“Stripe vs PayPal – which payment gateway is right for my business?”

This is the question many business owners end up asking before picking a payment provider for their e-store. While Stripe and PayPal are two of the most popular options, choosing between them can be a challenge. Fortunately, understanding the differences between them can go a long way towards making the right call.

To ease your dilemma, today, we’ll get down to the bottom of the Stripe vs PayPal debate and answer 13 questions to help you uncover which one is best for your business.

Let’s get started!

Stripe vs Paypal – Why is it crucial to make the right choice?

Before diving into our Stripe vs PayPal debate, let’s look at why making the right decision is critical in the first place.

While we’re sure that getting paid is probably at the top of every business owner’s priority list, there’s one thing to remember: when it comes to handling your finances, your preferences might differ from those of other entrepreneurs. For instance, you might have a lot of international customers. In this case, you might have to keep an eye on currency-related fees. Alternatively, you may want to transfer funds between accounts as quickly as possible.

You have to be aware that each payment processor offers different features, and one might suit your needs better than the other. User-friendliness, accepted payment types, allowed currencies, or third-party integration options are just a few aspects you have to consider before making the final decision.

Our comprehensive Stripe vs PayPal comparison is here to help. Let’s think through the most important questions to see how Stripe and PayPal would support your business’s unique needs!

1. Stripe vs PayPal – What should you know about them?

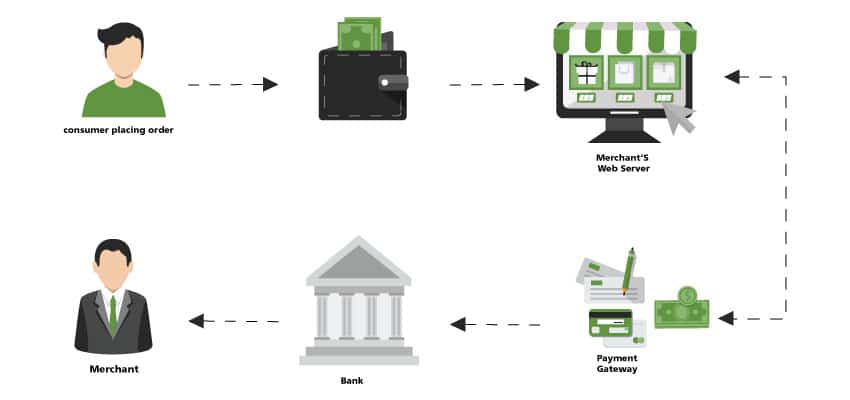

Both Stripe and PayPal are payment gateways. They act as intermediaries for merchants and the appropriate credit card networks/financial institutions to authorize and accept payments.

This is where they fall into the web of e-commerce:

Both companies have a longstanding stranglehold on the market and hold the most market share. According to CardRates.com, PayPal is used by 53.9% of the market, and Stripe comes in second with around 18.6%:

2. What’s worth knowing about Stripe?

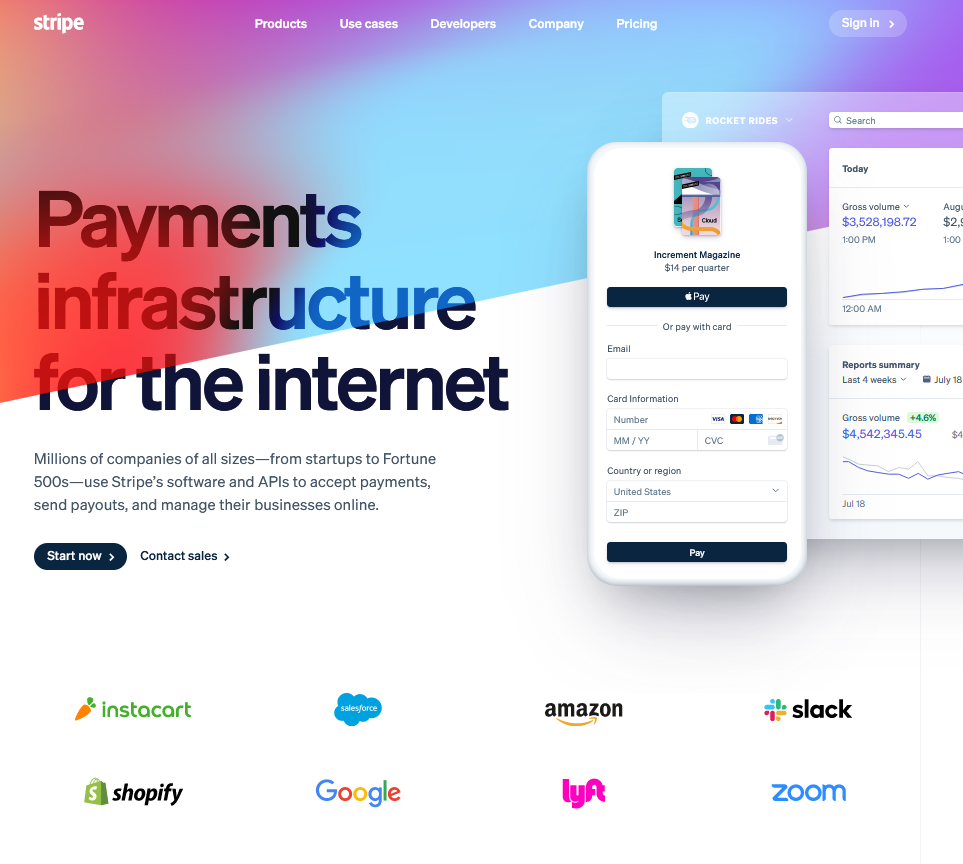

Stripe helps companies of all sizes manage their business finances and accept payments electronically.

One of the key differences between Stripe vs PayPal is that the Stripe API is specifically designed for e-commerce: it offers a lot of customizability and development tools. However, you can also use it without any coding experience.

Comparing the foundation date of Stripe vs PayPal, Stripe hasn’t been around as long as PayPal. Nevertheless, it’s made significant strides in becoming a reliable payment processing tool in the e-commerce space. Currently, 3.1 million active websites use Stripe. Earlier this year, it became the most highly valued venture-backed private company in the U.S. and the third most valuable in the world, valued at $95 billion! Some of its prominent customers include Amazon, Google, Lyft, Zoom, and Shopify.

3. How does PayPal compare at first glance?

When comparing Stripe vs PayPal, the latter is geared less toward developers and has fewer technical features. It also offers personal accounts for individuals, whereas Stripe is exclusively for companies.

Nevertheless, PayPal also provides a variety of e-commerce solutions. Currently, it has over 400 million active users, including Hulu, Spotify, and the Red Cross.

4. Can you use both payment gateways?

The short answer is: sure, you can!

WWF is an example of using both Stripe and PayPal to accept donations. (Side note: if you’re also a non-profit and want to know the secret of firing up your fundraising, check out our guide on how to design the perfect donation page.)

You might also like to read how to create a form and accept donations on WordPress.

The longer answer?

Well, using more than one payment gateway can be advantageous when selling in several countries, for instance. A lot of consumers use PayPal balances to pay for everything.

However, you have to keep in mind that using two gateways can cause you extra headaches. If you’re not as big as WWF or don’t have the extra time and money to spare, we don’t recommend using two gateways. It’s also a bad idea if you’re using a custom back-end or other integrations, as two gateways can turn simple tasks into complex problems.

5. Stripe vs PayPal fees: who wins the debate?

The “Stripe vs PayPal pricing” debate is probably the hottest topic and the first question that comes to your mind when deciding between the two solutions.

The good news is that the basic plans of Stripe as well as the PayPal business account are free. This means that PayPal and Stripe registration is free: there are no monthly fees or monthly minimums.

However, there are transaction fees as you begin to collect payments.

Currently, PayPal Digital Payments transaction fees cost 3.49% + $0.49 per transaction. The PayPal QR code payments fee for transactions above $10.00 is 1.9% + $0.10 per transaction. Online credit and debit card transactions cost 2.59% + $0.49. Finally, in-person credit and debit card transaction fees are 2.29% + $0.09 per transaction. PayPal also adds a 1.50% fee to any international transaction.

PayPal goes into an even more thorough breakdown of merchant fees based on factors such as additional risk factors, hosted, embedded, or customized checkout, or charity transactions.

How does Stripe pricing compare?

Comparing Stripe vs PayPal, Stripe fees are a lot simpler: it charges a fee of 2.90% + $0.30 for all standard payments (any successful charge on a card or digital wallet in your organization’s native country and currency).

