trying

- Active – success! Payment cleared

- Past_due – payment failed but subscription hanging in there

- Canceled – payment failures finally killed the subscription

- Unpaid – the final state before cancellation

Knowing these states helps you track exactly where each customer stands in the recovery journey.

How WP Full Pay works with Stripe for failed payments

WP Full Pay takes Stripe’s capabilities and elevates them within your WordPress environment by:

- Letting you create custom notifications without leaving WordPress

- Simplifying payment recovery setting management right in your admin dashboard

- Making it dead simple to build self-service customer portal experiences

- Bringing recovery analytics directly into your WordPress dashboard

This tight integration means less bouncing between interfaces and more time actually solving problems.

Setting up an effective failed payment recovery system in WordPress

Configuring Stripe dunning settings

The dunning process is your systematic plan for recovering failed payments. Here’s how to set it up in Stripe:

- Head to your Stripe Dashboard → Billing → Customer Portal settings

- Create a retry schedule that makes sense (usually 3-5 attempts over 2-4 weeks)

- Decide how many strikes before you’re out (cancellation threshold)

- Make sure automated emails for payment issues are switched on

Creating a customer payment portal in WordPress

A self-service customer portal is like giving customers the keys to fix their own problems:

- Using WP Full Pay, create a payment form specifically for updating payment methods

- Configure it to allow existing customers to update their stored payment info

- Build a dedicated page with this form that only paying subscribers can access

- Sprinkle links to this portal throughout your dunning emails and account pages

Implementing automatic account updaters

Account updater services are like payment magic—they refresh expired or replaced card information without anyone lifting a finger:

- Check that this feature is enabled in your Stripe account (usually is by default)

- For Visa cards, make sure Stripe is connected to Visa Account Updater

- For Mastercard, confirm Automatic Billing Updater is switched on

- Keep an eye on how well this is working in your Stripe Dashboard under “Automatic card updates”

Setting up payment retry schedules

Your payment retries should be as unique as your business:

- Consider billing cycles—monthly subscribers need different handling than annual ones

- Weigh customer value—it makes sense to try harder for your $500/month clients than your $5/month ones

- Look at industry benchmarks (typically 3-5 attempts over 2-3 weeks)

- Pay attention to timing—avoid weekends for B2B services, but target paydays for consumer subscriptions

Communication strategies for failed payments

Creating Effective Failed Payment Notification Emails

Failed payment notifications need to walk a fine line—clear but not accusatory:

- State the problem directly but don’t make customers feel like criminals

- Give them a one-click path to fixing the issue

- Include all the relevant details they need (subscription name, amount, date)

- Offer alternatives if you have them – Always provide a lifeline to customer support

Here’s a template that works well:

“` Subject: Quick action needed: Payment issue with your [Service Name] subscription

Hi [Customer Name],

We tried to process your payment of [Amount] for your [Service Name] subscription, but it didn’t go through. This is often due to an expired card or temporary bank issue.

To keep your service running without interruption, please update your payment details here: [Direct Link to Payment Update Form] Your subscription benefits will continue until [Grace Period Date].

Need help? Reply to this email or call us at [Support Number].

Thank you,

[Company Name] Team “`

Designing a multi-step dunning email sequence

An effective dunning email sequence gradually turns up the heat:

- First notice (Day 1): Friendly heads-up, assuming they simply didn’t notice

- Second notice (Day 4-5): “Hey, just checking in again about that payment issue…”

- Third notice (Day 8-10): “Just so you know, your service might be affected soon…”

- Final notice (Day 12-14): Clear warning that service suspension is imminent

Mix up your subject lines, sending times, and messaging approaches—variety increases the chances someone will actually open and read your messages.

Using SMS and in-app notifications for payment reminders

Email shouldn’t be your only communication channel:

SMS works brilliantly for urgent, short messages with direct payment links.

In-app notifications catch people when they’re actively using your service.

WordPress dashboard messages put important alerts right where site members will see them.

Using multiple channels can dramatically boost your response rates—some people who never check email respond instantly to texts.

When and how to make personal contact

Sometimes, the human touch makes all the difference:

- For high-value B2B customers, a call from their account manager can work wonders

- Your founders reaching out personally to early customers shows you care

- Proactive live chat when customers are active on your site can catch them at the perfect moment

Personal outreach often uncovers underlying issues automated systems miss—maybe they’re actually unhappy with your service but never bothered to tell you.

