Digital payment platforms like Stripe provide tools to handle payments securely. This includes creating professional payment forms and generating invoices for customers.

Invoices and payment forms sound similar, but they work in very different ways. They’re two completely different methods of collecting payment with the same end goal: selling your product or services online and getting paid for them in a timely manner.

In this blog post, we will explain the difference between payment forms and invoices.

📖 You might also like to read step-by-step guide on how to integrate Stripe with WordPress.

Invoice vs. Payment Form: What are They?

Invoices and payment forms are common ways for accepting and tracking payments from customers. Although they serve similar functions, they differ in certain aspects. Let’s explore each in more detail.

What is an Invoice?

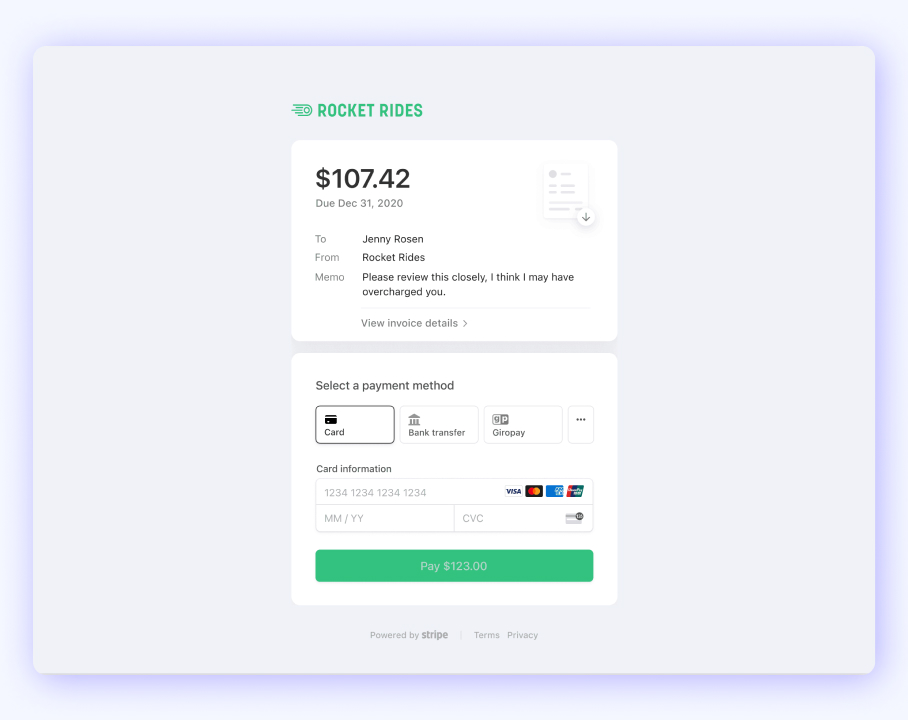

An invoice is a digital document issued to customers by businesses requesting payment for goods and services rendered. It includes details such as the date of issue, items sold, total amount due, payment terms, and other relevant transaction information.

Invoice form example by Stripe

Invoice form example by Stripe

Invoices are typically created after a transaction has occurred, and businesses rely on this document to track their accounts receivable.

For example, after you order a physical product from Amazon, you’ll receive an email with an invoice. It will list your details, the product, tax, and the total payment amount. An invoice can also be a document that precedes a payment, such as when you receive your monthly credit card statement. In some cases, it’s a summary of your purchases, but most of the time, digital invoices are automatically created after a payment is made.

What is a Payment Form?

A payment form, on the other hand, is a digital form integrated into a website where customers input their payment details to authorize electronic transactions for goods or services. Payment forms cater to upfront payments from customers, with funds being deducted immediately from their accounts.

An example of a payment form that most people are familiar with is Netflix. To subscribe, all you have to do is fill in credit card and account information on a simple sign-up page. When you press “Get Started,” you’re completing the payment, and most of the time, your first payment is processed right away.

This is essentially how all payment forms work, but they can also have a variety of custom options specific to your business’s needs

Invoice vs Payment Form: What are Their Purposes?

While both forms may seem similar, invoice and payment forms have distinct purposes and features. Understanding the differences between these types of forms makes it easier to decide which one to use.

The Purpose of an Invoice

Invoices act as the backbone of a business’s financial records, offering the following benefits:

- 📈 Record-keeping and financial tracking: Invoices serve as a standardized way to document a transaction. They help both the buyer and the seller in keeping track of payments and managing their financial records.