An international card as well as any currency conversions will add an extra 1%. If you want to accept large payments via ACH direct debit instead, the fee will be 0.8% of the total with a cap of $5.00. Stripe also offers custom pricing for large or unconventional companies. It even offers automated tax calculation and collection on your Stripe transactions which costs 0.5% per transaction.

The winner?

When it comes to transaction fees, Stripe is slightly more competitive than PayPal due to its simpler fee structure and generally lower rates.

6. Comparing Stripe vs PayPal, who has lower chargeback fees?

You know the pain of chargebacks: money is taken back from you and returned to the customer. You even have to pay additional fees. The question is: comparing Stripe vs PayPal, which one is the lesser of two evils in this case?

PayPal’s chargeback fees include unauthorized transactions, item not received complaints, and complaints about products significantly deviating from the description. In case of a chargeback, the amount gets refunded to the customer, and you have to pay a $20 fee.

Stripe demands only $15 for chargebacks. If the customer’s bank resolves the dispute in your favor, this fee is refundable! As a bonus, Stripe gives you the ability to detect and block credit card fraud with its Stripe Radar features. This service is included for free for accounts with standard 2.90% + $0.30 pricing.

You might also like to read about Stripe Radar – The smart fraud prevention tool.

So, it’s not a surprise to say that Stripe is the clear winner in the chargeback category!

But will it keep this win streak up when it comes to the speed of payouts?

7. Between Stripe vs PayPal, which gateway has the fastest payouts?

There’s only a slight difference between Stripe vs PayPal in this regard.

Usually, PayPal provides free local transfers to bank accounts in 1 business day. If you need the money immediately, you can choose to pay a 1.5% fee for an instant bank or card transfer.

Stripe is a bit slower considering payouts: in the case of standard, low-risk industries in the U.S., payments arrive in your bank account on a 2-day rolling basis. You can also opt to receive payouts weekly or monthly.

Consequently, PayPal is the clear winner here!

8. What types of payments do Stripe and PayPal accept?

The rule behind giving customers access to different payment methods is simple: the more options you provide, the more sales you can drive.

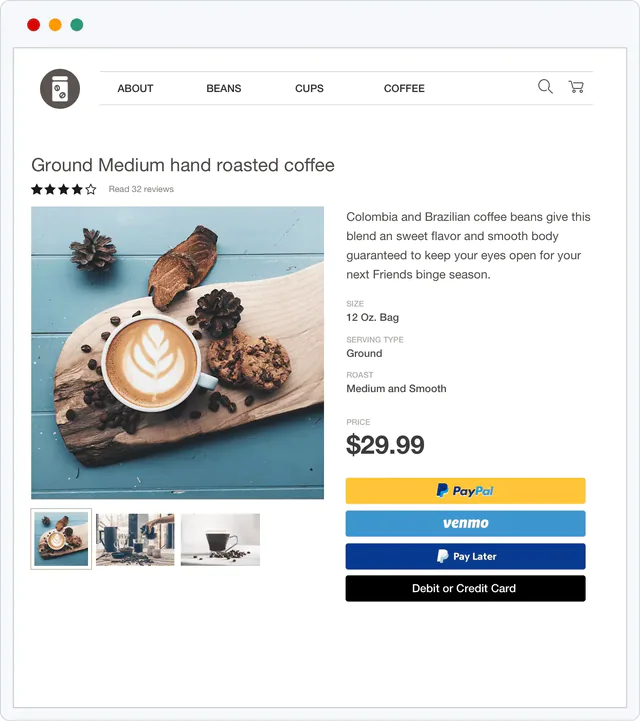

PayPal lets you accept every major credit card, any payment method PayPal users can store, and PayPal Credit.

Stripe, on the other hand, accepts far more payment methods, including:

📖 Read more about supported payment methods by Stripe.

Comparing Stripe vs PayPal, it’s clear that Stripe accepts a wider variety of payment types. Additionally, PayPal seems to prefer keeping cash within its own ecosystem. Depending on your customers’ preferences, this practice might restrict potential purchases.

Consequently, Stripe is the more appealing option in this regard, especially, if your business is collecting payments from customers around the world.

9. Stripe vs PayPal – Which one is more user-friendly?

Our next question is: how user-friendly is Stripe vs PayPal for you as a website owner or a developer?

Well, if you’re not a tech-wiz, the answer is clear: you’ll love PayPal more than Stripe.

PayPal is a very user-friendly platform; its interface is well-labeled. Generally, you don’t need any specific technical knowledge to operate it.

