Businesses that offer Buy Now Pay Later shopping options at checkout have reported 30% higher conversions and up to 50% higher average cart sizes, according to recent studies.

These numbers can make a huge difference to the bottom line of any online retailer, right?

Offering Buy Now Pay Later shopping options provides immense value for businesses looking to reach new customers, boost sales, and drive growth. Luckily, your business can get a piece of the action by simply partnering with one or more Buy Now Pay Later providers.

Let’s dive in!

Buy Now Pay Later – also known as BNPL – is a payment method that allows customers to buy products and services without having to pay the full amount right away.

Instead, they’ll typically pay for it either in full after 30 days or in smaller installments over time.

For instance, a buyer making a $100 purchase could pay for it in four interest-free installments of $25. You, as the merchant, will receive the full amount ($100) up front from the third-party lender you’ve partnered with, minus any fees.

A further perk of Buy Now Pay Later shopping is that you won’t have to deal with time-consuming and complex tasks such as underwriting customers, managing the installments, or collecting payments during the process.

Buy Now Pay Later providers – such as Affirm, Klarna, Afterpay, and Zip – take these weights off your shoulders, so you can focus on growing your business!

Tempting, right?

But how much does Buy Now Pay Later shopping cost?

BNPL merchant fees tend to range from 3.39 % – 6%, plus a small fixed fee on each transaction. Typically, customers aren’t charged any fees unless they’re late on an installment payment.

Let’s see in detail why Buy Now Pay Later shopping apps can be a win-win for all involved.

Attract new customers

Without doubt, BNPL is a sales trigger. It makes larger purchases less intimidating, providing customers with a streamlined, customizable, and affordable payment experience.

Buy Now Pay Later shopping options are particularly popular among younger customers who often don’t have a credit card. According to studies, more than 26% of Millennials and almost 11% of Generation Z shoppers used Buy Now Pay Later shopping to pay for their most recent online purchases.

Several BNPL providers also have shopping apps with millions of members. Partnering with them means you can appear in their app as a participating merchant and gain exposure to potential new buyers.

Remember: the more payment options you offer, the more sales opportunities you’re creating for your business!

According to a research, not seeing BNPL in checkout page as a payment option is reason that 66% BNPL users abandon their carts.

Read more about 8 cart abandonment reasons and how to solve them.

Boost conversions and average order value

Businesses that accept Buy Now Pay Later shopping on Stripe have seen a 27% increase in sales volume! Afterpay also claims that using its services boosts average order value by up to 18%.

Magic?

Not exactly.

The truth is that customers are more likely to make a purchase if they can pay for the item over time. Buy Now Pay Later shopping helps to reduce the sticker shock: shoppers find it more encouraging to make smaller, interest-free payments over a few weeks than one big transaction with a credit card, with interest continually accruing.

Similarly, businesses that sell lower-priced goods might see customers purchasing additional items once they know they can pay the full price later.

Learn more about the types of payment methods supported by Stripe.

Build a loyal customer base

Buy Now Pay Later shopping offers customers a fast and convenient way to access financing. There’s no lengthy application process or additional processing time, and buyers don’t have to pay any application fees. Most providers have affordable, simple-to-understand repayment plans and terms. Shoppers can apply for BNPL from the comfort of their homes with just a few clicks.

These positive experiences mean they’ll come back again and again. In fact, Affirm claims to drive an average repeat purchase rate of as much as 20% for its merchant partners!

Shield your business from fraud

No matter if your customer successfully pays their installments, you’ll receive the total transaction amount up front!

This means that BNPL providers take on all the customer risk and any associated costs, shielding your business from fraud. You’ll never have to worry about collecting payments or customers defaulting on their payment plans – just the ideal payment method to add to your site, right?

Gain an edge in the market

48% of shoppers who’ve already used Buy Now Pay Later shopping said they wouldn’t buy from a merchant that doesn’t offer this payment method.

Why is this so alarming?

Well, if you look around, you’ll find that more and more of your competitors are offering Shop Now Pay Later options – if you don’t, you may be sacrificing sales to your rivals!

Buy Now Pay Later shopping options are typically presented at checkout alongside credit cards and other payment options you may provide (such as Apple Pay, Google Pay, Alipay, Giropay, or Sofort, for instance).