- ⏰ Deferred payments: Invoices establish payment terms, allowing buyers to pay at a later date. This can be beneficial for businesses that want to offer flexibility to their customers by letting them pay after receiving the product or service.

📖 Read more about how to How to Save Customer Card Details for Future Transactions?

Who benefits from invoices?

Invoice forms are often used by businesses and freelancers who provide products or services but don’t receive payment immediately upon delivery.

When you should send an invoice?

Invoices are ideal in several scenarios:

- For big-ticket items: Ideal for B2B services and high-value products, such as enterprise software or large-scale manufacturing equipment.

- To have more control: Include specific terms, like 30-day payment windows or itemized service lists, ensuring clarity and professionalism.

- Convenience: Easily track payment activity. For instance, a digital marketing agency can quickly reference past invoices to show a client paid for an ad campaign last year.

- Avoid fraud: More transaction data can prevent fraud. For example, if a client disputes a charge, an invoice listing specific services rendered can resolve the issue swiftly.

- Contract-based services: Freelancers such as graphic designers or writers use invoices to bill clients upon project completion.

- Wholesale transactions: Retailers invoice once goods are dispatched, with terms like “net 30.”

- Recurring services: Monthly consulting services or subscription plans, like retainer agreements. See this blog post about how to create subscription forms with Stripe in WordPress sites.

- Delayed payments: Payment terms like “net 30” or “net 60” are invoiced accordingly.

The Purpose of a Payment Form

Payment forms streamline the payment process and can benefit your business in the following ways:

- 💳 Instant payment confirmation: Payment forms are designed for immediate payment processing. This can lead to quicker cash flow for businesses, as funds are typically transferred straightaway from the customer’s bank account or credit card.

- 🖥️ Online transactions: These forms are essential for e-commerce platforms where transactions occur in real-time. They facilitate a seamless buying experience for customers, eliminating the need for manual invoicing and follow-ups.

Who benefits from payment forms?

Payment forms are best suited for businesses involved in e-commerce, subscription services, or any operation requiring upfront payments.

📖 You might also like to read Using Donation Forms to Monetize Your WordPress Blogging.

📖 Read also How to Add a Payment Gateway to Your WordPress Blog.

When you should use a payment form?

Payment forms work best for:

- For digital product sales: Ideal for online courses or SaaS products, where payments are instantly processed, and access is granted after payment.

- For recurring payments: SaaS businesses use subscription-based billing to automate monthly charges for software access.

- For custom payment options: Payment forms can collect one-time charges, installment plans, or custom amounts for services or products, integrating with popular apps and CRM systems.

- E-commerce websites: Customers pay directly at checkout for items like clothing, electronics, or books. See this blog post about how to accept Stripe payments on WordPress without WooCommerce.

- Appointment-Based Businesses: Healthcare providers can collect payments upon booking a telehealth appointment.

- Event registration: Workshops or conferences collect registration fees in advance via payment forms.

- Online services: SaaS providers, membership websites, or online course platforms use payment forms for upfront payments.

- Donations & Fundraising: Non-profits or digital creators use different types of checkout forms to accept donations.

📖 You might also like to read Using Donation Forms to Monetize Your WordPress Blogging.

How Save Card Forms Make Invoicing and Payments Easier

The Save Card form lets customers securely store their credit card details for future use. This means they don’t have to enter payment information every time they make a payment. It’s especially helpful for businesses that send recurring invoices or run subscription-based services. Instead of waiting for customers to pay each invoice manually, businesses can automatically charge the saved card when a payment is due, making transactions faster and more reliable.

📖 Read more about how to create save card forms with WordPress.

For example, if a consulting business bills clients every month, a saved card ensures payments are processed immediately when an invoice is issued—without any extra steps from the client. Similarly, subscription-based businesses like SaaS platforms can use the Save Card Form to enable automatic recurring billing, reducing late payments and making the process seamless.

By using WP Full Pay’s Save Card Form, businesses can automate invoicing, speed up payments, and improve cash flow, all while providing a better experience for customers.

📖 You might also like to read step-by-step guide on how to integrate Stripe with WordPress.

💡 With WP Full Pay version 7.0 and later, you no longer need to manually add Stripe API keys. Stripe Connect makes the integration process easy and allows you to connect your Stripe account directly through the WP Full Pay.

When assessing whether an invoice or a payment form is best suited for your business, consider the nature of your transactions and customer expectations. Invoices offer clarity and legal standing for larger or detailed transactions, while payment forms provide immediacy and efficiency for straightforward sales.