Stripe lands at the opposite end of the spectrum: it was built with web developers in mind.

It offers extensive documentation, third-party integrations, and a high level of customizability. Consequently, Stripe feels like a land flowing with milk and honey if you’re (or have) a programmer or developer working behind the scenes. If not, there’s no reason to worry, either! It’s still possible for you to set it up and use it.

So, who’s the winner?

When comparing Stripe vs PayPal, the latter indeed is one of the easiest payment gateways to set up on a website. However, it’s not always the best choice in terms of user-friendliness. Why?

If done correctly, a highly customized checkout leads to higher conversion rates and sales! That’s why there are a lot of companies that want to customize their online payment experience. With the help of a developer, you can fine-tune Stripe in ways you may not be able to with PayPal.

10. How do Stripe vs PayPal compare in terms of security and compliance?

According to Baymard Institute, the average shopping cart abandonment rate for e-commerce stores hovers around 69%. This means that 7 out of 10 people leave your site before finishing the checkout process. Why?

One of the top reasons is security: a third of online shoppers hesitate to buy from e-commerce sites due to fear of credit card fraud and data theft.

How do Stripe vs PayPal compare in this regard?

The good news is that both PayPal and Stripe have you covered when it comes to PCI compliance. Depending on the chosen plan, PayPal may redirect customers to the PayPal website to complete transactions, thereby accepting the burden of PCI compliance. However, if you choose the PayPal Payments Pro plan, you may have some extra work on your part to maintain optimal compliance.

Stripe, on the other hand, is fully compliant with no effort necessary on your end.

All in all, both Stripe and PayPal are great choices when it comes to giving your customers access to secure online payment.

Pro tip: use trust seals on your website to signal your customers that doing business with you is safe!

11. What’s the difference between Stripe vs PayPal regarding accepted currencies?

Do you plan to do business internationally?

If so, let’s take a look at how well Stripe vs PayPal will serve your ambitions.

Stripe currently accepts 135+ currencies. You’ll have the option to route certain currencies to specific bank accounts to avoid the need to convert. Alternatively, Stripe lets you accept payments to a single bank account for a 1% conversion fee.

On the other hand, PayPal can only process 25 currencies. When you receive a foreign payment, you can either choose to convert it to USD for a 1.50% fee or hold it as it is in your PayPal account.

With the above numbers in mind, Stripe clearly wins this category.

12. Stripe vs PayPal: which payment processor provides a better checkout experience?

One of the most exciting aspects of the Stripe vs PayPal debate is the comparison of the checkout experience since it directly impacts your sales!

Stripe provides a fast and interactive checkout experience with a secure and smooth payment flow. All your customers have to do is enter their credit card details, hit submit, and they’re taken to your thank you page after payment. The Stripe checkout process features real-time card validation with built-in error messaging as well as a fully responsive design with Apple Pay and Google Pay. Additionally, it supports over 25 languages and over 135 currencies, and payment methods are dynamically shown to your customers. You can even customize buttons and background color to create an engaging brand experience.

What about PayPal?

Well, it’s a bit more complicated. Let’s take a look at the process from the customer’s point of view.