Preventive strategies to reduce failed payments

Implementing pre-dunning notifications

Pre-dunning is all about stopping problems before they start:

- Send card expiration warnings 30, 15, and 7 days before the dreaded date

- Remind customers about upcoming large charges 3-7 days before they hit

- Always include dead-simple ways to update payment info

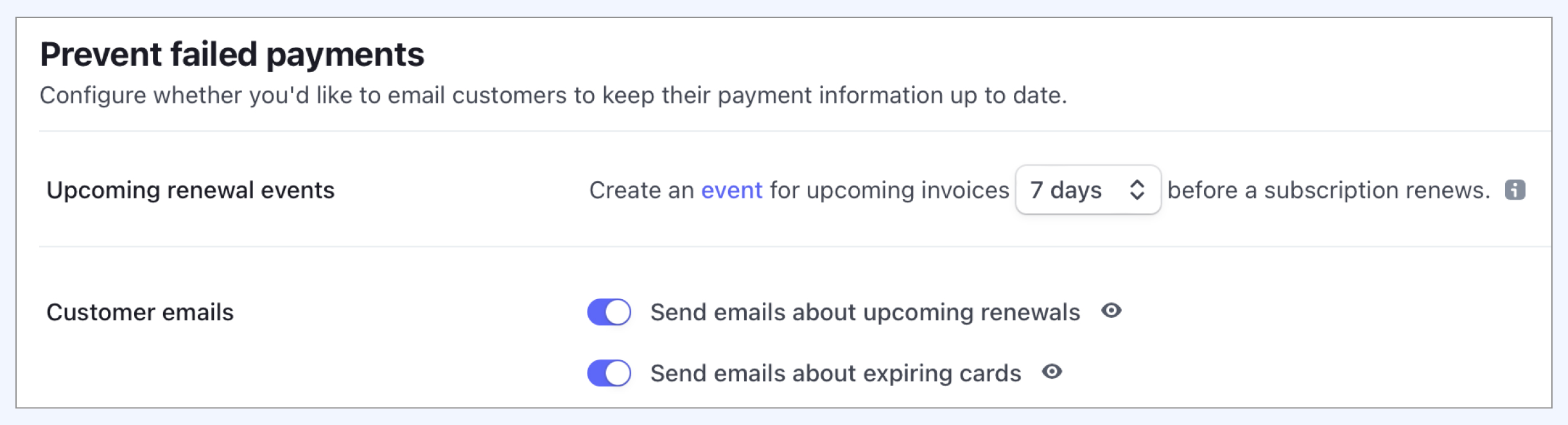

On your Stripe dashboard, navigate to Settings → Subscriptions and emails and hit the toggle on to configure pre-dunning notifications.

Offering multiple payment methods in WordPress

Payment method flexibility is like having multiple insurance policies:

- Set up WP Full Pay to handle both credit cards and direct debits.

- Add digital wallet options like Apple Pay and Google Pay for modern shoppers.

- Consider ACH payments for U.S. customers—they’re less prone to failures.

- Let customers store backup payment methods—Plan B is always good.

Creating a frictionless payment update experience

The easier you make it to update payment info, the more customers will actually do it:

- Enable secure one-click updates through email links

- Strip your forms down to the bare essentials—nobody likes filling out fields

- Make sure everything works flawlessly on mobile

- Use clear progress indicators so customers know exactly where they stand

Using card tokenization and network tokens

Card tokenization and network tokens are technical solutions that make a real difference:

- Make sure Stripe’s Network Tokens feature is switched on

- Implement Click-to-Pay if your setup supports it

- Take advantage of Stripe’s Adaptive Acceptance to optimize authorization rates

- Keep an eye on your token success metrics in Stripe analytics

Analyzing and improving your failed payment recovery rate

Key metrics to track for payment recovery

These failed payment analytics should be on your regular dashboard:

- Recovery rate: What percentage of failed payments do you successfully rescue?

- Time-to-recovery: How many days between failure and successful payment?

- Dunning effectiveness: Which communications actually get responses?

- Decline reasons: What specific issues keep causing failures?

- Lifecycle recovery: Which retry attempt tends to be most successful?

📖 You might also like to read: Stripe reports and metrics: how to manage and track?

Using Stripe dashboard for failed payment insights

The Stripe Dashboard is packed with useful analytics:

- Go to Billing → Subscriptions → Overview

- Check out the “Subscription Status” section to understand your involuntary churn

- Review retry success rates under Payment Settings

- Export detailed payment attempt logs when you need to dive deeper

A/B testing different recovery approaches

Never stop optimizing your recovery process:

- Test different email subject lines and content approaches

- Experiment with the timing between retry attempts

- Try various incentives to encourage swift payment updates

- Mix up your communication channel combinations

Setting up failed payment recovery reports

Regular reporting keeps recovery efforts visible and important:

- Create weekly recovery rate summaries

- Run monthly churn analysis separating voluntary from involuntary losses

- Assess quarterly revenue impact

- Compare your metrics against industry benchmarks

Advanced techniques for subscription payment recovery

1. Implementing flexible grace periods

Grace periods give customers breathing room while you work on fixing payment issues:

- For monthly plans, 3-7 days usually works well

- For annual subscriptions, consider 14-30 days

- Reward loyal customers with longer grace periods

- Always make it crystal clear when the grace period ends

2. Offering payment plan options

When financial hardship hits, flexibility can save the relationship:

- Temporary downgrades to more affordable plans

- Splitting large subscription fees into smaller payments

- Deferred payment options for longtime customers

- A “pause” feature for those going through temporary tight spots

3. Using incentives to encourage payment updates

Sometimes a little carrot works better than any stick:

- Offer small account credits for prompt payment updates

- Extend subscription periods slightly as a thank-you for quick resolution

- Unlock premium features temporarily when payment issues are fixed

- Waive reinstatement fees after brief lapses

4. Automated workflows for different types of payment failures

Different problems may require different advanced solutions:

- For expired cards, focus messaging on updating card details

- With insufficient funds issues, optimize retry timing around paydays

- For processing errors, reassure customers it’s not their fault

- When fraud blocks are triggered, provide clear verification instructions

WordPress-specific solutions with WP Full Pay

Setting up subscription management forms

WP Full Pay makes creating specialized subscription forms refreshingly simple:

- Log into your WordPress dashboard

- Go to WP Full Pay → Forms → Add New

- Choose “Subscription” as your form type

- Customize the display options and fields to your liking

- Create clear success/failure messages specifically for payment updates

Creating custom payment recovery messages

Personalized recovery communications build trust:

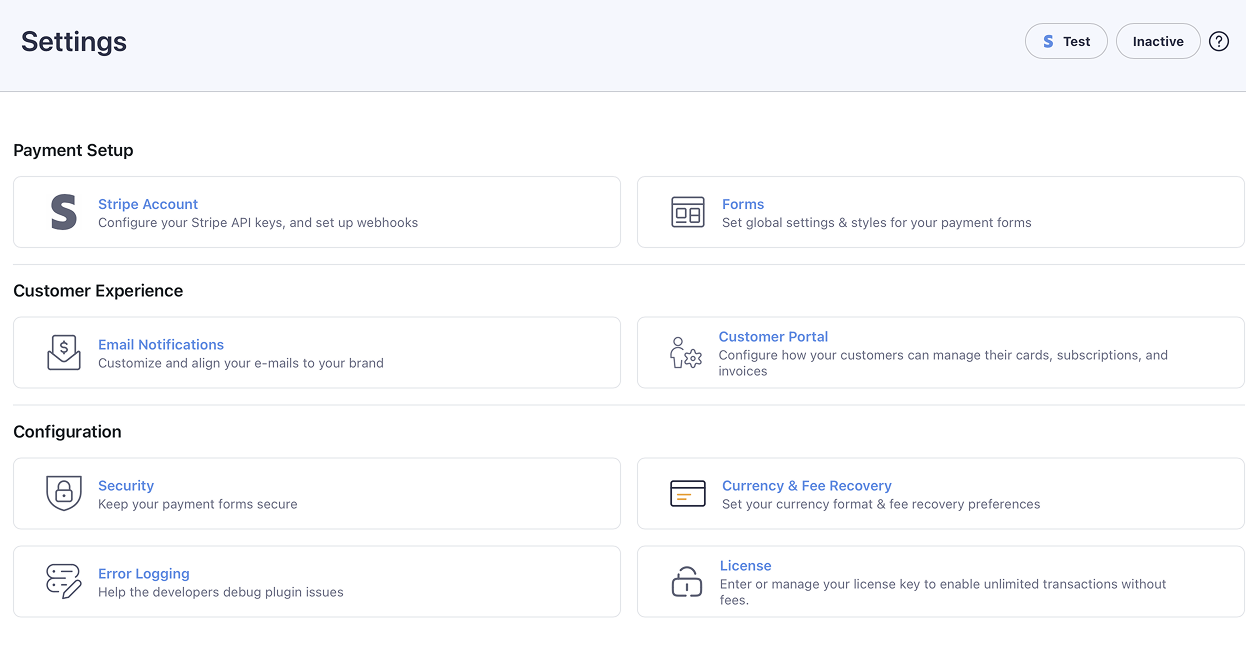

- Go to WP Full Pay → Settings → Email notifications

- Customize messages (customer name, amount, subscription details)

- Preview how your messages look on different devices before going live

Legal and compliance considerations for payment recovery

Privacy and data protection best practices

Keep your recovery processes legally sound:

- Never include full card details in any emails or notifications

- Make sure payment update forms are secured with proper encryption

- Require appropriate authentication before allowing payment updates

- Follow data retention best practices for payment records

Fair debt collection practices

While subscription recoveries typically aren’t subject to debt collection regulations, it’s still wise to:

- Avoid language that could be perceived as threatening

- Clearly distinguish between service suspension and debt collection

- Provide straightforward ways to dispute charges

- Train your team on appropriate language for recovery communications

Terms of service requirements

Your terms should clearly spell out:

- Your retry policies and timeframes

- What happens if non-payment continues

- Details about grace periods

- Customer responsibilities for keeping payment methods current

Documentation and record keeping

Maintain detailed records of:

- All payment attempts, successful and failed

- Your communication history regarding payment issues

- Customer actions taken during the recovery process

- Timestamps of any service changes related to payment status

Final checklist for failed payment management

✓ Implement smart retries tailored to your specific customer base

✓ Create a thoughtful multi-channel communication strategy

✓ Offer seamless self-service payment update options

✓ Enable account updater services and tokenization

✓ Design preventive measures like pre-dunning

✓ Track and analyze your recovery metrics religiously

✓ Never stop testing and improving your approach