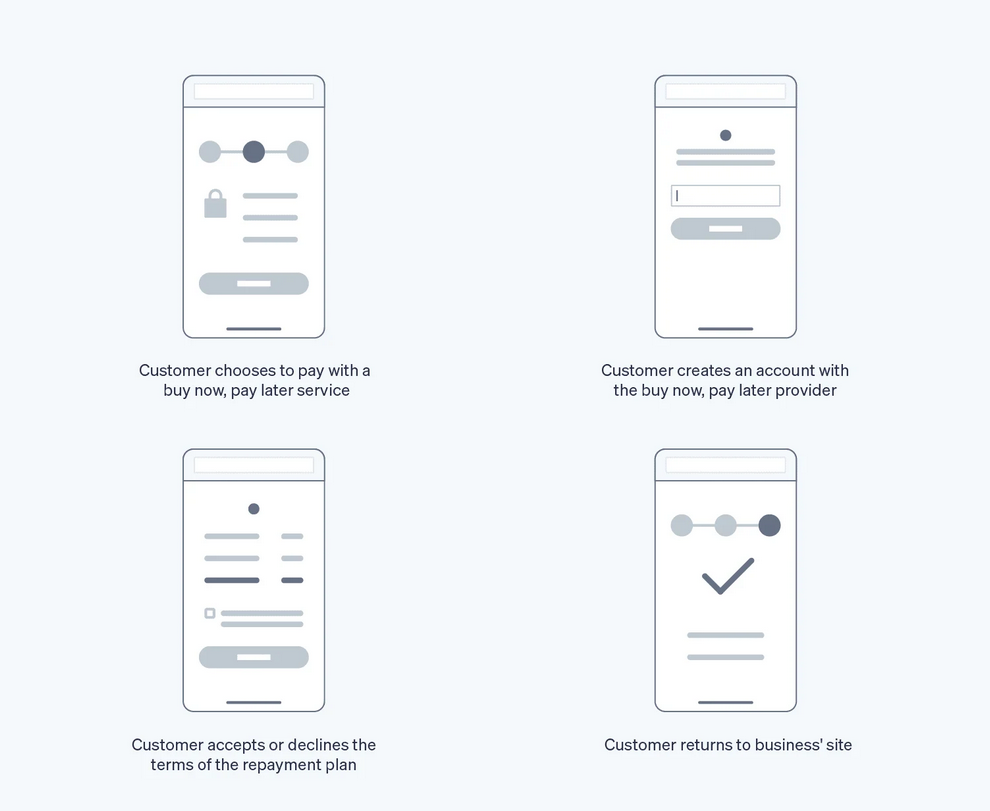

When buyers make a one-time purchase, they simply select the offered BNPL provider in the payment form. Next, they’ll be redirected to the provider’s site or app to create an account or log in.

As the next step, buyers will usually be approved in seconds for what’s basically a short-term loan. They’ll have the option to decline or accept the terms of the repayment plan, typically selecting bi-weekly or monthly installments after making a small down payment.

Once the purchase is complete, you’ll receive the full payment up front (minus any fees). Customers will later pay their installments directly to the Buy Now Pay Later provider, often with no interest and no additional fees when they pay on time.

How to select the right BNPL provider for your business?

If you’re searching for the best BNPL option for your business, you should ask yourself the following questions:

- Does the provider have a successful track record of working with clients in your industry?

- Does the provider offer a simple integration process?

- Does your business typically have a high or low average order value?

- In which regions do you sell?

After checking if the provider is familiar with the nuances of your retail category, you should scan its repayment terms. If your business typically has a high average order value, look for BNPL providers that offer repayment over a longer period of time. On the other hand, businesses with a lower average order value may attract customers by offering fewer installments over a shorter amount of time.

As BNPL providers offer different credit limits, evaluate your average order value again and select a provider that offers enough credit for your buyers to successfully make a purchase.

Next, you should check if the provider offers a direct tech integration with your platform. Even better if the provider has an existing partnership with your e-commerce, web hosting, or checkout platforms. This could make offering BNPL to your customers as simple as a few clicks.

Finally, you should decide in which markets you’d like to offer Buy Now Pay Later shopping options. Based on where your customers are located, this may mean partnering with more than one BNPL provider. Strive to select the provider that’s most popular in the region. For instance, Afterpay and Zip are the most popular Buy Now Pay Later shopping providers in Australia, and Affirm is widely used in the US and Canada. Klarna is similarly popular in Germany and the Nordics.

Setting up Buy Now Pay Later shopping options for your business is simple, especially, if you’re using Stripe as your payment processing platform.