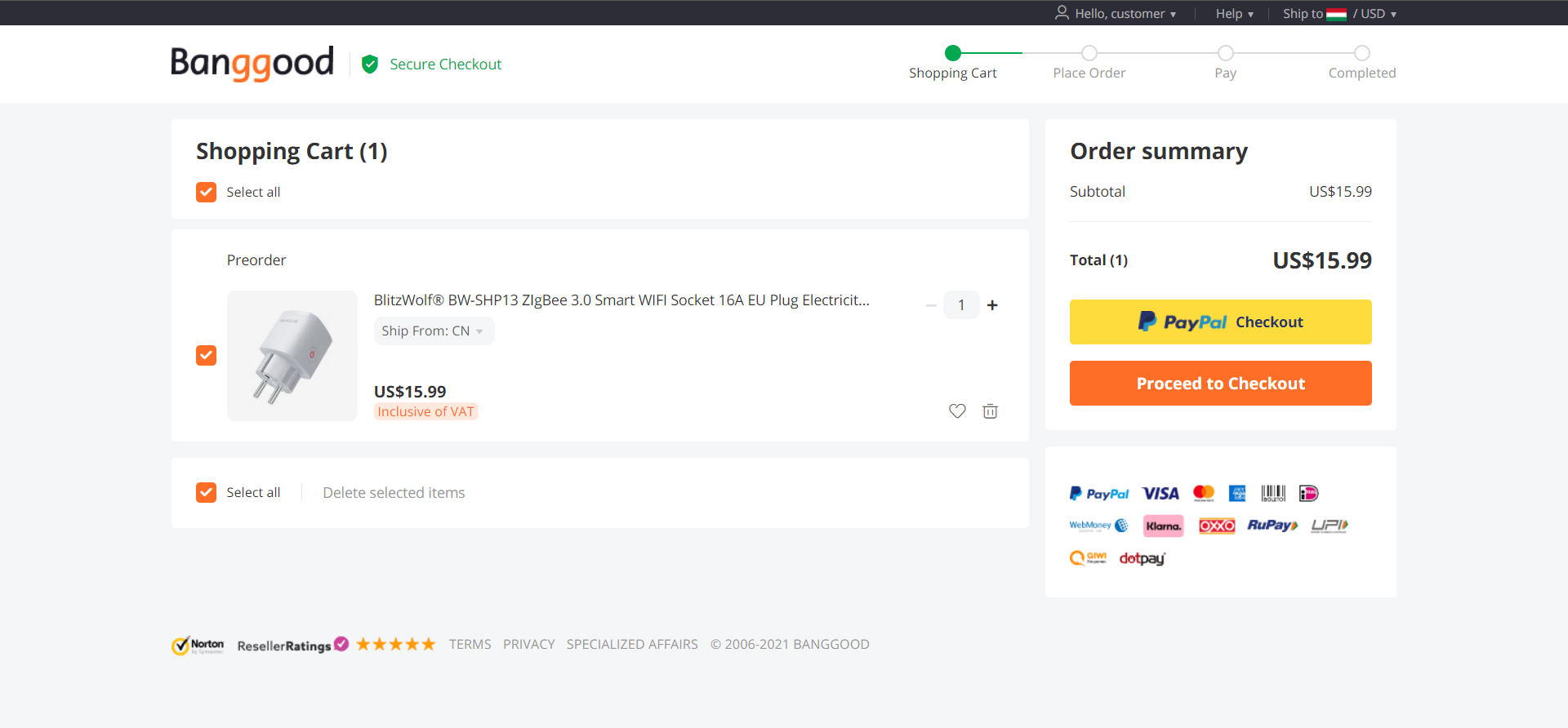

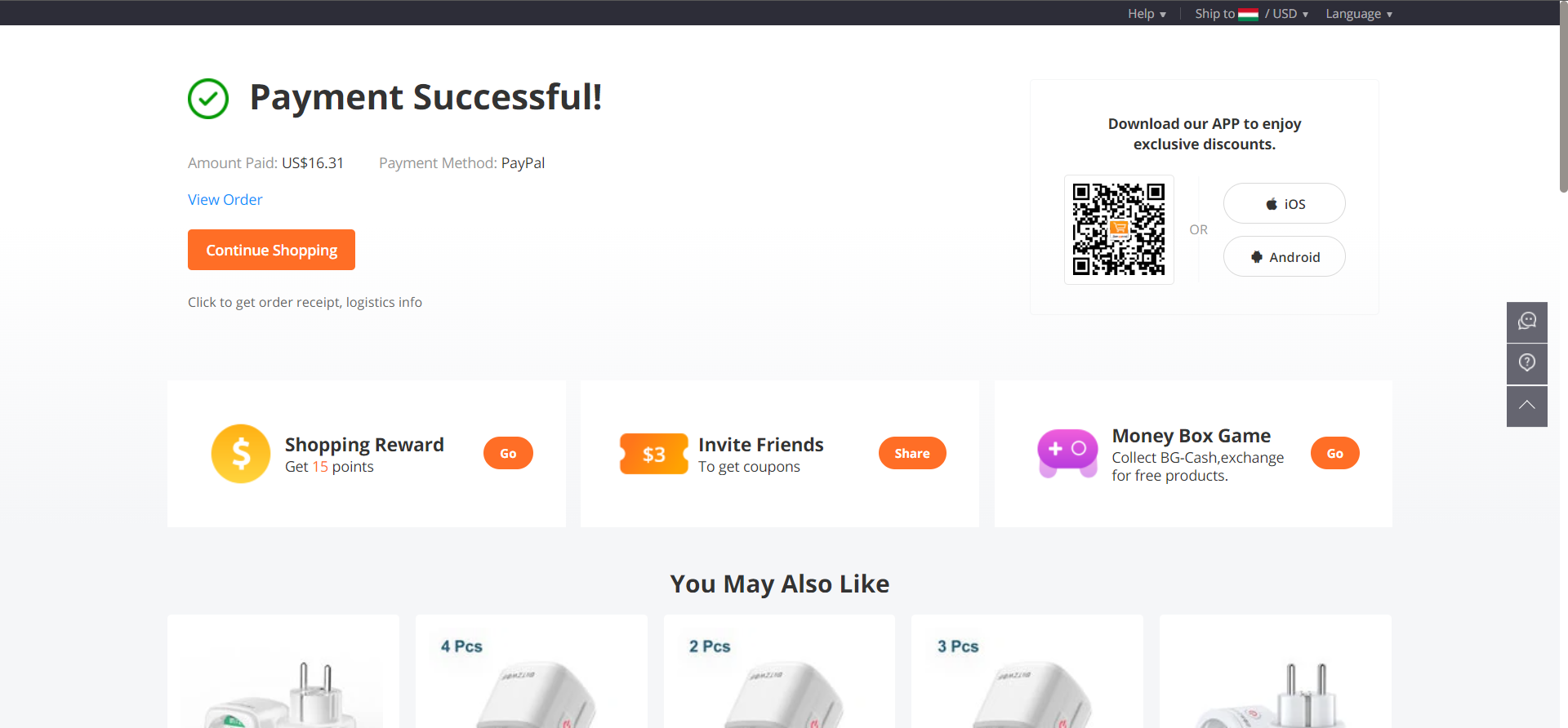

Let’s say, you want to buy a smart plug on Banggood. So, you add it to your cart and head to the checkout section:

Next, you tap the “PayPal Checkout” button. A new window pops up where you can log into your PayPal account:

After typing in your login data, you have to wait a few seconds until a new window pops up where you see your default payment details. You don’t wish to modify anything, so you click “Next”.

Nope, you’re still not done with purchasing that smart plug!

You’re redirected to the seller’s website and have to fill out your missing shipping details:

Next, you click “Save”. Now you’re ready to pay by clicking the “Pay Now” button.

Finally, after a dozen clicks (drumbeat🥁), your purchase is confirmed!

13. Who wins the Stripe vs PayPal debate when it comes to third-party integrations?

3…2…1… we’ve arrived at our last Stripe vs PayPal comparison!🎉

This one is about third-party integrations. Quite an important topic for a WordPress user, right?

As a plugin lover, you can relax: Stripe goes above and beyond in terms of its integrations! It provides entire categories dedicated to CRM, email marketing, fundraising, customer support, e-commerce, inventory management, and many more. For instance, the WordPress plugin WP Full Pay lets you accept payments and create subscriptions with ease – no coding skills required! Powered by Stripe, you can embed payment forms into any page and take payments directly from your website without making your customers leave for a third-party website.

PayPal, on the other hand, has fewer options. It focuses on integrations with popular vendors, such as WooCommerce or Shopify.

Thus, considering the last aspect of our Stripe vs PayPal debate, it’s clear that Stripe is a powerhouse in terms of integrations!

Stripe vs Paypal – Wrapping up

Approaching the end of our Stripe vs PayPal debate, we’ve still got one question left: who’s the final victor?

It’s clear that both payment gateways offer a reliable and secure checkout process to your customers. Therefore, your choice should depend on careful consideration of your unique business needs!

What do we recommend?:

- PayPal is better suited for freelancers, startups, and generally smaller businesses who don’t need flexible solutions and customization options. It’s also a good choice for companies just getting started who don’t have the developer knowledge to customize their platforms. However – especially as a small business – you have to take into account that PayPal now comes at one of the highest rates for a service of its type! Doing more than an occasional transaction, this might cut deeply into your revenue!

- Stripe is a fantastic choice for medium-sized and larger businesses and companies in general who need flexibility and the ability to customize their online payment experience. It’s also a popular choice among tech-savvy business owners or those with in-house developers. Comparing Stripe vs PayPal, it’s clear that Stripe has a competitive edge due to its seamless, customizable checkout, simpler fee structure, wider variety of accepted payment types/currencies, and integration offerings. This might lead to higher conversions for your business!