Depending on your Stripe integration method, adding BNPL options for your customers may require adding a single line of code or just clicking a button in the Stripe Dashboard.

Don’t forget to use the Payment Method Messaging Element as well! It’ll automatically determine the available plans and conditions, generate a localized description, and display it in your payment form – increasing conversion and average order value.

For detailed information on setting up your Buy Now Pay Later shopping options, make sure to visit the Stripe Docs!

What about recurring payments? Do BNPL providers support them?

Recurring payments are ongoing transactions where a customer authorizes a business to withdraw funds from their account at regular intervals.

If you’re a subscription-based business and want to offer Buy Now Pay Later shopping options to your customers, the bad news is that currently, most BNPL providers don’t support these types of payments.

However, we have some good news as well!

The Stripe payments plugin WP Full Pay allows your customers to pay in installments on your WordPress site. The plugin lets you turn any subscription plan into a payment option that is canceled automatically after a certain number of charges.

This is especially useful if you’re a training provider for instance, and want to allow your students to pay their tuition fee in installments, so that there’s no upfront cost burden to enroll in the course.

How can you add a new plan as payment in installments in WP Full Pay?

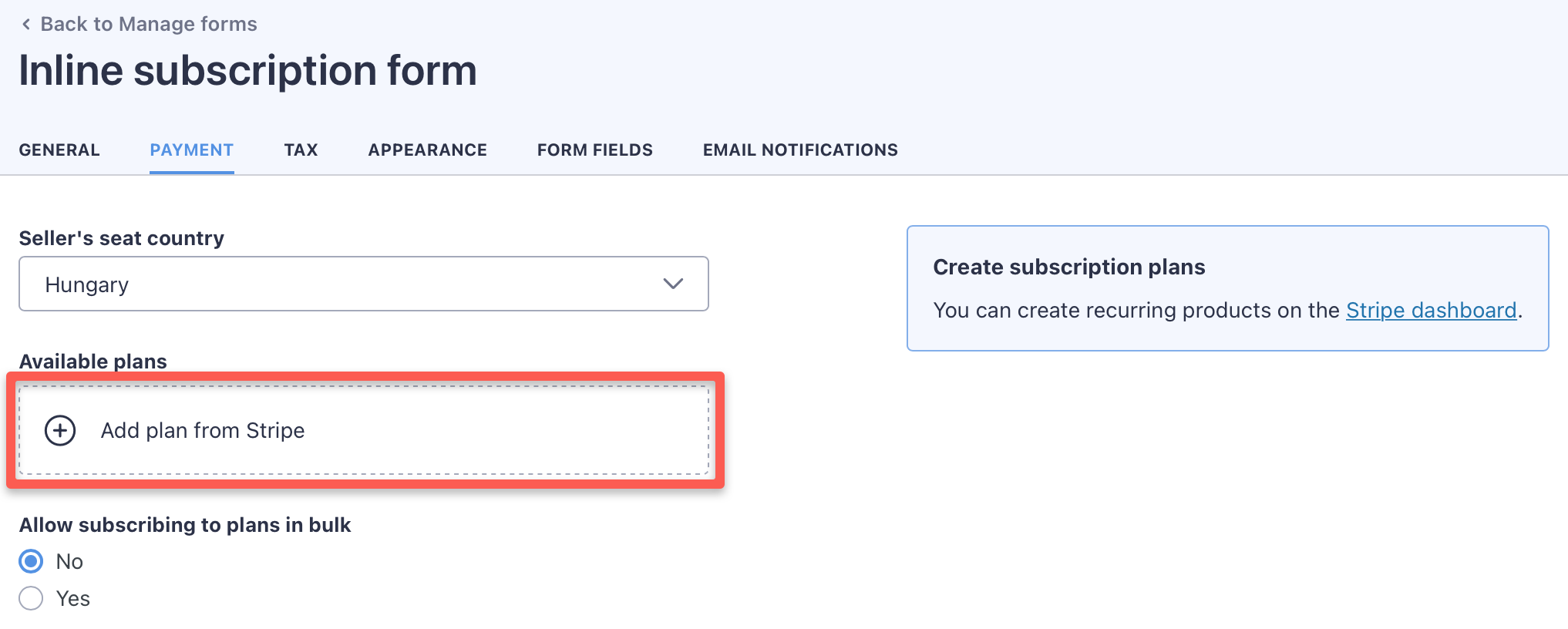

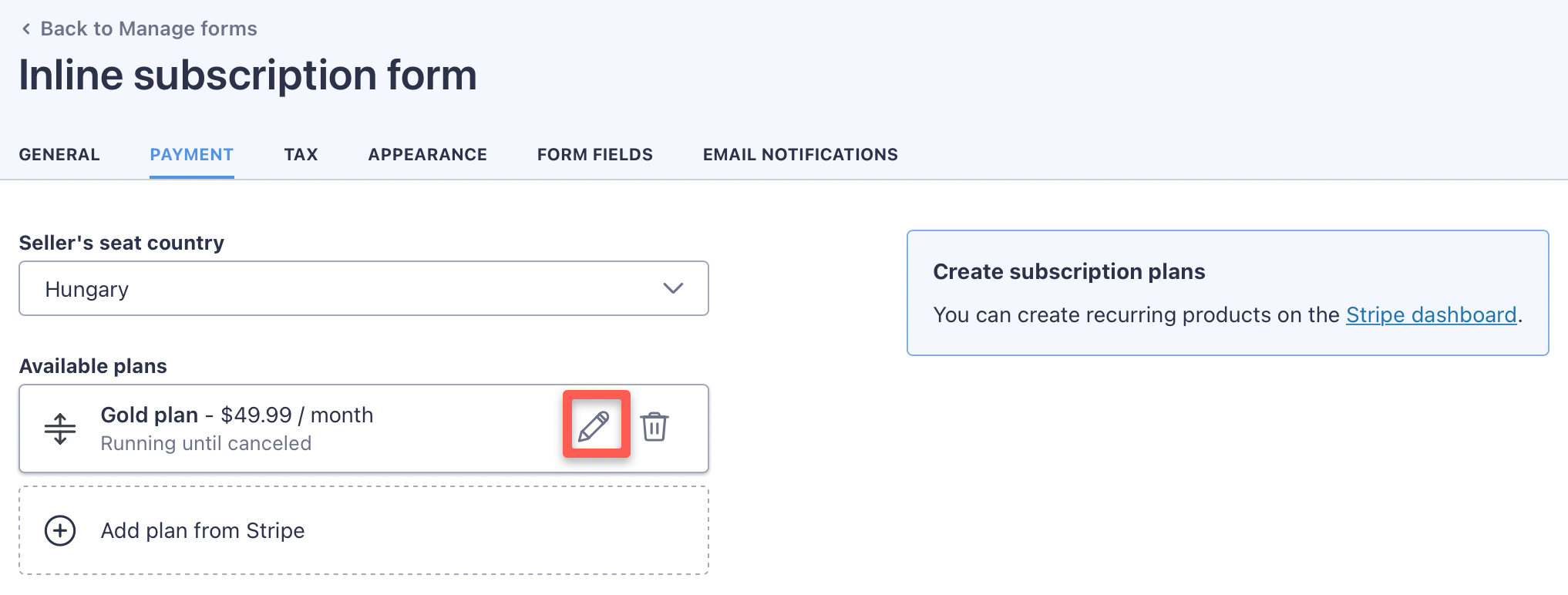

On any subscription form, click the “Add plan from Stripe” button on the “Payment” tab:

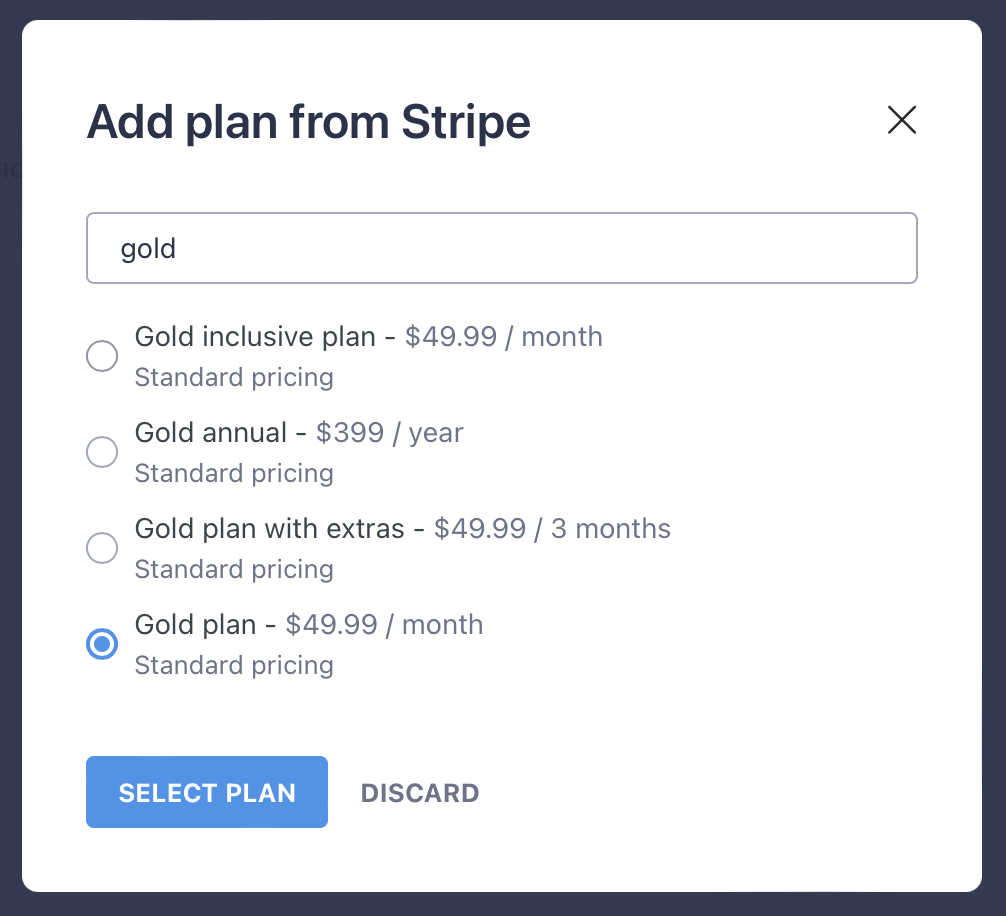

The first step of the “Add plan from Stripe” dialog wizard will require you to select the subscription plan you’d like to turn into an installment plan:

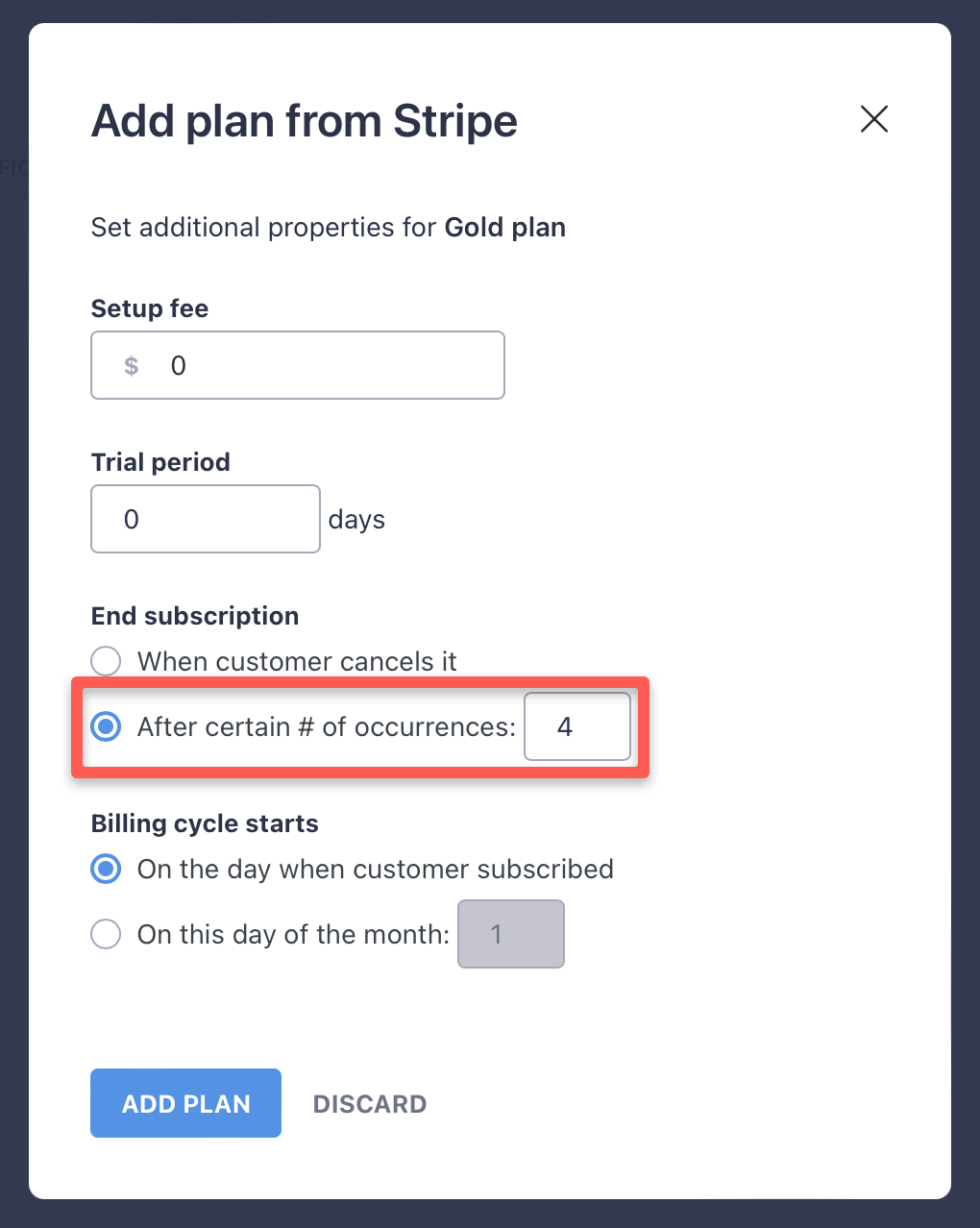

Next, indicate that the plan should be canceled after a certain number of charges, and set the cancellation count:

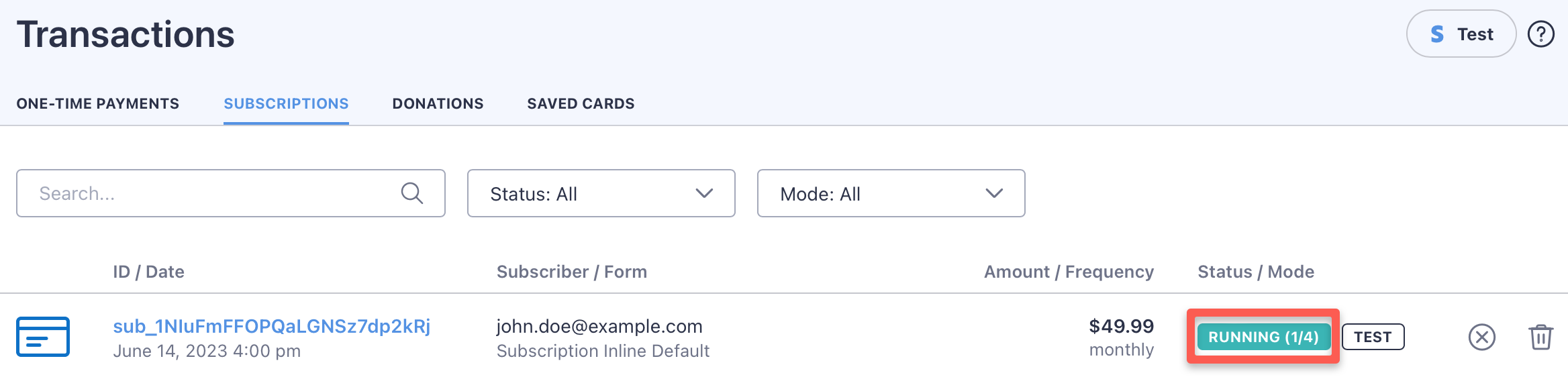

The initial payment counts towards the cancellation count. So a cancellation count of 4 means an initial charge plus 3 recurring charges.

In the plan list of the “Payment tab”, a payment in installments plan is indicated explicitly:

How to turn an already added plan into installment payments?

You can turn an already added plan into installment payments by simply clicking the “Edit” action of the plan:

For subscriptions with payment in installments, the charge count will be explicitly displayed on the “Full Pay / Transactions / Subscriptions” page in WP admin:

While the size of the BNPL lending market was worth around a few billion dollars in 2019 in the US, it’s estimated to grow by 1,200% by 2024!

It’s no secret: as the younger generations begin to gain further purchasing power, and as credit cards continue to decline in popularity, we’ll see a notable increase in the desire for flexible payment options.

Therefore, for businesses that want to remain on the cutting edge, offering Buy Now Pay Later shopping options is a must to see gains in cart conversion, average order value, and customer acquisition!